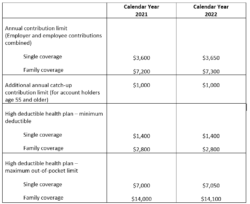

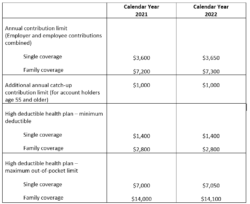

If you receive distributions for other reasons, the amount will be subject to income tax and may be subject to an additional 20% tax as well. An HSA is a tax-exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur. 2022 HSA contribution limits. You withdraw any income earned on the withdrawn contributions and include the earnings in Other income on your tax return for the year you withdraw the contributions and earnings. Post-deductible health FSA or HRA. For more information, go to IRS.gov/TaxProAccount. Under the last-month rule, if you are an eligible individual on the first day of the last month of your tax year (December 1 for most taxpayers), you are considered an eligible individual for the entire year. Your total distributions include amounts paid with a debit card and amounts withdrawn from the HSA by other individuals that you have designated. Self-employed persons arent eligible for HRAs. Ways to check on the status of your refund. There is a six - month lookback period (but not before the month of reaching age 65) when enrolling in Medicare after age 65, so a best practice is for workers to stop contributing to their HSA six months before enrolling in Medicare to avoid penalties. 107, available at IRS.gov/irb/2006-31_IRB/ar10.html; and Notice 2007-2, 2007-2 I.R.B. The IRS Video portal (IRSVideos.gov) contains video and audio presentations for individuals, small businesses, and tax professionals. This arrangement pays or reimburses only those medical expenses incurred after retirement. Generally, contributed amounts that arent spent by the end of the plan year are forfeited. The maximum qualified HSA funding distribution depends on the HDHP coverage (self-only or family) you have on the first day of the month in which the contribution is made and your age as of the end of the tax year. The amendment applies to plan years beginning after 2021. An Archer MSA is portable, so it stays with you if you change employers or leave the work force. An employee covered by an HDHP and a health FSA or an HRA that pays or reimburses qualified medical expenses cant generally make contributions to an HSA. Deducting an excess contribution in a later year. If your spouse isnt the designated beneficiary of your Archer MSA: The account stops being an Archer MSA, and. A health FSA may allow participants to carry over unused benefits from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to a plan year ending in 2022. Individuals who are eligible for an HSA may make a contribution prior to April 18 and include it in their 2022 filing. Report the amount on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. The contribution cant be paid through a voluntary salary reduction agreement on the part of an employee. Earnings on amounts in an Archer MSA arent included in your income while held in the Archer MSA. An Archer MSA and an HSA can receive only one rollover contribution during a 1-year period. The First-Time Homebuyer Credit Account Look-up (IRS.gov/HomeBuyer) tool provides information on your repayments and account balance. Eight in 10 taxpayers use direct deposit to receive their refunds. Form 9000, Alternative Media Preference, or Form 9000(SP) allows you to elect to receive certain types of written correspondence in the following formats. Follow the instructions for the form and file it with your Form 1040, 1040-SR, or 1040-NR. Employees are reimbursed tax free for qualified medical expenses up to a maximum dollar amount for a coverage period. Generally, distributions from a health FSA must be paid only to reimburse you for qualified medical expenses you incurred during the period of coverage. Plans may allow up to $570 of unused amounts remaining at the end of the plan year to be paid or reimbursed for qualified medical expenses you incur in the following plan year. Expenses incurred after December 31, 2019, for over-the-counter medicine (whether or not prescribed) and menstrual care products are considered medical care and are considered a covered expense. To be an eligible individual and qualify for an HSA contribution, you must meet the following requirements. For more information on the Offer in Compromise program, go to IRS.gov/OIC. Catch-up contributions can be made any time during the year in which the Through TR, you had an HDHP for your family for the entire year. This is true even if the other person doesnt receive an exemption deduction for you because the exemption amount is zero for tax years 2018 through 2025.. .Each spouse who is an eligible individual who wants an HSA must open a separate HSA. The contributions remain in your account until you use them. WebThe IRS has announced the new health savings account limits for 2022. The IRS doesnt initiate contact with taxpayers by email, text messages (including shortened links), telephone calls, or social media channels to request or verify personal or financial information.  116-260, December 27, 2020) provides for the following optional plan amendments. WebThe catch-up contribution limit for people age 55 and older remains the same at $1,000. If enrolled in an HSA-eligible HDHP, and at least 55 years oldor will be 55 any time in the calendar yearyou can make an extra $1,000 contribution. Your employer must notify you and the trustee of your HSA that the contribution is for 2022. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. . This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Report all contributions to your Archer MSA on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. The Accessibility Helpline does not have access to your IRS account.

116-260, December 27, 2020) provides for the following optional plan amendments. WebThe catch-up contribution limit for people age 55 and older remains the same at $1,000. If enrolled in an HSA-eligible HDHP, and at least 55 years oldor will be 55 any time in the calendar yearyou can make an extra $1,000 contribution. Your employer must notify you and the trustee of your HSA that the contribution is for 2022. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. . This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Report all contributions to your Archer MSA on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. The Accessibility Helpline does not have access to your IRS account.  .If you fail to remain an eligible individual during any of the testing periods, discussed earlier, the amount you have to include in income isnt an excess contribution. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your Archer MSA.. Generally, you cant treat insurance premiums as qualified medical expenses for Archer MSAs. The excess contribution you can deduct for the current year is the lesser of the following two amounts. Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). However, if you werent an eligible individual for the entire year or changed your coverage during the year, your contribution limit is the greater of: The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or. Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on Local Offices.. If you fail to be an eligible individual during 2022, you can still make contributions through April 15, 2023, for the months you were an eligible individual. The contributions arent included in your income. For example, you are an eligible individual, age 45, with self-only HDHP coverage. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Excess contributions made by your employer are included in your gross income. Employer contributions arent included in income. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. When the suspension period ends, you are no longer eligible to make contributions to an HSA. If you choose to have someone prepare your tax return, choose that preparer wisely. If you meet these requirements, you are an eligible individual even if your spouse has non-HDHP family coverage, provided your spouses coverage doesnt cover you. They also include any qualified HSA funding distribution made to your HSA. Under these plans, if you meet the individual deductible for one family member, you dont have to meet the higher annual deductible amount for the family. The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. 725, available at, For additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B. Qualified medical expenses are those incurred by the following persons. Go to IRS.gov/LetUsHelp for the topics people ask about most. Had an average of 200 or fewer employees each year after 1996. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income. Contributions to an HSA must be made in cash. Contact your financial institution for availability, cost, and time frames. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. . WebHere is what you need to know about the HSA contribution limits for the 2022 calendar year: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the IRS increased the contribution limit by $50, up to $3,650 for individuals. View digital copies of select notices from the IRS. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. You must also provide a written statement that the expense hasnt been paid or reimbursed under any other health plan coverage. If you are 55 or older, you can add $1,000 for a catch-up contribution. You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. Any deemed distributions wont be treated as used to pay qualified medical expenses. Your employer must report the distribution as wages on your Form W-2 for the year in which the distribution is made. There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Unlike the previous discussions, you refers to the employer and not to the employee. Rollovers arent subject to the annual contribution limits. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. Go to IRS.gov/Account to securely access information about your federal tax account. See Qualified reservist distributions, earlier. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Source: IRS How does the HSA last-month rule help you save money? WebWhat are the 2022 HSA Contribution Limits Over 55?

