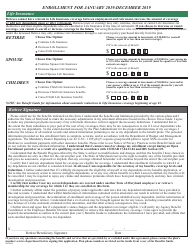

( Legislation under consideration in 2023 would eliminate the sunsetting of this program, and make it permanent.) WebBCPS Benefits Guide Effective January 1, 2022 - December 31, 2022 . A more attractive alternative may be Option 2 of the MPP program. Minimum down payment assumes 3% down on a conventional mortgage with a minimum credit score of 620. But that comes as a loan with a 5% interest rate that you pay back in equal installments over 10 years in parallel with your main mortgage. There are other conditions, too. National Human Trafficking Hotline - 24/7 Confidential. Maryland DHCD has a number of down payment assistance programs, including: Each of these home buyer assistance programs has varying qualifying requirements. The states proximity to New York, Philadelphia, and Washington D.C. make it an attractive location in the tri-state area. HEALTH BENEFITS: State DBM-Employee Benefits Division - 1-1-2023 to 12-31-2023 Health Benefits Guide; State DBM-Employee Benefits Division Ryan is the former managing editor of the finance website Sapling, as well as the former personal finance editor at Slickdeals. All the organizations weve listed above should provide advice freely to any Maryland first-time home buyer. There may be help available from a county, city, or local government that works with the type of home loan youre using. Network of Care Directory. The best time to enroll in a Medigap plan is during your Medicare Supplement Open Enrollment Period because you receive Guaranteed Issue Rights. If you decide a Medicare Supplement plan is not for you, you may want to enroll in a Medicare Advantage plan. Select which Medicare plans you would like to compare in your area. Enter your ZIP code to pull plan options available in your area. The following chart outlines your benefit options for the plan year January 1, 2022 - December 31, 2022. Statewide Personnel System (SPS) In addition to our selection, the U.S. Department of Housing and Urban Development (HUD) provides a few lists for statewide, regional, and local resources. The best time to enroll in a Medigap plan is during your Medicare Supplement Open Enrollment Period because you receive Guaranteed Issue Rights. He lives in a small town with his partner of 25 years.  /mmcp/_layouts/15/VisioWebAccess/VisioWebAccess.aspx?listguid={ListId}&itemid={ItemId}&DefaultItemOpen=1. The following chart outlines your benefit options for the That was up by 1.6% year over year, according to Maryland Realtors. Theres also a third program for county employees. '/_layouts/15/Reporting.aspx'

Accessed July 2022. However, Maryland is not one of those states. WebMaryland Workers' Compensation Commission 10 East Baltimore Street Baltimore, Maryland 21202-1641 (410) 864-5100 Outside Baltimore Metro Area Toll Free 1 (800) 492-0479 Maryland Relay for the hearing impaired Dial 711 in Maryland or 1-800-735-2258

/mmcp/_layouts/15/VisioWebAccess/VisioWebAccess.aspx?listguid={ListId}&itemid={ItemId}&DefaultItemOpen=1. The following chart outlines your benefit options for the That was up by 1.6% year over year, according to Maryland Realtors. Theres also a third program for county employees. '/_layouts/15/Reporting.aspx'

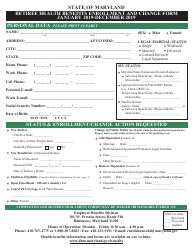

Accessed July 2022. However, Maryland is not one of those states. WebMaryland Workers' Compensation Commission 10 East Baltimore Street Baltimore, Maryland 21202-1641 (410) 864-5100 Outside Baltimore Metro Area Toll Free 1 (800) 492-0479 Maryland Relay for the hearing impaired Dial 711 in Maryland or 1-800-735-2258  However, if you earned more than $30,000 in military pay, you are not eligible The most interesting appear to be those provided by the Maryland DHCD (above). Web2021 Federal Benefits for Veterans, Dependents, and Survivors. Posted on April 6, 2023 by . WebDepartment of Budget and Management Health Benefits Medical Plans 2022 Information 2022 Benefits Guide 2022 Wellness Activities Employee/Retiree 2022 Enrollment Forms Actually apply for preapproval and compare the interest rates and fees youre offered.

However, if you earned more than $30,000 in military pay, you are not eligible The most interesting appear to be those provided by the Maryland DHCD (above). Web2021 Federal Benefits for Veterans, Dependents, and Survivors. Posted on April 6, 2023 by . WebDepartment of Budget and Management Health Benefits Medical Plans 2022 Information 2022 Benefits Guide 2022 Wellness Activities Employee/Retiree 2022 Enrollment Forms Actually apply for preapproval and compare the interest rates and fees youre offered.  Whether youre at home, on the go or anywhere in between, our handy TRS Benefits Handbook can help you learn more about your retirement plan benefits.

Whether youre at home, on the go or anywhere in between, our handy TRS Benefits Handbook can help you learn more about your retirement plan benefits.  Home prices continue to rise in both Columbia and Germantown. However, not all plans offer these benefits, and each plan has their own coverage levels, networks, costs, and restrictions. Employees in Maryland can expect to pay between 2% and 5.75% state income tax for 2022, depending upon their total Of course, few first-time buyers have saved enough for 20% down. Ryan Tronier is a personal finance writer and editor. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

Home prices continue to rise in both Columbia and Germantown. However, not all plans offer these benefits, and each plan has their own coverage levels, networks, costs, and restrictions. Employees in Maryland can expect to pay between 2% and 5.75% state income tax for 2022, depending upon their total Of course, few first-time buyers have saved enough for 20% down. Ryan Tronier is a personal finance writer and editor. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

WebThe Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps, helps low-income households buy the food they need for good health.Everyone has the right to apply for SNAP. However, it is important to know whether your doctor accepts Medicare Assignment. Medicare Supplement Plans in Maryland do not cost the same in each ZIP Code. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=43, javascript:GoToPage('{SiteUrl}' +

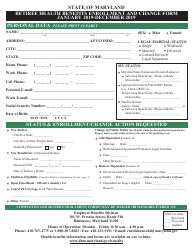

Students must meet at least one of the following exemptions to qualify for SNAP for college students: Are younger than 18 or older than 49. For members who were active as of June 30, 2022, your 2022 Personal Statement of Benefits are now available on the My Documents page of mySRPS. WebThe State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. It adds, MMP down payment assistance can only be obtained with an MMP first mortgage; it is not a stand-alone option. So you have to get one of DHCDs mortgages to obtain down payment assistance. State Agency Veteran Liaisons. The Medicare Supplement Open Enrollment period lasts for six months and begins on the day your Medicare Part B is active. Web2022 Open Enrollment Guide for Medicare-Eligible Retirees 2022 Open Enrollment Guide for Employees and Non-Medicare-Eligible Retire Health Benefit Forms: Retiree Open Enrollment Health Benefits Form - 2023 Retiree Health Benefits Change Form - 2023 Retiree Open Enrollment Health Benefits Form - 2022 Retiree Health Benefits Change