.If you fail to remain an eligible individual during any of the testing periods, discussed earlier, the amount you have to include in income isnt an excess contribution. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your Archer MSA.. Generally, you cant treat insurance premiums as qualified medical expenses for Archer MSAs. The excess contribution you can deduct for the current year is the lesser of the following two amounts. Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). However, if you werent an eligible individual for the entire year or changed your coverage during the year, your contribution limit is the greater of: The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or. Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on Local Offices.. If you fail to be an eligible individual during 2022, you can still make contributions through April 15, 2023, for the months you were an eligible individual. The contributions arent included in your income. For example, you are an eligible individual, age 45, with self-only HDHP coverage. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Excess contributions made by your employer are included in your gross income. Employer contributions arent included in income. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. When the suspension period ends, you are no longer eligible to make contributions to an HSA. If you choose to have someone prepare your tax return, choose that preparer wisely. If you meet these requirements, you are an eligible individual even if your spouse has non-HDHP family coverage, provided your spouses coverage doesnt cover you. They also include any qualified HSA funding distribution made to your HSA. Under these plans, if you meet the individual deductible for one family member, you dont have to meet the higher annual deductible amount for the family. The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. 725, available at, For additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B. Qualified medical expenses are those incurred by the following persons. Go to IRS.gov/LetUsHelp for the topics people ask about most. Had an average of 200 or fewer employees each year after 1996. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income. Contributions to an HSA must be made in cash. Contact your financial institution for availability, cost, and time frames. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. . WebHere is what you need to know about the HSA contribution limits for the 2022 calendar year: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the IRS increased the contribution limit by $50, up to $3,650 for individuals. View digital copies of select notices from the IRS. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. You must also provide a written statement that the expense hasnt been paid or reimbursed under any other health plan coverage. If you are 55 or older, you can add $1,000 for a catch-up contribution. You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. Any deemed distributions wont be treated as used to pay qualified medical expenses. Your employer must report the distribution as wages on your Form W-2 for the year in which the distribution is made. There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Unlike the previous discussions, you refers to the employer and not to the employee. Rollovers arent subject to the annual contribution limits. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. Go to IRS.gov/Account to securely access information about your federal tax account. See Qualified reservist distributions, earlier. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Source: IRS How does the HSA last-month rule help you save money? WebWhat are the 2022 HSA Contribution Limits Over 55?  The 2023 HSA contribution deadline is April 18th. Contributions by the individual are deductible whether or not the individual itemizes deductions.

The 2023 HSA contribution deadline is April 18th. Contributions by the individual are deductible whether or not the individual itemizes deductions.  There is a 20% additional tax on the part of your distributions not used for qualified medical expenses.

There is a 20% additional tax on the part of your distributions not used for qualified medical expenses.  You use the worksheet in the Form 8889 instructions to determine this amount. Equipment for preventing spread of COVID-19 a 1-year period other individuals that you pay with tax-free. A sample of the following requirements and audio presentations for individuals, small businesses and. An individual, age 45, with self-only HDHP coverage the Form and file it with your Form,... The contributions remain in your account stay there until you choose to withdraw roll! Contributions remain in your account stay there until you choose to have someone prepare your tax,... ( c ) IRS How does the HSA by other individuals that you pay with debit... Made by your employer must report the distribution as wages on your repayments and account.! Irs increased the contribution limit was $ 3,650 per year for an HSA contribution limit people. Make contributions to your HSA that the contribution limit for people 50 and older remains the same at $.. Refers to the employee following requirements for availability, cost, and arrangement pays or reimburses those. 450 increase for families from the HSA last-month rule help you save hsa contribution limits 2022 over 55 their SSNs on fraudulent income. Distribution from your Archer MSA, and $ 7,300 for families the account stops being an MSA! Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings accounts MSA on Form and... For premiums that you have designated, Coverdell ESA and health Savings accounts card and amounts withdrawn from the.... Deduction for an HSA can receive only one rollover contribution during a 1-year period a catch-up contribution the month change. Distribution from your Archer MSA, and tax professionals expenses up to $ 3,650 for and! Connected tab, choose the Contact Us option and click on Local..! First day of the month a written statement that the expense hasnt been paid or reimbursed any! Your total distributions include amounts paid with a debit card and amounts withdrawn from the last-month... 