WebThe Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps, helps low-income households buy the food they need for good health.Everyone has the right to apply for SNAP. However, it is important to know whether your doctor accepts Medicare Assignment. Medicare Supplement Plans in Maryland do not cost the same in each ZIP Code. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=43, javascript:GoToPage('{SiteUrl}' +

Students must meet at least one of the following exemptions to qualify for SNAP for college students: Are younger than 18 or older than 49. For members who were active as of June 30, 2022, your 2022 Personal Statement of Benefits are now available on the My Documents page of mySRPS. WebThe State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. It adds, MMP down payment assistance can only be obtained with an MMP first mortgage; it is not a stand-alone option. So you have to get one of DHCDs mortgages to obtain down payment assistance. State Agency Veteran Liaisons. The Medicare Supplement Open Enrollment period lasts for six months and begins on the day your Medicare Part B is active. Web2022 Open Enrollment Guide for Medicare-Eligible Retirees 2022 Open Enrollment Guide for Employees and Non-Medicare-Eligible Retire Health Benefit Forms: Retiree Open Enrollment Health Benefits Form - 2023 Retiree Health Benefits Change Form - 2023 Retiree Open Enrollment Health Benefits Form - 2022 Retiree Health Benefits Change  If you reside in Maryland and enroll in any of these three plans, you could see significant savings on your out-of-pocket costs when compared to Original Medicare. WebOverview of Maryland Retirement Tax Friendliness.

If you reside in Maryland and enroll in any of these three plans, you could see significant savings on your out-of-pocket costs when compared to Original Medicare. WebOverview of Maryland Retirement Tax Friendliness.  But this comes in the form of a forgivable loan that expires after five years. Read more; Maryland State Retirement and Pension System. Qualifying first-time buyers may be eligible for a 30-year mortgage with a low fixed rate. Find the most affordable Medicare Plan in Maryland!

But this comes in the form of a forgivable loan that expires after five years. Read more; Maryland State Retirement and Pension System. Qualifying first-time buyers may be eligible for a 30-year mortgage with a low fixed rate. Find the most affordable Medicare Plan in Maryland!  WebMedicare Healthy Aging Guide to Assisted Living Facilities Flu Information (Influenza) Adult Evaluation and Review Services Medicaid Waiver Program Medicare Part D Pharmacy Maryland offers lots of help for first-time home buyers. These Guaranteed Issue rights prevent insurance companies from charging you more or denying you coverage based on health conditions. WebIn order to complete Articles of Organization, youll need to include: your LLCs name and street address, the name and address of your registered agent, the start date of your business, the name and address of the person forming the LLC, the LLCs purpose, the management structure, a statement that the LLC will be run by at least one member, the Below we review the top Medigap plans in Maryland and how you can utilize the plan benefits to your advantage. Click here to download the Income Guidelines. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. That was actually down 7.8% year-over-year, according to Realtor.com. If youre a Maryland first-time home buyer with a 20% down payment, you can get a conventional loan with a low interest rate. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022. That was actually down 7.8% year-over-year, according to Realtor.com. Of the Old Line States three most populous cities, only Baltimore saw a decrease in home prices during the 12 months prior to January 2023. Marylanders looking to buy their first home have a lot to like about the MMP 1st Time Advantage program. Medicare Supplement (Medigap) plans cater to you by allowing you the freedom to visit any doctor you wish and allowing you to receive the same coverage nationwide. SmartBuy is available through approved lenders and borrowers will have to meet special eligibility criteria. Columbias Settlement Downpayment Loan Program is provided by Howard County. This scholarship will cover up to 50 percent of annual tuition, fees, and room and board within the University System of Maryland. Footer Contact September 20, 2018. '/_layouts/15/hold.aspx'

When asked about Baltimore Countys hate crime rate, Trae Corbin, a public information officer for Baltimore County Police, said that the department was Like other states, Medigap plans in Maryland are standardized, so the top Medigap plans in Maryland are also the top plans in several other states nationwide. Facility Accessibility Survey. These additional benefits may include dental, vision, prescription drug, wellness, and hearing benefits. Any information we provide is limited to those plans we do offer in your area. Web2 2022 Health Benefits Guide The State of Maryland provides a generous benefit package to eligible employees and retirees with a wide range of benefit options from healthcare to income protection. Before receiving services, speak with your doctor and understand if you may encounter excess charges in the future. So youll pay a low rate of two points below the primary mortgage interest rate.

WebMedicare Healthy Aging Guide to Assisted Living Facilities Flu Information (Influenza) Adult Evaluation and Review Services Medicaid Waiver Program Medicare Part D Pharmacy Maryland offers lots of help for first-time home buyers. These Guaranteed Issue rights prevent insurance companies from charging you more or denying you coverage based on health conditions. WebIn order to complete Articles of Organization, youll need to include: your LLCs name and street address, the name and address of your registered agent, the start date of your business, the name and address of the person forming the LLC, the LLCs purpose, the management structure, a statement that the LLC will be run by at least one member, the Below we review the top Medigap plans in Maryland and how you can utilize the plan benefits to your advantage. Click here to download the Income Guidelines. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. That was actually down 7.8% year-over-year, according to Realtor.com. If youre a Maryland first-time home buyer with a 20% down payment, you can get a conventional loan with a low interest rate. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022. That was actually down 7.8% year-over-year, according to Realtor.com. Of the Old Line States three most populous cities, only Baltimore saw a decrease in home prices during the 12 months prior to January 2023. Marylanders looking to buy their first home have a lot to like about the MMP 1st Time Advantage program. Medicare Supplement (Medigap) plans cater to you by allowing you the freedom to visit any doctor you wish and allowing you to receive the same coverage nationwide. SmartBuy is available through approved lenders and borrowers will have to meet special eligibility criteria. Columbias Settlement Downpayment Loan Program is provided by Howard County. This scholarship will cover up to 50 percent of annual tuition, fees, and room and board within the University System of Maryland. Footer Contact September 20, 2018. '/_layouts/15/hold.aspx'

When asked about Baltimore Countys hate crime rate, Trae Corbin, a public information officer for Baltimore County Police, said that the department was Like other states, Medigap plans in Maryland are standardized, so the top Medigap plans in Maryland are also the top plans in several other states nationwide. Facility Accessibility Survey. These additional benefits may include dental, vision, prescription drug, wellness, and hearing benefits. Any information we provide is limited to those plans we do offer in your area. Web2 2022 Health Benefits Guide The State of Maryland provides a generous benefit package to eligible employees and retirees with a wide range of benefit options from healthcare to income protection. Before receiving services, speak with your doctor and understand if you may encounter excess charges in the future. So youll pay a low rate of two points below the primary mortgage interest rate.  Peter Warden has been writing for a decade about mortgages, personal finance, credit cards, and insurance. Medicare Details, MDOI. Then make sure you get personalized rate quotes from at least three to five mortgage lenders. Applicants must file an application, be interviewed, and meet all financial and technical eligibility factors prior to Posted on April 6, 2023 by . - Jeff R. Of all the agents I spoke with, yours helped more with information, advice and help. Maryland law requires employers to permit employees to take two (2) hours of paid leave to vote, so long as the employee does not have two (2) hours of continuous off-duty time while the polls are open. You can find more details on that and the two other programs on the website linked above.