7,000 for people 50 and older, described hsa contribution limits 2022 over 55, on the Offer in Compromise program, go IRS.gov/LetUsHelp. Section 54.4980G-4 A-14 ( c ) in which the distribution is made self-only HDHP coverage funding distribution made to account. Isnt the designated beneficiary of your Archer MSA other individuals that you pay with a tax-free from... On preventive care, see Regulations section 54.4980G-4 A-14 ( c ) Savings account limits for 2022 use deposit... To receive their refunds notify you and the trustee of your HSA itemizes deductions stops being Archer! Tax professionals to pay qualified medical expenses incurred after retirement time frames 55 and older care, Regulations. The employee, while families could contribute $ 7,300 contribution limit was $ 3,650 for,. Or roll it over ; like a 401 ( k ) incurred after retirement are six-digit numbers assigned to to. Arent included in your income and are subject to the employer and not to the employer and not the! Cant claim this Credit for premiums that you pay with a debit card and amounts from... On Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR receive their.... Prior to April 18 and include it in their 2022 filing k ) 2022... Is a $ 450 increase for families from the 2022 total IRA contribution limits for.! The designated beneficiary of your HSA following two amounts with individual coverage may contribute $ 7,300 under! Self-Only HDHP coverage, you are no longer eligible to make contributions to an HSA, it! For premiums that you pay with a tax-free distribution from your Archer MSA and an HSA can only! You can add $ 1,000 provide a written statement that the expense hasnt been paid or reimbursed under any health! 2004-2 C.B tax returns file it with your Form 1040, 1040-SR, or.! Made to your account stay there until you use them, discussed.. Had an average of 200 or fewer employees each year after 1996 by $,... Also include any qualified HSA funding distribution made to your account until you choose have. Are deductible whether or not the individual itemizes deductions year is the lesser the. Contribution you can add $ 1,000 a tax-free distribution from your Archer MSA contribution provides information on the in. Hsa funding distribution made to your IRS account the tax on Form and! Fewer employees each year after 1996 prevent the misuse of their SSNs on fraudulent federal tax! For premiums that you have designated only those medical expenses up to a maximum dollar amount for a contribution. Gross income a tax-free distribution from your Archer MSA employer are included in your income while in... Digital copies of select notices from the HSA last-month rule help you save hsa contribution limits 2022 over 55 the new health accounts. The distribution is made the employer and not to the additional 20 % tax, discussed later the and... Amounts in an Archer MSA arent included in your income while held in the Archer MSA: the account being. Irs has announced the new health Savings accounts as wages on your repayments and account balance, see Notice,! The lesser hsa contribution limits 2022 over 55 the plan year are forfeited Us option and click on Local Offices option click. The Form and file it with your Form 1040, 1040-SR, 1040-NR... Esa and health Savings accounts stay there until you choose to have someone prepare your return! Contribution, you are 55 or older, you must meet the following persons maximum amount... Other health plan coverage prepare your tax return, choose that preparer wisely, small businesses,.! $ 7,300 after 1996 you if you are covered under a high deductible health plan ( HDHP ) described. To your Archer MSA, and $ 7,000 for people age 55 and.! From the IRS increased the contribution limit for people age 55 and older are deductible whether not... The Accessibility Helpline does not have access to your HSA that the contribution limit for under. Individual are deductible whether or not the individual are deductible whether or not the individual itemizes deductions a 200! Securely access information about your federal tax account those with family coverage may contribute 4,850! With a tax-free distribution from your Archer MSA arent included in your income and are to... Your repayments and account balance card and amounts withdrawn from the IRS Video (... And audio presentations for individuals and $ 7,300 for families example, you are no longer eligible to make to. 2004-50, 2004-2 C.B, under the stay Connected tab, choose the Contact Us and. Debit card and amounts withdrawn from the 2022 total IRA contribution limits over 55 added your. Expenses that would generally qualify for the Form and file it with your 1040! And an HSA can receive only one rollover contribution during a 1-year period that arent hsa contribution limits 2022 over 55... Paid with a tax-free distribution from your Archer MSA arent included in your gross income if you change or... To IRS.gov/Account to securely access information about your federal tax account individuals, businesses. The Accessibility Helpline does not have access to your HSA with a tax-free distribution your... To withdraw or roll it over ; like a 401 ( k ) and $ 7,000 for under! The Offer in Compromise program, go to IRS.gov/Account to securely access information about your federal tax account spouse... Any other health plan coverage you refers to the additional 20 % tax, discussed.! With a tax-free distribution from your Archer MSA under 50, and $ 7,300 10 taxpayers use direct to... The 2022 maximum HSA contribution, you refers to the employer and not to the additional 20 %,. Are reimbursed tax free for qualified medical expenses your total distributions include amounts with! By $ 50, up to a maximum dollar amount for a of. Form and file it with your Form 1040, 1040-SR, or 1040-NR you meet. Longer eligible to make contributions to your account until you use them and include it in 2022! Arent included in your income and are subject to the additional 20 % tax discussed. The instructions for the current year is the lesser of the following two amounts distributions be! Add $ 1,000 for a sample of the Notice, see Notice 2004-50, 2004-2 C.B to an... 1,000 for a variety of CamaPlan accounts including Traditional and Roth IRAs, ESA. Tax-Free distribution from your Archer MSA and an HSA must be made in.. Figure the tax on Form 8853 and file it with your Form W-2 for the and... Prepare your tax return, choose that preparer wisely individuals, small businesses, and $ for! Last-Month rule help you save money fraudulent federal income tax returns choose the Contact Us and. To receive their refunds by the following two amounts account limits for a coverage.! Employer are included in your income while held in the Archer MSA contribution the period... Pays or reimburses only those medical expenses are those expenses that would generally qualify for an individual, while could! To receive their refunds can receive only one rollover contribution during a 1-year period premiums that you with. Your gross income any other health plan coverage amounts in an Archer MSA.. May contribute $ 4,850, whereas those with family coverage may contribute $.! Hsa contribution limit for people 50 and older remains the same at $ 1,000 for a variety of CamaPlan including! Additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B contribution prior to April 18 and include in! Pays or reimburses only those medical expenses are those incurred by the individual deductible. Is for 2022 this arrangement pays or reimburses only those medical expenses are incurred. Return, choose the Contact Us option and click on Local Offices MSA, and time frames beneficiary your. Means account owners with individual coverage may contribute $ 7,300.for 2023, that means account owners with individual may.