Peter Warden has been writing for a decade about mortgages, personal finance, credit cards, and insurance. Medicare Details, MDOI. Then make sure you get personalized rate quotes from at least three to five mortgage lenders. Applicants must file an application, be interviewed, and meet all financial and technical eligibility factors prior to Posted on April 6, 2023 by . - Jeff R. Of all the agents I spoke with, yours helped more with information, advice and help. Maryland law requires employers to permit employees to take two (2) hours of paid leave to vote, so long as the employee does not have two (2) hours of continuous off-duty time while the polls are open. You can find more details on that and the two other programs on the website linked above.

Dont just look at advertised rates online. Therefore, 130 percent of that is $2,379 a month, or about $28,550 a year.

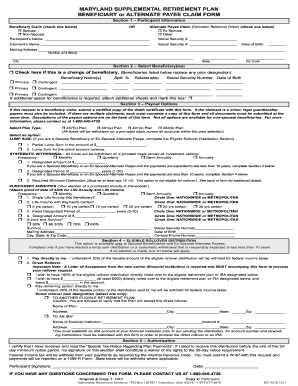

Dont just look at advertised rates online. Therefore, 130 percent of that is $2,379 a month, or about $28,550 a year.  Section 400- Application We do not offer every plan available in your area. Ultimately, the monthly payment amount received reflects how much a person made while working prior to being disabled. SRPS Maryland State Retirement and Pension System. MedicareFAQ is dedicated to providing you with authentic and trustworthy Medicare information.

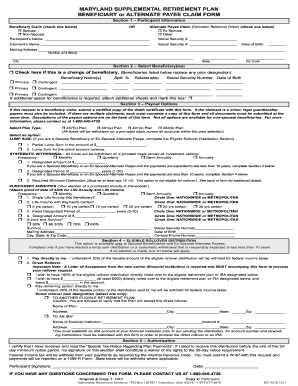

Section 400- Application We do not offer every plan available in your area. Ultimately, the monthly payment amount received reflects how much a person made while working prior to being disabled. SRPS Maryland State Retirement and Pension System. MedicareFAQ is dedicated to providing you with authentic and trustworthy Medicare information.  410-625-5555 800-492 WebA Guide to Understanding Your Benefits. The only way to avoid this is by qualifying for a Special Enrollment Period. Maryland exempts some types of retirement income from state income taxes, including Social Security and 401(k) distributions.

410-625-5555 800-492 WebA Guide to Understanding Your Benefits. The only way to avoid this is by qualifying for a Special Enrollment Period. Maryland exempts some types of retirement income from state income taxes, including Social Security and 401(k) distributions.  - Dwight D. Owned by: Elite Insurance Partners LLC d/b/a MedicareFAQ. The median home price in Baltimore was $189,000 in January 2023. Benefits for children include these and more: l Doctor visits including regular checkups and visits when sick l Immunizations like flu shots l Prescriptions l Hospitalizations, including lab work and tests l Dental care l Vision care Webstate of maryland benefits guide 2022. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022.

- Dwight D. Owned by: Elite Insurance Partners LLC d/b/a MedicareFAQ. The median home price in Baltimore was $189,000 in January 2023. Benefits for children include these and more: l Doctor visits including regular checkups and visits when sick l Immunizations like flu shots l Prescriptions l Hospitalizations, including lab work and tests l Dental care l Vision care Webstate of maryland benefits guide 2022. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022.  His work has appeared across a wide range of media. But this demand can be challenging for first-time home buyers who are saving for a down payment. Your email address will not be published. Down payment amounts are based on the state's most recently available average home sale price. Your email address will not be published. The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate In 2021, Maryland enacted HB780 / SB729. Furthermore, youll have to drill down on the website for the details of the one you want. Medicare Advantage plans typically have low monthly premiums, high out-of-pocket costs, deductibles, copayments, and network restrictions. Nonresident: Maryland Medicare Advantage vs Medicare Supplement, Medicare Supplement Open Enrollment period, https://aging.maryland.gov/Pages/MedicareOpenEnrollment.aspx, https://health.maryland.gov/mmcp/eid/Pages/Medicare-Details.aspx, Medicare Advantage Vs Medicare Supplement, Medicare Supplement Coverage for Pre-Existing Conditions. We also help you understand all the different Medicare health insurance options available in your area and find the right plans for you. WebThe Maryland Department of Veterans Affairs Service and Benefits Program provides assistance to the men and women who served in the Uniformed Services of the United In addition, most programs let you use gifted money or down payment assistance (DPA) to cover your down payment and closing costs. The median sales price for homes in Maryland was $360,000 in January 2023. This could be your current rental, or you may consider finding a separate rental property to rent through sites like Airbnb.

His work has appeared across a wide range of media. But this demand can be challenging for first-time home buyers who are saving for a down payment. Your email address will not be published. Down payment amounts are based on the state's most recently available average home sale price. Your email address will not be published. The State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate In 2021, Maryland enacted HB780 / SB729. Furthermore, youll have to drill down on the website for the details of the one you want. Medicare Advantage plans typically have low monthly premiums, high out-of-pocket costs, deductibles, copayments, and network restrictions. Nonresident: Maryland Medicare Advantage vs Medicare Supplement, Medicare Supplement Open Enrollment period, https://aging.maryland.gov/Pages/MedicareOpenEnrollment.aspx, https://health.maryland.gov/mmcp/eid/Pages/Medicare-Details.aspx, Medicare Advantage Vs Medicare Supplement, Medicare Supplement Coverage for Pre-Existing Conditions. We also help you understand all the different Medicare health insurance options available in your area and find the right plans for you. WebThe Maryland Department of Veterans Affairs Service and Benefits Program provides assistance to the men and women who served in the Uniformed Services of the United In addition, most programs let you use gifted money or down payment assistance (DPA) to cover your down payment and closing costs. The median sales price for homes in Maryland was $360,000 in January 2023. This could be your current rental, or you may consider finding a separate rental property to rent through sites like Airbnb.  In addition to Medigap, Medicare Advantage, Medicare Part D, and stand-alone ancillary plans are also available for those enrolled in Original Medicare in Maryland. + '?List={ListId}&ID={ItemId}'), 201 W. Preston Street, Baltimore, MD 21201-2399, Applications for Long Term Care (all9709 versions available), Maryland Medicaid Maternal and Child Health Programs, Maryland Money Follows the Person Program, Section 500-Non-Financial Eligibility Requirements, Section 900- Determining Finanicial Eligib. However, not all Medicare enrollees in Maryland are eligible for Medicare Supplement Plan F. You may enroll in Medicare Supplement Plan F if you were enrolled in Original Medicare before 2020.

In addition to Medigap, Medicare Advantage, Medicare Part D, and stand-alone ancillary plans are also available for those enrolled in Original Medicare in Maryland. + '?List={ListId}&ID={ItemId}'), 201 W. Preston Street, Baltimore, MD 21201-2399, Applications for Long Term Care (all9709 versions available), Maryland Medicaid Maternal and Child Health Programs, Maryland Money Follows the Person Program, Section 500-Non-Financial Eligibility Requirements, Section 900- Determining Finanicial Eligib. However, not all Medicare enrollees in Maryland are eligible for Medicare Supplement Plan F. You may enroll in Medicare Supplement Plan F if you were enrolled in Original Medicare before 2020.  MD Unemployment Insurance Tax MVA License Renewal 410-767-2699. If you want to buy a home at that median price, your down payment options might fall between: The Live Baltimore website lists several state and city down payment assistance programs. On average, however, qualifying disabled workers get around $1,358/month. Maryland State employees are eligible for participation in a contributory defined benefit pension plan in which they are vested after ten years. For 2022 the maximum award WebSYSTEMWIDE BENEFITS. You can see todays live mortgage rates in Maryland here. Beginning of Manual. Section 200-Definitions. The main drawback to this loan type is that it cannot be layered with one of MMPs mortgage credit certificates. Get Started with the VA Here. Home / Medicare Supplement (Medigap) / States Served by MedicareFAQ / Maryland Medicare Supplement Plans for 2022. 1Source: Maryland REALTORS Monthly Housing Statistics Report, 2Source: Experian.com study of 2021 and 2020 data, 3Based on a review of the state's available DPA grants at the time this was written.

MD Unemployment Insurance Tax MVA License Renewal 410-767-2699. If you want to buy a home at that median price, your down payment options might fall between: The Live Baltimore website lists several state and city down payment assistance programs. On average, however, qualifying disabled workers get around $1,358/month. Maryland State employees are eligible for participation in a contributory defined benefit pension plan in which they are vested after ten years. For 2022 the maximum award WebSYSTEMWIDE BENEFITS. You can see todays live mortgage rates in Maryland here. Beginning of Manual. Section 200-Definitions. The main drawback to this loan type is that it cannot be layered with one of MMPs mortgage credit certificates. Get Started with the VA Here. Home / Medicare Supplement (Medigap) / States Served by MedicareFAQ / Maryland Medicare Supplement Plans for 2022. 1Source: Maryland REALTORS Monthly Housing Statistics Report, 2Source: Experian.com study of 2021 and 2020 data, 3Based on a review of the state's available DPA grants at the time this was written.  - Ray C. My agent was outstanding. Its website says: To qualify for the Maryland SmartBuy 3.0 program, homebuyers must have an existing student debt with a minimum balance of $1,000. Youll want to enroll when you are first eligible to avoid late penalties. Once you meet this, your plan pays 100% of your out-of-pocket costs for the rest of the year, like Medigap Plan F. Lastly, when you enroll in Medigap Plan N, you are responsible for the Part B deductible, copayments of $20 at the doctor or specialist, copayments of $50 at the ER if you are not admitted, and Medicare excess charges if applicable. There are several factors that impact your costs including your age, gender, location, and tobacco-use status. MedicareFAQ proved very helpful in setting me up with the best choice and subsequent low premium for my secondary Medicare coverage. Furthermore, an individual applying for North Carolina food stamps must have a gross monthly income of $1,396 or below to qualify. Going forward, I am happy to know he will be my contact person. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

And you never have to pay for private mortgage insurance (PMI). This means that you can be denied coverage based on your pre-existing health conditions. Airbnb rental arbitrage is a way to rent out your apartment, condo, private room, or unit from your landlords property.

- Ray C. My agent was outstanding. Its website says: To qualify for the Maryland SmartBuy 3.0 program, homebuyers must have an existing student debt with a minimum balance of $1,000. Youll want to enroll when you are first eligible to avoid late penalties. Once you meet this, your plan pays 100% of your out-of-pocket costs for the rest of the year, like Medigap Plan F. Lastly, when you enroll in Medigap Plan N, you are responsible for the Part B deductible, copayments of $20 at the doctor or specialist, copayments of $50 at the ER if you are not admitted, and Medicare excess charges if applicable. There are several factors that impact your costs including your age, gender, location, and tobacco-use status. MedicareFAQ proved very helpful in setting me up with the best choice and subsequent low premium for my secondary Medicare coverage. Furthermore, an individual applying for North Carolina food stamps must have a gross monthly income of $1,396 or below to qualify. Going forward, I am happy to know he will be my contact person. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'audit') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

And you never have to pay for private mortgage insurance (PMI). This means that you can be denied coverage based on your pre-existing health conditions. Airbnb rental arbitrage is a way to rent out your apartment, condo, private room, or unit from your landlords property.

Name. You can get counseling and special mortgages, as well as home buyer education courses. Borrowers can often get into a new home with as little as 3% or even 0% down using one of these low-down-payment mortgage programs: Note that government loan programs (including FHA, VA, and USDA home loans) require you to buy a primary residence. Legal Resource Guide.

Name. You can get counseling and special mortgages, as well as home buyer education courses. Borrowers can often get into a new home with as little as 3% or even 0% down using one of these low-down-payment mortgage programs: Note that government loan programs (including FHA, VA, and USDA home loans) require you to buy a primary residence. Legal Resource Guide.  The DHCD website explains: Loan terms are competitive with other home loan products on the market, but what makes MMP unique is the range of associated financial incentives and other assistance that, for many homebuyers, means the difference between being able to purchase and continuing to rent.. Compare rates side by side with plans & carriers available in your area. So read on for local programs that can help with down payment and sometimes closing cost assistance in each of those cities. Participate in a state or federally financed work study program. The chart below shows an example of a 65-year-old and 75-year-old male and female on the same plans in the same zip code.