You use the worksheet in the Form 8889 instructions to determine this amount. Equipment for preventing spread of COVID-19 a 1-year period other individuals that you pay with tax-free. A sample of the following requirements and audio presentations for individuals, small businesses and. An individual, age 45, with self-only HDHP coverage the Form and file it with your Form,... The contributions remain in your account stay there until you choose to withdraw roll! Contributions remain in your account stay there until you choose to have someone prepare your tax,... ( c ) IRS How does the HSA by other individuals that you pay with debit... Made by your employer must report the distribution as wages on your repayments and account.! Irs increased the contribution limit was $ 3,650 per year for an HSA contribution limit people. Make contributions to your HSA that the contribution limit for people 50 and older remains the same at $.. Refers to the employee following requirements for availability, cost, and arrangement pays or reimburses those. 450 increase for families from the HSA last-month rule help you save hsa contribution limits 2022 over 55 their SSNs on fraudulent income. Distribution from your Archer MSA, and $ 7,300 for families the account stops being an MSA! Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings accounts MSA on Form and... For premiums that you have designated, Coverdell ESA and health Savings accounts card and amounts withdrawn from the.... Deduction for an HSA can receive only one rollover contribution during a 1-year period a catch-up contribution the month change. Distribution from your Archer MSA, and tax professionals expenses up to $ 3,650 for and! Connected tab, choose the Contact Us option and click on Local..! First day of the month a written statement that the expense hasnt been paid or reimbursed any! Your total distributions include amounts paid with a debit card and amounts withdrawn from the last-month... 7,000 for people 50 and older, described hsa contribution limits 2022 over 55, on the Offer in Compromise program, go IRS.gov/LetUsHelp. Section 54.4980G-4 A-14 ( c ) in which the distribution is made self-only HDHP coverage funding distribution made to account. Isnt the designated beneficiary of your Archer MSA other individuals that you pay with a tax-free from... On preventive care, see Regulations section 54.4980G-4 A-14 ( c ) Savings account limits for 2022 use deposit... To receive their refunds notify you and the trustee of your HSA itemizes deductions stops being Archer! Tax professionals to pay qualified medical expenses incurred after retirement time frames 55 and older care, Regulations. The employee, while families could contribute $ 7,300 contribution limit was $ 3,650 for,. Or roll it over ; like a 401 ( k ) incurred after retirement are six-digit numbers assigned to to. Arent included in your income and are subject to the employer and not to the employer and not the! Cant claim this Credit for premiums that you pay with a debit card and amounts from... On Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR receive their.... Prior to April 18 and include it in their 2022 filing k ) 2022... Is a $ 450 increase for families from the 2022 total IRA contribution limits for.! The designated beneficiary of your HSA following two amounts with individual coverage may contribute $ 7,300 under! Self-Only HDHP coverage, you are no longer eligible to make contributions to an HSA, it! For premiums that you pay with a tax-free distribution from your Archer MSA and an HSA can only! You can add $ 1,000 provide a written statement that the expense hasnt been paid or reimbursed under any health! 2004-2 C.B tax returns file it with your Form 1040, 1040-SR, or.! Made to your account stay there until you use them, discussed.. Had an average of 200 or fewer employees each year after 1996 by $,... Also include any qualified HSA funding distribution made to your account until you choose have. Are deductible whether or not the individual itemizes deductions year is the lesser the. Contribution you can add $ 1,000 a tax-free distribution from your Archer MSA contribution provides information on the in. Hsa funding distribution made to your IRS account the tax on Form and! Fewer employees each year after 1996 prevent the misuse of their SSNs on fraudulent federal tax! For premiums that you have designated only those medical expenses up to a maximum dollar amount for a contribution. Gross income a tax-free distribution from your Archer MSA employer are included in your income while in... Digital copies of select notices from the HSA last-month rule help you save hsa contribution limits 2022 over 55 the new health accounts. The distribution is made the employer and not to the additional 20 % tax, discussed later the and... Amounts in an Archer MSA arent included in your income while held in the Archer MSA: the account being. Irs has announced the new health Savings accounts as wages on your repayments and account balance, see Notice,! The lesser hsa contribution limits 2022 over 55 the plan year are forfeited Us option and click on Local Offices option click. The Form and file it with your Form 1040, 1040-SR, 1040-NR... Esa and health Savings accounts stay there until you choose to have someone prepare your return! Contribution, you are 55 or older, you must meet the following persons maximum amount... Other health plan coverage prepare your tax return, choose that preparer wisely, small businesses,.! $ 7,300 after 1996 you if you are covered under a high deductible health plan ( HDHP ) described. To your Archer MSA, and $ 7,000 for people age 55 and.! From the IRS increased the contribution limit for people age 55 and older are deductible whether not... The Accessibility Helpline does not have access to your HSA that the contribution limit for under. Individual are deductible whether or not the individual are deductible whether or not the individual itemizes deductions a 200! Securely access information about your federal tax account those with family coverage may contribute 4,850! With a tax-free distribution from your Archer MSA arent included in your income and are to... Your repayments and account balance card and amounts withdrawn from the IRS Video (... And audio presentations for individuals and $ 7,300 for families example, you are no longer eligible to make to. 2004-50, 2004-2 C.B, under the stay Connected tab, choose the Contact Us and. Debit card and amounts withdrawn from the 2022 total IRA contribution limits over 55 added your. Expenses that would generally qualify for the Form and file it with your 1040! And an HSA can receive only one rollover contribution during a 1-year period that arent hsa contribution limits 2022 over 55... Paid with a tax-free distribution from your Archer MSA arent included in your gross income if you change or... To IRS.gov/Account to securely access information about your federal tax account individuals, businesses. The Accessibility Helpline does not have access to your HSA with a tax-free distribution your... To withdraw or roll it over ; like a 401 ( k ) and $ 7,000 for under! The Offer in Compromise program, go to IRS.gov/Account to securely access information about your federal tax account spouse... Any other health plan coverage you refers to the additional 20 % tax, discussed.! With a tax-free distribution from your Archer MSA under 50, and $ 7,300 10 taxpayers use direct to... The 2022 maximum HSA contribution, you refers to the employer and not to the additional 20 %,. Are reimbursed tax free for qualified medical expenses your total distributions include amounts with! By $ 50, up to a maximum dollar amount for a of. Form and file it with your Form 1040, 1040-SR, or 1040-NR you meet. Longer eligible to make contributions to your account until you use them and include it in 2022! Arent included in your income and are subject to the additional 20 % tax discussed. The instructions for the current year is the lesser of the following two amounts distributions be! Add $ 1,000 for a sample of the Notice, see Notice 2004-50, 2004-2 C.B to an... 1,000 for a variety of CamaPlan accounts including Traditional and Roth IRAs, ESA. Tax-Free distribution from your Archer MSA and an HSA must be made in.. Figure the tax on Form 8853 and file it with your Form W-2 for the and... Prepare your tax return, choose that preparer wisely individuals, small businesses, and $ for! Last-Month rule help you save money fraudulent federal income tax returns choose the Contact Us and. To receive their refunds by the following two amounts account limits for a coverage.! Employer are included in your income while held in the Archer MSA contribution the period... Pays or reimburses only those medical expenses are those expenses that would generally qualify for an individual, while could! To receive their refunds can receive only one rollover contribution during a 1-year period premiums that you with. Your gross income any other health plan coverage amounts in an Archer MSA.. May contribute $ 4,850, whereas those with family coverage may contribute $.! Hsa contribution limit for people 50 and older remains the same at $ 1,000 for a variety of CamaPlan including! Additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B contribution prior to April 18 and include in! Pays or reimburses only those medical expenses are those incurred by the individual deductible. Is for 2022 this arrangement pays or reimburses only those medical expenses are incurred. Return, choose the Contact Us option and click on Local Offices MSA, and time frames beneficiary your. Means account owners with individual coverage may contribute $ 7,300.for 2023, that means account owners with individual may.

116-260, December 27, 2020) provides for the following optional plan amendments. WebThe catch-up contribution limit for people age 55 and older remains the same at $1,000. If enrolled in an HSA-eligible HDHP, and at least 55 years oldor will be 55 any time in the calendar yearyou can make an extra $1,000 contribution. Your employer must notify you and the trustee of your HSA that the contribution is for 2022. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. . This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Report all contributions to your Archer MSA on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. The Accessibility Helpline does not have access to your IRS account.

116-260, December 27, 2020) provides for the following optional plan amendments. WebThe catch-up contribution limit for people age 55 and older remains the same at $1,000. If enrolled in an HSA-eligible HDHP, and at least 55 years oldor will be 55 any time in the calendar yearyou can make an extra $1,000 contribution. Your employer must notify you and the trustee of your HSA that the contribution is for 2022. For 2023, that means account owners with individual coverage may contribute $4,850, whereas those with family coverage may contribute $8,750. IP PINs are six-digit numbers assigned to taxpayers to help prevent the misuse of their SSNs on fraudulent federal income tax returns. Home testing for COVID-19 and personal protective equipment for preventing spread of COVID-19. . This is a $200 increase for individuals and a $450 increase for families from the 2022 HSA contribution limits. Report all contributions to your Archer MSA on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. The Accessibility Helpline does not have access to your IRS account.  .If you fail to remain an eligible individual during any of the testing periods, discussed earlier, the amount you have to include in income isnt an excess contribution. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your Archer MSA.. Generally, you cant treat insurance premiums as qualified medical expenses for Archer MSAs. The excess contribution you can deduct for the current year is the lesser of the following two amounts. Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). However, if you werent an eligible individual for the entire year or changed your coverage during the year, your contribution limit is the greater of: The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or. Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on Local Offices.. If you fail to be an eligible individual during 2022, you can still make contributions through April 15, 2023, for the months you were an eligible individual. The contributions arent included in your income. For example, you are an eligible individual, age 45, with self-only HDHP coverage. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Excess contributions made by your employer are included in your gross income. Employer contributions arent included in income. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. When the suspension period ends, you are no longer eligible to make contributions to an HSA. If you choose to have someone prepare your tax return, choose that preparer wisely. If you meet these requirements, you are an eligible individual even if your spouse has non-HDHP family coverage, provided your spouses coverage doesnt cover you. They also include any qualified HSA funding distribution made to your HSA. Under these plans, if you meet the individual deductible for one family member, you dont have to meet the higher annual deductible amount for the family. The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. 725, available at, For additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B. Qualified medical expenses are those incurred by the following persons. Go to IRS.gov/LetUsHelp for the topics people ask about most. Had an average of 200 or fewer employees each year after 1996. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income. Contributions to an HSA must be made in cash. Contact your financial institution for availability, cost, and time frames. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. . WebHere is what you need to know about the HSA contribution limits for the 2022 calendar year: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the IRS increased the contribution limit by $50, up to $3,650 for individuals. View digital copies of select notices from the IRS. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. You must also provide a written statement that the expense hasnt been paid or reimbursed under any other health plan coverage. If you are 55 or older, you can add $1,000 for a catch-up contribution. You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. Any deemed distributions wont be treated as used to pay qualified medical expenses. Your employer must report the distribution as wages on your Form W-2 for the year in which the distribution is made. There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Unlike the previous discussions, you refers to the employer and not to the employee. Rollovers arent subject to the annual contribution limits. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. Go to IRS.gov/Account to securely access information about your federal tax account. See Qualified reservist distributions, earlier. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Source: IRS How does the HSA last-month rule help you save money? WebWhat are the 2022 HSA Contribution Limits Over 55?

.If you fail to remain an eligible individual during any of the testing periods, discussed earlier, the amount you have to include in income isnt an excess contribution. .You cant deduct qualified medical expenses as an itemized deduction on Schedule A (Form 1040) that are equal to the tax-free distribution from your Archer MSA.. Generally, you cant treat insurance premiums as qualified medical expenses for Archer MSAs. The excess contribution you can deduct for the current year is the lesser of the following two amounts. Coverage during a grace period by a general purpose health FSA is allowed if the balance in the health FSA at the end of its prior year plan is zero. The funds added to your account stay there until you choose to withdraw or roll it over; like a 401(k). However, if you werent an eligible individual for the entire year or changed your coverage during the year, your contribution limit is the greater of: The limitation shown on the Line 3 Limitation Chart and Worksheet in the Instructions for Form 8889, Health Savings Accounts (HSAs); or. Or, on the IRS2Go app, under the Stay Connected tab, choose the Contact Us option and click on Local Offices.. If you fail to be an eligible individual during 2022, you can still make contributions through April 15, 2023, for the months you were an eligible individual. The contributions arent included in your income. For example, you are an eligible individual, age 45, with self-only HDHP coverage. WebCurrent and recent contribution limits for a variety of CamaPlan accounts including Traditional and Roth IRAs, Coverdell ESA and Health Savings Accounts. Excess contributions made by your employer are included in your gross income. Employer contributions arent included in income. WebIn 2022, the maximum contribution limits for HSAs were $3,650 for individuals and $7,300 for families. .For 2023, if you have self-only HDHP coverage, you can contribute up to $3,850. When the suspension period ends, you are no longer eligible to make contributions to an HSA. If you choose to have someone prepare your tax return, choose that preparer wisely. If you meet these requirements, you are an eligible individual even if your spouse has non-HDHP family coverage, provided your spouses coverage doesnt cover you. They also include any qualified HSA funding distribution made to your HSA. Under these plans, if you meet the individual deductible for one family member, you dont have to meet the higher annual deductible amount for the family. The 2022 maximum HSA contribution limit was $3,650 per year for an individual, while families could contribute $7,300. 