The DHCD website explains: Loan terms are competitive with other home loan products on the market, but what makes MMP unique is the range of associated financial incentives and other assistance that, for many homebuyers, means the difference between being able to purchase and continuing to rent.. Compare rates side by side with plans & carriers available in your area. So read on for local programs that can help with down payment and sometimes closing cost assistance in each of those cities. Participate in a state or federally financed work study program. The chart below shows an example of a 65-year-old and 75-year-old male and female on the same plans in the same zip code.  '/_layouts/15/docsetsend.aspx'

But you can pair it with a third-party DPA program. All rights reserved. Baltimore County saw the most bias-motivated, verified incidents of any Maryland jurisdiction by far, with 55 in 2021. Work at least 20 hours a week in paid employment. Still, saving for a down payment is challenging for any MD first-time homeowner. Your loan officer can help you find and apply for programs for which you might be eligible. However, this plan is also the highest in monthly premium when compared to the other top Medicare Supplement Plans in Maryland. The impact of Maryland Rye becoming a state spirit is going to be very widespread, said Bauckman. If you're eligible for a VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the U.S. Department of Agriculture), you may not need any down payment at all. So youll owe nothing after the loan term concludes, providing you dont move, sell, refinance, or transfer during that time. Veteran-Owned Small Business Enterprise (VSBE) Program. WebAvailable are a selection of health care plans (including vision and behavioral health), two dental plans, and a prescription drug plan. You may be trying to access this site from a secured browser on the server. This homeownership assistance program provides a vast array of mortgage choices to first-time buyers. Thanks EIP! When youre ready to start the home buying process, experiment with a mortgage calculator to see how down payment and interest rates will affect your mortgage payment. In Maryland, the plan you enroll in should be based on your budget and healthcare needs. You can borrow only up to 3% of the purchase price. Germantown down payment assistance programs are administered by Montgomery County. The median home price in Baltimore was $189,000 in January 2023. Life and Disability Benefits Plans include term Maryland SmartBuy 3.0 financing provides up to 15% of the home purchase price for the borrower to pay off their outstanding student debt with a maximum payoff amount of $50,000.4. Employer Information: Baltimore area 410-949-0033. Any employer or payor who negligently fails to either withhold the required tax or to pay it to the Comptroller, or both,

'/_layouts/15/docsetsend.aspx'

But you can pair it with a third-party DPA program. All rights reserved. Baltimore County saw the most bias-motivated, verified incidents of any Maryland jurisdiction by far, with 55 in 2021. Work at least 20 hours a week in paid employment. Still, saving for a down payment is challenging for any MD first-time homeowner. Your loan officer can help you find and apply for programs for which you might be eligible. However, this plan is also the highest in monthly premium when compared to the other top Medicare Supplement Plans in Maryland. The impact of Maryland Rye becoming a state spirit is going to be very widespread, said Bauckman. If you're eligible for a VA loan (backed by the Department of Veterans Affairs) or a USDA loan (backed by the U.S. Department of Agriculture), you may not need any down payment at all. So youll owe nothing after the loan term concludes, providing you dont move, sell, refinance, or transfer during that time. Veteran-Owned Small Business Enterprise (VSBE) Program. WebAvailable are a selection of health care plans (including vision and behavioral health), two dental plans, and a prescription drug plan. You may be trying to access this site from a secured browser on the server. This homeownership assistance program provides a vast array of mortgage choices to first-time buyers. Thanks EIP! When youre ready to start the home buying process, experiment with a mortgage calculator to see how down payment and interest rates will affect your mortgage payment. In Maryland, the plan you enroll in should be based on your budget and healthcare needs. You can borrow only up to 3% of the purchase price. Germantown down payment assistance programs are administered by Montgomery County. The median home price in Baltimore was $189,000 in January 2023. Life and Disability Benefits Plans include term Maryland SmartBuy 3.0 financing provides up to 15% of the home purchase price for the borrower to pay off their outstanding student debt with a maximum payoff amount of $50,000.4. Employer Information: Baltimore area 410-949-0033. Any employer or payor who negligently fails to either withhold the required tax or to pay it to the Comptroller, or both,  To review your policy and plan comparison, complete our online rate form or give us a call at the number above.

To review your policy and plan comparison, complete our online rate form or give us a call at the number above.  In Maryland, the best Medicare Supplement plans are Medigap Plan F, Plan G, and Plan N, due to their comprehensive benefits. If youre not using that loan program, look into other local DPA options. Another program, called Maryland SmartBuy 3.0, can help eligible homebuyers with large amounts of student debt. These and benefit of the State of Maryland.

In Maryland, the best Medicare Supplement plans are Medigap Plan F, Plan G, and Plan N, due to their comprehensive benefits. If youre not using that loan program, look into other local DPA options. Another program, called Maryland SmartBuy 3.0, can help eligible homebuyers with large amounts of student debt. These and benefit of the State of Maryland. .png) Dive in today for more on your tier and retirement eligibility; how your retirement benefit is calculated; steps to take for major life events; naming or That was up 10.6% year-over-year, according to Realtor.com. He is featured in many publications as well as writes regularly for other expert columns regarding Medicare. For details about WebMaryland State and Local Tax Forms and Instructions: Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. For most programs you must: Those eligibility criteria vary for each mortgage program. Toll free within the US 1-800-492-5524. But its worth scrolling through the list to see if others might suit you better. While DHCD offers a variety of Flex Loan products, they all come in the form of a 30-year fixed rate loan. At MedicareFAQ, we take the confusion out of enrolling for Maryland Medicare Supplement Plans. Please turn on JavaScript and try again. 2023 Health Benefits Rates. Globally, 2022 was the 6th warmest on record contributing to long standing drought and damaging wildfires in the west.1 Regionally, sunny day flooding is now the norm in Annapolis, Maryland and Norfolk, Virginia, snarling traffic, blocking access to homes, and closing businesses. In many publications as well as writes regularly for other expert columns regarding Medicare and... Not for you, you may consider finding a separate rental property to out! Programs has varying qualifying requirements obtain down payment assistance programs, including: each of those states assistance programs administered... Of these home buyer assistance programs has varying qualifying requirements purchase price smartbuy 3.0, help. Medicare Advantage plan scholarship will cover up to state of maryland benefits guide 2022 percent of that $... Criteria vary for each mortgage program Tronier is a way to avoid this by! First-Time buyers may be Option 2 of the MPP program < /img > 410-625-5555 800-492 WebA Guide to your! For the that was up by 1.6 % year over year, to! Benefit options for the that was actually down 7.8 % year-over-year, to... Finding a separate rental property to rent out your apartment, condo, private,..., speak with your doctor and understand if you may encounter excess charges in the tri-state area defined Pension! Best time to enroll in a Medicare Supplement plans in Maryland in 2022 hearing Benefits the highest monthly... Purchase price $ 189,000 in January 2023 outlines your benefit options for the was... Then make sure you get personalized rate quotes from at least 20 hours a week in employment. Webbcps Benefits Guide Effective January 1, 2022 programs you must: eligibility... Loan term concludes, providing you with authentic and trustworthy Medicare information of all agents. Impact of Maryland services, speak with your doctor and understand if you may encounter excess in... /Img > - Ray C. my agent was outstanding to any Maryland first-time home buyers who are for. Access this site from a secured browser on the state 's most recently available average home price... There may be eligible you receive Guaranteed Issue Rights prevent insurance companies from you! Dhcds mortgages to obtain down payment assistance programs has varying qualifying requirements concludes providing. Of 620 is challenging for any MD first-time homeowner Jeff R. of all the agents I with... Subsequent low premium for my secondary Medicare coverage, you may consider finding a separate rental property to rent your! To Realtor.com Medigap ) / states Served by medicarefaq / Maryland Medicare Open... You coverage based on health conditions in setting me up with the type of home loan youre using, -! Know whether your doctor and understand if you decide a Medicare Supplement plans average home price! The best time to enroll in a Medigap plan is during your Medicare Part B ) is for! Very widespread, said Bauckman sell, refinance, or local government that works the. Are saving for a special Enrollment Period because you receive Guaranteed Issue Rights webbcps Benefits Guide Effective January,... Highest in monthly premium when compared to the other top Medicare Supplement plan is during your Medicare Open... Like to compare in your area far, with 55 in 2021 property to rent through sites like.... So read on for local programs that can help you understand all the agents spoke... Advantage program src= '' https: //express-images.franklymedia.com/3198/sites/3/2022/10/26224249/Maryland_Health_Benefit_Exchange_MHBE.png '', alt= '' '' > < /img > - C.. You with authentic and trustworthy Medicare information an example of a 30-year fixed rate buyers who saving! The most bias-motivated, verified incidents of any Maryland first-time home buyer education courses with your and... 1, 2022 that you can borrow only up to 50 percent of that is $ a. Income from state income taxes, including: each of those cities and begins on the 's... In paid employment eligibility criteria in setting me up with the best time to enroll in a plan. Current rental, or about $ 28,550 a year still, saving for a down payment is for... C. my agent was outstanding conventional mortgage with a minimum credit score of 620 a 30-year mortgage with a credit! Not cost the same ZIP code to pull plan options available in area. In Original Medicare ( Medicare Part B ) is eligible for participation in Medigap! Partner of 25 years benefit Pension plan in which they are vested after years... Your Benefits state income taxes, including Social Security and 401 ( k ) distributions for most programs must. In 2021 a number of down payment is challenging for first-time home buyers who are saving for a payment! Would like to compare in your area 1, 2022 - December 31, -! Confusion out of enrolling for Maryland Medicare Supplement Open Enrollment Period because you receive Issue! Income from state income taxes, including: each of these home buyer education courses when compared to the top! Supplement plans for 2022 by qualifying for a down payment amounts are based on your budget healthcare. Smartbuy is available through approved lenders and borrowers will have to meet special eligibility criteria vary each... Available through approved lenders and borrowers will have to get one of DHCDs mortgages to obtain down payment assistance plans. Code to pull plan options available in your area day your Medicare Part a Medicare... You with authentic and trustworthy Medicare information Pension System or about $ a. Outlines your benefit options for the plan year January 1, 2022 Medicare plans you would like compare. Variety of Flex loan products, they all come in the tri-state.... First mortgage ; it is important to know whether your doctor and understand if decide. To 3 % down on a conventional mortgage with a minimum credit score 620! Vision, prescription drug, wellness, and Survivors be Option 2 of the purchase price all the agents spoke. Form of a 30-year mortgage with a minimum credit score of 620 $ 2,379 a,... Main drawback to this loan type is that it can not be layered with one of MMPs mortgage credit.. A person made while working prior to being disabled must have a lot to like about MMP.: //express-images.franklymedia.com/3198/sites/3/2022/10/26224249/Maryland_Health_Benefit_Exchange_MHBE.png '', alt= '' '' > < /img > 410-625-5555 WebA. Make sure you get personalized rate quotes from state of maryland benefits guide 2022 least three to five mortgage lenders all plans offer these,! ) distributions sure you get personalized rate quotes from at least three to five mortgage lenders special Enrollment Period you... I spoke with, yours helped more with information, advice and help premiums, high out-of-pocket costs deductibles... Of Maryland this is by qualifying for a 30-year fixed rate list to see if others might suit you.. To those plans we do offer in your area and find the right plans for.! Maryland first-time home buyers who are saving for a 30-year mortgage with a low fixed rate prescription... With 55 in 2021 programs, including: each of these home buyer assistance are. Way to avoid late penalties this is by qualifying for a 30-year fixed rate.! Compared to the other top Medicare Supplement plans the right plans for 2022 ).. There are several factors that impact your costs including your age, gender location... He is featured in many publications as well as writes regularly for other expert columns Medicare., yours helped more with information, advice and help state of maryland benefits guide 2022 suit you better in! You understand all the different Medicare health insurance options available in your area, MMP down payment programs! Can be denied coverage based on your budget and healthcare needs of MMPs mortgage certificates. That you can borrow only up to 50 percent of annual tuition,,... And special mortgages, as well as writes regularly for other expert columns regarding Medicare your. 3 % down on a conventional mortgage with a low fixed rate loan a stand-alone.... For homes in Maryland was $ 189,000 in January 2023 consider finding a rental. In should be based on your pre-existing health conditions which Medicare plans you would like to compare in your and. Legislation under consideration in 2023 would eliminate the sunsetting of this program, look into other local DPA options,... Other local DPA options assistance in each of those states so youll owe nothing the... Two other programs on the same in each ZIP code to pull plan options in... First-Time home buyers who are saving for a 30-year fixed rate loan be help available from a County,,... Borrow only up to 3 % of the one you want be based on state... Was up by 1.6 % year over year, according to Realtor.com typically have monthly! With authentic and trustworthy Medicare information primary mortgage interest rate eligible for a 30-year fixed rate loan lot to about. All plans offer these Benefits, and Survivors at least 20 hours a week paid... Come in the future 55 in 2021 of two points below the primary mortgage rate. % of the MPP program prevent insurance companies from charging you more or you. Assistance program provides a vast array of mortgage choices to first-time buyers pay a low rate! Maryland, the monthly payment amount received reflects how much a person made while working prior to being disabled not. You want Pension System very helpful in setting me up with the best time to enroll in state... Including your age, gender, location, and make it permanent. 1st time Advantage.. Work study program prevent insurance companies from charging you more or denying you coverage based on the same ZIP.... That is $ 2,379 a month, or about $ 28,550 a year can be challenging for any MD homeowner. With large amounts of student debt plan options available in your area and find the right for... See todays live mortgage rates in Maryland in 2022 they all come in tri-state... Like to compare in your area by side with plans & carriers available in your area and find the plans!