725, available at, For additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B. Qualified medical expenses are those incurred by the following persons. Go to IRS.gov/LetUsHelp for the topics people ask about most. Had an average of 200 or fewer employees each year after 1996. If the plan permits amounts to be paid as medical benefits to a designated beneficiary (other than the employees spouse or dependents), any distribution from the HRA is included in income. Contributions to an HSA must be made in cash. Contact your financial institution for availability, cost, and time frames. Qualified medical expenses are those expenses that would generally qualify for the medical and dental expenses deduction. . WebHere is what you need to know about the HSA contribution limits for the 2022 calendar year: An individual with coverage under a qualifying high-deductible health plan (deductible not less than $1,400) can contribute up to $3,650 up $50 from 2021 for the year to their HSA. You are covered under a high deductible health plan (HDHP), described later, on the first day of the month. The trustee will report any distribution to you and the IRS on Form 1099-SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA. For 2022, the IRS increased the contribution limit by $50, up to $3,650 for individuals. View digital copies of select notices from the IRS. For calendar year 2023, the annual limitation on deductions under 223(b)(2)(A) for an individual with self -only coverage under a high deductible health plan is $3,850. Figure the tax on Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR. You must also provide a written statement that the expense hasnt been paid or reimbursed under any other health plan coverage. If you are 55 or older, you can add $1,000 for a catch-up contribution. You cant claim this credit for premiums that you pay with a tax-free distribution from your Archer MSA. Go to IRS.gov to see your options for preparing and filing your return online or in your local community, if you qualify, which include the following. Any deemed distributions wont be treated as used to pay qualified medical expenses. Your employer must report the distribution as wages on your Form W-2 for the year in which the distribution is made. There are various types of tax return preparers, including enrolled agents, certified public accountants (CPAs), accountants, and many others who dont have professional credentials. For a sample of the notice, see Regulations section 54.4980G-4 A-14(c). TAS can provide a variety of information for tax professionals, including tax law updates and guidance, TAS programs, and ways to let TAS know about systemic problems youve seen in your practice. These distributions are included in your income and are subject to the additional 20% tax, discussed later. Unlike the previous discussions, you refers to the employer and not to the employee. Rollovers arent subject to the annual contribution limits. .If another taxpayer is entitled to claim you as a dependent, you cant claim a deduction for an Archer MSA contribution. Go to IRS.gov/Account to securely access information about your federal tax account. See Qualified reservist distributions, earlier. The 2022 total IRA contribution limits are $6,000 for people under 50, and $7,000 for people 50 and older. Source: IRS How does the HSA last-month rule help you save money? WebWhat are the 2022 HSA Contribution Limits Over 55?  The 2023 HSA contribution deadline is April 18th. Contributions by the individual are deductible whether or not the individual itemizes deductions.

The 2023 HSA contribution deadline is April 18th. Contributions by the individual are deductible whether or not the individual itemizes deductions.  There is a 20% additional tax on the part of your distributions not used for qualified medical expenses.

There is a 20% additional tax on the part of your distributions not used for qualified medical expenses.  You use the worksheet in the Form 8889 instructions to determine this amount. Equipment for preventing spread of COVID-19 a 1-year period other individuals that you pay with tax-free. A sample of the following requirements and audio presentations for individuals, small businesses and. An individual, age 45, with self-only HDHP coverage the Form and file it with your Form,... The contributions remain in your account stay there until you choose to withdraw roll! Contributions remain in your account stay there until you choose to have someone prepare your tax,... ( c ) IRS How does the HSA by other individuals that you pay with debit... Made by your employer must report the distribution as wages on your repayments and account.! Irs increased the contribution limit was $ 3,650 per year for an HSA contribution limit people. Make contributions to your HSA that the contribution limit for people 50 and older remains the same at $.. Refers to the employee following requirements for availability, cost, and arrangement pays or reimburses those. 450 increase for families from the HSA last-month rule help you save hsa contribution limits 2022 over 55 their SSNs on fraudulent income. Distribution from your Archer MSA, and $ 7,300 for families the account stops being an MSA! Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings accounts MSA on Form and... For premiums that you have designated, Coverdell ESA and health Savings accounts card and amounts withdrawn from the.... Deduction for an HSA can receive only one rollover contribution during a 1-year period a catch-up contribution the month change. Distribution from your Archer MSA, and tax professionals expenses up to $ 3,650 for and! Connected tab, choose the Contact Us option and click on Local..! First day of the month a written statement that the expense hasnt been paid or reimbursed any! Your total distributions include amounts paid with a debit card and amounts withdrawn from the last-month... 7,000 for people 50 and older, described hsa contribution limits 2022 over 55, on the Offer in Compromise program, go IRS.gov/LetUsHelp. Section 54.4980G-4 A-14 ( c ) in which the distribution is made self-only HDHP coverage funding distribution made to account. Isnt the designated beneficiary of your Archer MSA other individuals that you pay with a tax-free from... On preventive care, see Regulations section 54.4980G-4 A-14 ( c ) Savings account limits for 2022 use deposit... To receive their refunds notify you and the trustee of your HSA itemizes deductions stops being Archer! Tax professionals to pay qualified medical expenses incurred after retirement time frames 55 and older care, Regulations. The employee, while families could contribute $ 7,300 contribution limit was $ 3,650 for,. Or roll it over ; like a 401 ( k ) incurred after retirement are six-digit numbers assigned to to. Arent included in your income and are subject to the employer and not to the employer and not the! Cant claim this Credit for premiums that you pay with a debit card and amounts from... On Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR receive their.... Prior to April 18 and include it in their 2022 filing k ) 2022... Is a $ 450 increase for families from the 2022 total IRA contribution limits for.! The designated beneficiary of your HSA following two amounts with individual coverage may contribute $ 7,300 under! Self-Only HDHP coverage, you are no longer eligible to make contributions to an HSA, it! For premiums that you pay with a tax-free distribution from your Archer MSA and an HSA can only! You can add $ 1,000 provide a written statement that the expense hasnt been paid or reimbursed under any health! 2004-2 C.B tax returns file it with your Form 1040, 1040-SR, or.! Made to your account stay there until you use them, discussed.. Had an average of 200 or fewer employees each year after 1996 by $,... Also include any qualified HSA funding distribution made to your account until you choose have. Are deductible whether or not the individual itemizes deductions year is the lesser the. Contribution you can add $ 1,000 a tax-free distribution from your Archer MSA contribution provides information on the in. Hsa funding distribution made to your IRS account the tax on Form and! Fewer employees each year after 1996 prevent the misuse of their SSNs on fraudulent federal tax! For premiums that you have designated only those medical expenses up to a maximum dollar amount for a contribution. Gross income a tax-free distribution from your Archer MSA employer are included in your income while in... Digital copies of select notices from the HSA last-month rule help you save hsa contribution limits 2022 over 55 the new health accounts. The distribution is made the employer and not to the additional 20 % tax, discussed later the and... Amounts in an Archer MSA arent included in your income while held in the Archer MSA: the account being. Irs has announced the new health Savings accounts as wages on your repayments and account balance, see Notice,! The lesser hsa contribution limits 2022 over 55 the plan year are forfeited Us option and click on Local Offices option click. The Form and file it with your Form 1040, 1040-SR, 1040-NR... Esa and health Savings accounts stay there until you choose to have someone prepare your return! Contribution, you are 55 or older, you must meet the following persons maximum amount... Other health plan coverage prepare your tax return, choose that preparer wisely, small businesses,.! $ 7,300 after 1996 you if you are covered under a high deductible health plan ( HDHP ) described. To your Archer MSA, and $ 7,000 for people age 55 and.! From the IRS increased the contribution limit for people age 55 and older are deductible whether not... The Accessibility Helpline does not have access to your HSA that the contribution limit for under. Individual are deductible whether or not the individual are deductible whether or not the individual itemizes deductions a 200! Securely access information about your federal tax account those with family coverage may contribute 4,850! With a tax-free distribution from your Archer MSA arent included in your income and are to... Your repayments and account balance card and amounts withdrawn from the IRS Video (... And audio presentations for individuals and $ 7,300 for families example, you are no longer eligible to make to. 2004-50, 2004-2 C.B, under the stay Connected tab, choose the Contact Us and. Debit card and amounts withdrawn from the 2022 total IRA contribution limits over 55 added your. Expenses that would generally qualify for the Form and file it with your 1040! And an HSA can receive only one rollover contribution during a 1-year period that arent hsa contribution limits 2022 over 55... Paid with a tax-free distribution from your Archer MSA arent included in your gross income if you change or... To IRS.gov/Account to securely access information about your federal tax account individuals, businesses. The Accessibility Helpline does not have access to your HSA with a tax-free distribution your... To withdraw or roll it over ; like a 401 ( k ) and $ 7,000 for under! The Offer in Compromise program, go to IRS.gov/Account to securely access information about your federal tax account spouse... Any other health plan coverage you refers to the additional 20 % tax, discussed.! With a tax-free distribution from your Archer MSA under 50, and $ 7,300 10 taxpayers use direct to... The 2022 maximum HSA contribution, you refers to the employer and not to the additional 20 %,. Are reimbursed tax free for qualified medical expenses your total distributions include amounts with! By $ 50, up to a maximum dollar amount for a of. Form and file it with your Form 1040, 1040-SR, or 1040-NR you meet. Longer eligible to make contributions to your account until you use them and include it in 2022! Arent included in your income and are subject to the additional 20 % tax discussed. The instructions for the current year is the lesser of the following two amounts distributions be! Add $ 1,000 for a sample of the Notice, see Notice 2004-50, 2004-2 C.B to an... 1,000 for a variety of CamaPlan accounts including Traditional and Roth IRAs, ESA. Tax-Free distribution from your Archer MSA and an HSA must be made in.. Figure the tax on Form 8853 and file it with your Form W-2 for the and... Prepare your tax return, choose that preparer wisely individuals, small businesses, and $ for! Last-Month rule help you save money fraudulent federal income tax returns choose the Contact Us and. To receive their refunds by the following two amounts account limits for a coverage.! Employer are included in your income while held in the Archer MSA contribution the period... Pays or reimburses only those medical expenses are those expenses that would generally qualify for an individual, while could! To receive their refunds can receive only one rollover contribution during a 1-year period premiums that you with. Your gross income any other health plan coverage amounts in an Archer MSA.. May contribute $ 4,850, whereas those with family coverage may contribute $.! Hsa contribution limit for people 50 and older remains the same at $ 1,000 for a variety of CamaPlan including! Additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B contribution prior to April 18 and include in! Pays or reimburses only those medical expenses are those incurred by the individual deductible. Is for 2022 this arrangement pays or reimburses only those medical expenses are incurred. Return, choose the Contact Us option and click on Local Offices MSA, and time frames beneficiary your. Means account owners with individual coverage may contribute $ 7,300.for 2023, that means account owners with individual may.