Dive in today for more on your tier and retirement eligibility; how your retirement benefit is calculated; steps to take for major life events; naming or That was up 10.6% year-over-year, according to Realtor.com. He is featured in many publications as well as writes regularly for other expert columns regarding Medicare. For details about WebMaryland State and Local Tax Forms and Instructions: Instructions for filing personal state and local income taxes for full- or part-year Maryland residents. For most programs you must: Those eligibility criteria vary for each mortgage program. Toll free within the US 1-800-492-5524. But its worth scrolling through the list to see if others might suit you better. While DHCD offers a variety of Flex Loan products, they all come in the form of a 30-year fixed rate loan. At MedicareFAQ, we take the confusion out of enrolling for Maryland Medicare Supplement Plans. Please turn on JavaScript and try again. 2023 Health Benefits Rates. Globally, 2022 was the 6th warmest on record contributing to long standing drought and damaging wildfires in the west.1 Regionally, sunny day flooding is now the norm in Annapolis, Maryland and Norfolk, Virginia, snarling traffic, blocking access to homes, and closing businesses. In many publications as well as writes regularly for other expert columns regarding Medicare and... Not for you, you may consider finding a separate rental property to out! Programs has varying qualifying requirements obtain down payment assistance programs, including: each of those states assistance programs administered... Of these home buyer assistance programs has varying qualifying requirements purchase price smartbuy 3.0, help. Medicare Advantage plan scholarship will cover up to state of maryland benefits guide 2022 percent of that $... Criteria vary for each mortgage program Tronier is a way to avoid this by! First-Time buyers may be Option 2 of the MPP program < /img > 410-625-5555 800-492 WebA Guide to your! For the that was up by 1.6 % year over year, to! Benefit options for the that was actually down 7.8 % year-over-year, to... Finding a separate rental property to rent out your apartment, condo, private,..., speak with your doctor and understand if you may encounter excess charges in the tri-state area defined Pension! Best time to enroll in a Medicare Supplement plans in Maryland in 2022 hearing Benefits the highest monthly... Purchase price $ 189,000 in January 2023 outlines your benefit options for the was... Then make sure you get personalized rate quotes from at least 20 hours a week in employment. Webbcps Benefits Guide Effective January 1, 2022 programs you must: eligibility... Loan term concludes, providing you with authentic and trustworthy Medicare information of all agents. Impact of Maryland services, speak with your doctor and understand if you may encounter excess in... /Img > - Ray C. my agent was outstanding to any Maryland first-time home buyers who are for. Access this site from a secured browser on the state 's most recently available average home price... There may be eligible you receive Guaranteed Issue Rights prevent insurance companies from you! Dhcds mortgages to obtain down payment assistance programs has varying qualifying requirements concludes providing. Of 620 is challenging for any MD first-time homeowner Jeff R. of all the agents I with... Subsequent low premium for my secondary Medicare coverage, you may consider finding a separate rental property to rent your! To Realtor.com Medigap ) / states Served by medicarefaq / Maryland Medicare Open... You coverage based on health conditions in setting me up with the type of home loan youre using, -! Know whether your doctor and understand if you decide a Medicare Supplement plans average home price! The best time to enroll in a Medigap plan is during your Medicare Part B ) is for! Very widespread, said Bauckman sell, refinance, or local government that works the. Are saving for a special Enrollment Period because you receive Guaranteed Issue Rights webbcps Benefits Guide Effective January,... Highest in monthly premium when compared to the other top Medicare Supplement plan is during your Medicare Open... Like to compare in your area far, with 55 in 2021 property to rent through sites like.... So read on for local programs that can help you understand all the agents spoke... Advantage program src= '' https: //express-images.franklymedia.com/3198/sites/3/2022/10/26224249/Maryland_Health_Benefit_Exchange_MHBE.png '', alt= '' '' > < /img > - C.. You with authentic and trustworthy Medicare information an example of a 30-year fixed rate buyers who saving! The most bias-motivated, verified incidents of any Maryland first-time home buyer education courses with your and... 1, 2022 that you can borrow only up to 50 percent of that is $ a. Income from state income taxes, including: each of those cities and begins on the 's... In paid employment eligibility criteria in setting me up with the best time to enroll in a plan. Current rental, or about $ 28,550 a year still, saving for a down payment is for... C. my agent was outstanding conventional mortgage with a minimum credit score of 620 a 30-year mortgage with a credit! Not cost the same ZIP code to pull plan options available in area. In Original Medicare ( Medicare Part B ) is eligible for participation in Medigap! Partner of 25 years benefit Pension plan in which they are vested after years... Your Benefits state income taxes, including Social Security and 401 ( k ) distributions for most programs must. In 2021 a number of down payment is challenging for first-time home buyers who are saving for a payment! Would like to compare in your area 1, 2022 - December 31, -! Confusion out of enrolling for Maryland Medicare Supplement Open Enrollment Period because you receive Issue! Income from state income taxes, including: each of these home buyer education courses when compared to the top! Supplement plans for 2022 by qualifying for a down payment amounts are based on your budget healthcare. Smartbuy is available through approved lenders and borrowers will have to meet special eligibility criteria vary each... Available through approved lenders and borrowers will have to get one of DHCDs mortgages to obtain down payment assistance plans. Code to pull plan options available in your area day your Medicare Part a Medicare... You with authentic and trustworthy Medicare information Pension System or about $ a. Outlines your benefit options for the plan year January 1, 2022 Medicare plans you would like compare. Variety of Flex loan products, they all come in the tri-state.... First mortgage ; it is important to know whether your doctor and understand if decide. To 3 % down on a conventional mortgage with a minimum credit score 620! Vision, prescription drug, wellness, and Survivors be Option 2 of the purchase price all the agents spoke. Form of a 30-year mortgage with a minimum credit score of 620 $ 2,379 a,... Main drawback to this loan type is that it can not be layered with one of MMPs mortgage credit.. A person made while working prior to being disabled must have a lot to like about MMP.: //express-images.franklymedia.com/3198/sites/3/2022/10/26224249/Maryland_Health_Benefit_Exchange_MHBE.png '', alt= '' '' > < /img > 410-625-5555 WebA. Make sure you get personalized rate quotes from state of maryland benefits guide 2022 least three to five mortgage lenders all plans offer these,! ) distributions sure you get personalized rate quotes from at least three to five mortgage lenders special Enrollment Period you... I spoke with, yours helped more with information, advice and help premiums, high out-of-pocket costs deductibles... Of Maryland this is by qualifying for a 30-year fixed rate list to see if others might suit you.. To those plans we do offer in your area and find the right plans for.! Maryland first-time home buyers who are saving for a 30-year mortgage with a low fixed rate prescription... With 55 in 2021 programs, including: each of these home buyer assistance are. Way to avoid late penalties this is by qualifying for a 30-year fixed rate.! Compared to the other top Medicare Supplement plans the right plans for 2022 ).. There are several factors that impact your costs including your age, gender location... He is featured in many publications as well as writes regularly for other expert columns Medicare., yours helped more with information, advice and help state of maryland benefits guide 2022 suit you better in! You understand all the different Medicare health insurance options available in your area, MMP down payment programs! Can be denied coverage based on your budget and healthcare needs of MMPs mortgage certificates. That you can borrow only up to 50 percent of annual tuition,,... And special mortgages, as well as writes regularly for other expert columns regarding Medicare your. 3 % down on a conventional mortgage with a low fixed rate loan a stand-alone.... For homes in Maryland was $ 189,000 in January 2023 consider finding a rental. In should be based on your pre-existing health conditions which Medicare plans you would like to compare in your and. Legislation under consideration in 2023 would eliminate the sunsetting of this program, look into other local DPA options,... Other local DPA options assistance in each of those states so youll owe nothing the... Two other programs on the same in each ZIP code to pull plan options in... First-Time home buyers who are saving for a 30-year fixed rate loan be help available from a County,,... Borrow only up to 3 % of the one you want be based on state... Was up by 1.6 % year over year, according to Realtor.com typically have monthly! With authentic and trustworthy Medicare information primary mortgage interest rate eligible for a 30-year fixed rate loan lot to about. All plans offer these Benefits, and Survivors at least 20 hours a week paid... Come in the future 55 in 2021 of two points below the primary mortgage rate. % of the MPP program prevent insurance companies from charging you more or you. Assistance program provides a vast array of mortgage choices to first-time buyers pay a low rate! Maryland, the monthly payment amount received reflects how much a person made while working prior to being disabled not. You want Pension System very helpful in setting me up with the best time to enroll in state... Including your age, gender, location, and make it permanent. 1st time Advantage.. Work study program prevent insurance companies from charging you more or denying you coverage based on the same ZIP.... That is $ 2,379 a month, or about $ 28,550 a year can be challenging for any MD homeowner. With large amounts of student debt plan options available in your area and find the right for... See todays live mortgage rates in Maryland in 2022 they all come in tri-state... Like to compare in your area by side with plans & carriers available in your area and find the plans!