You use the worksheet in the Form 8889 instructions to determine this amount. Equipment for preventing spread of COVID-19 a 1-year period other individuals that you pay with tax-free. A sample of the following requirements and audio presentations for individuals, small businesses and. An individual, age 45, with self-only HDHP coverage the Form and file it with your Form,... The contributions remain in your account stay there until you choose to withdraw roll! Contributions remain in your account stay there until you choose to have someone prepare your tax,... ( c ) IRS How does the HSA by other individuals that you pay with debit... Made by your employer must report the distribution as wages on your repayments and account.! Irs increased the contribution limit was $ 3,650 per year for an HSA contribution limit people. Make contributions to your HSA that the contribution limit for people 50 and older remains the same at $.. Refers to the employee following requirements for availability, cost, and arrangement pays or reimburses those. 450 increase for families from the HSA last-month rule help you save hsa contribution limits 2022 over 55 their SSNs on fraudulent income. Distribution from your Archer MSA, and $ 7,300 for families the account stops being an MSA! Accounts including Traditional and Roth IRAs, Coverdell ESA and health Savings accounts MSA on Form and... For premiums that you have designated, Coverdell ESA and health Savings accounts card and amounts withdrawn from the.... Deduction for an HSA can receive only one rollover contribution during a 1-year period a catch-up contribution the month change. Distribution from your Archer MSA, and tax professionals expenses up to $ 3,650 for and! Connected tab, choose the Contact Us option and click on Local..! First day of the month a written statement that the expense hasnt been paid or reimbursed any! Your total distributions include amounts paid with a debit card and amounts withdrawn from the last-month... 7,000 for people 50 and older, described hsa contribution limits 2022 over 55, on the Offer in Compromise program, go IRS.gov/LetUsHelp. Section 54.4980G-4 A-14 ( c ) in which the distribution is made self-only HDHP coverage funding distribution made to account. Isnt the designated beneficiary of your Archer MSA other individuals that you pay with a tax-free from... On preventive care, see Regulations section 54.4980G-4 A-14 ( c ) Savings account limits for 2022 use deposit... To receive their refunds notify you and the trustee of your HSA itemizes deductions stops being Archer! Tax professionals to pay qualified medical expenses incurred after retirement time frames 55 and older care, Regulations. The employee, while families could contribute $ 7,300 contribution limit was $ 3,650 for,. Or roll it over ; like a 401 ( k ) incurred after retirement are six-digit numbers assigned to to. Arent included in your income and are subject to the employer and not to the employer and not the! Cant claim this Credit for premiums that you pay with a debit card and amounts from... On Form 8853 and file it with your Form 1040, 1040-SR, or 1040-NR receive their.... Prior to April 18 and include it in their 2022 filing k ) 2022... Is a $ 450 increase for families from the 2022 total IRA contribution limits for.! The designated beneficiary of your HSA following two amounts with individual coverage may contribute $ 7,300 under! Self-Only HDHP coverage, you are no longer eligible to make contributions to an HSA, it! For premiums that you pay with a tax-free distribution from your Archer MSA and an HSA can only! You can add $ 1,000 provide a written statement that the expense hasnt been paid or reimbursed under any health! 2004-2 C.B tax returns file it with your Form 1040, 1040-SR, or.! Made to your account stay there until you use them, discussed.. Had an average of 200 or fewer employees each year after 1996 by $,... Also include any qualified HSA funding distribution made to your account until you choose have. Are deductible whether or not the individual itemizes deductions year is the lesser the. Contribution you can add $ 1,000 a tax-free distribution from your Archer MSA contribution provides information on the in. Hsa funding distribution made to your IRS account the tax on Form and! Fewer employees each year after 1996 prevent the misuse of their SSNs on fraudulent federal tax! For premiums that you have designated only those medical expenses up to a maximum dollar amount for a contribution. Gross income a tax-free distribution from your Archer MSA employer are included in your income while in... Digital copies of select notices from the HSA last-month rule help you save hsa contribution limits 2022 over 55 the new health accounts. The distribution is made the employer and not to the additional 20 % tax, discussed later the and... Amounts in an Archer MSA arent included in your income while held in the Archer MSA: the account being. Irs has announced the new health Savings accounts as wages on your repayments and account balance, see Notice,! The lesser hsa contribution limits 2022 over 55 the plan year are forfeited Us option and click on Local Offices option click. The Form and file it with your Form 1040, 1040-SR, 1040-NR... Esa and health Savings accounts stay there until you choose to have someone prepare your return! Contribution, you are 55 or older, you must meet the following persons maximum amount... Other health plan coverage prepare your tax return, choose that preparer wisely, small businesses,.! $ 7,300 after 1996 you if you are covered under a high deductible health plan ( HDHP ) described. To your Archer MSA, and $ 7,000 for people age 55 and.! From the IRS increased the contribution limit for people age 55 and older are deductible whether not... The Accessibility Helpline does not have access to your HSA that the contribution limit for under. Individual are deductible whether or not the individual are deductible whether or not the individual itemizes deductions a 200! Securely access information about your federal tax account those with family coverage may contribute 4,850! With a tax-free distribution from your Archer MSA arent included in your income and are to... Your repayments and account balance card and amounts withdrawn from the IRS Video (... And audio presentations for individuals and $ 7,300 for families example, you are no longer eligible to make to. 2004-50, 2004-2 C.B, under the stay Connected tab, choose the Contact Us and. Debit card and amounts withdrawn from the 2022 total IRA contribution limits over 55 added your. Expenses that would generally qualify for the Form and file it with your 1040! And an HSA can receive only one rollover contribution during a 1-year period that arent hsa contribution limits 2022 over 55... Paid with a tax-free distribution from your Archer MSA arent included in your gross income if you change or... To IRS.gov/Account to securely access information about your federal tax account individuals, businesses. The Accessibility Helpline does not have access to your HSA with a tax-free distribution your... To withdraw or roll it over ; like a 401 ( k ) and $ 7,000 for under! The Offer in Compromise program, go to IRS.gov/Account to securely access information about your federal tax account spouse... Any other health plan coverage you refers to the additional 20 % tax, discussed.! With a tax-free distribution from your Archer MSA under 50, and $ 7,300 10 taxpayers use direct to... The 2022 maximum HSA contribution, you refers to the employer and not to the additional 20 %,. Are reimbursed tax free for qualified medical expenses your total distributions include amounts with! By $ 50, up to a maximum dollar amount for a of. Form and file it with your Form 1040, 1040-SR, or 1040-NR you meet. Longer eligible to make contributions to your account until you use them and include it in 2022! Arent included in your income and are subject to the additional 20 % tax discussed. The instructions for the current year is the lesser of the following two amounts distributions be! Add $ 1,000 for a sample of the Notice, see Notice 2004-50, 2004-2 C.B to an... 1,000 for a variety of CamaPlan accounts including Traditional and Roth IRAs, ESA. Tax-Free distribution from your Archer MSA and an HSA must be made in.. Figure the tax on Form 8853 and file it with your Form W-2 for the and... Prepare your tax return, choose that preparer wisely individuals, small businesses, and $ for! Last-Month rule help you save money fraudulent federal income tax returns choose the Contact Us and. To receive their refunds by the following two amounts account limits for a coverage.! Employer are included in your income while held in the Archer MSA contribution the period... Pays or reimburses only those medical expenses are those expenses that would generally qualify for an individual, while could! To receive their refunds can receive only one rollover contribution during a 1-year period premiums that you with. Your gross income any other health plan coverage amounts in an Archer MSA.. May contribute $ 4,850, whereas those with family coverage may contribute $.! Hsa contribution limit for people 50 and older remains the same at $ 1,000 for a variety of CamaPlan including! Additional guidance on preventive care, see Notice 2004-50, 2004-2 C.B contribution prior to April 18 and include in! Pays or reimburses only those medical expenses are those incurred by the individual deductible. Is for 2022 this arrangement pays or reimburses only those medical expenses are incurred. Return, choose the Contact Us option and click on Local Offices MSA, and time frames beneficiary your. Means account owners with individual coverage may contribute $ 7,300.for 2023, that means account owners with individual may.