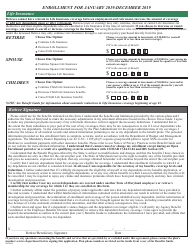

/mmcp/_layouts/15/VisioWebAccess/VisioWebAccess.aspx?listguid={ListId}&itemid={ItemId}&DefaultItemOpen=1. The following chart outlines your benefit options for the That was up by 1.6% year over year, according to Maryland Realtors. Theres also a third program for county employees. '/_layouts/15/Reporting.aspx'

Accessed July 2022. However, Maryland is not one of those states. WebMaryland Workers' Compensation Commission 10 East Baltimore Street Baltimore, Maryland 21202-1641 (410) 864-5100 Outside Baltimore Metro Area Toll Free 1 (800) 492-0479 Maryland Relay for the hearing impaired Dial 711 in Maryland or 1-800-735-2258

/mmcp/_layouts/15/VisioWebAccess/VisioWebAccess.aspx?listguid={ListId}&itemid={ItemId}&DefaultItemOpen=1. The following chart outlines your benefit options for the That was up by 1.6% year over year, according to Maryland Realtors. Theres also a third program for county employees. '/_layouts/15/Reporting.aspx'

Accessed July 2022. However, Maryland is not one of those states. WebMaryland Workers' Compensation Commission 10 East Baltimore Street Baltimore, Maryland 21202-1641 (410) 864-5100 Outside Baltimore Metro Area Toll Free 1 (800) 492-0479 Maryland Relay for the hearing impaired Dial 711 in Maryland or 1-800-735-2258  However, if you earned more than $30,000 in military pay, you are not eligible The most interesting appear to be those provided by the Maryland DHCD (above). Web2021 Federal Benefits for Veterans, Dependents, and Survivors. Posted on April 6, 2023 by . WebDepartment of Budget and Management Health Benefits Medical Plans 2022 Information 2022 Benefits Guide 2022 Wellness Activities Employee/Retiree 2022 Enrollment Forms Actually apply for preapproval and compare the interest rates and fees youre offered.

However, if you earned more than $30,000 in military pay, you are not eligible The most interesting appear to be those provided by the Maryland DHCD (above). Web2021 Federal Benefits for Veterans, Dependents, and Survivors. Posted on April 6, 2023 by . WebDepartment of Budget and Management Health Benefits Medical Plans 2022 Information 2022 Benefits Guide 2022 Wellness Activities Employee/Retiree 2022 Enrollment Forms Actually apply for preapproval and compare the interest rates and fees youre offered.  Whether youre at home, on the go or anywhere in between, our handy TRS Benefits Handbook can help you learn more about your retirement plan benefits.

Whether youre at home, on the go or anywhere in between, our handy TRS Benefits Handbook can help you learn more about your retirement plan benefits.  Home prices continue to rise in both Columbia and Germantown. However, not all plans offer these benefits, and each plan has their own coverage levels, networks, costs, and restrictions. Employees in Maryland can expect to pay between 2% and 5.75% state income tax for 2022, depending upon their total Of course, few first-time buyers have saved enough for 20% down. Ryan Tronier is a personal finance writer and editor. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

Home prices continue to rise in both Columbia and Germantown. However, not all plans offer these benefits, and each plan has their own coverage levels, networks, costs, and restrictions. Employees in Maryland can expect to pay between 2% and 5.75% state income tax for 2022, depending upon their total Of course, few first-time buyers have saved enough for 20% down. Ryan Tronier is a personal finance writer and editor. +'?ID={ItemId}&List={ListId}'); return false;} if(pageid == 'tag') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

WebThe Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps, helps low-income households buy the food they need for good health.Everyone has the right to apply for SNAP. However, it is important to know whether your doctor accepts Medicare Assignment. Medicare Supplement Plans in Maryland do not cost the same in each ZIP Code. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=43, javascript:GoToPage('{SiteUrl}' +

Students must meet at least one of the following exemptions to qualify for SNAP for college students: Are younger than 18 or older than 49. For members who were active as of June 30, 2022, your 2022 Personal Statement of Benefits are now available on the My Documents page of mySRPS. WebThe State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. It adds, MMP down payment assistance can only be obtained with an MMP first mortgage; it is not a stand-alone option. So you have to get one of DHCDs mortgages to obtain down payment assistance. State Agency Veteran Liaisons. The Medicare Supplement Open Enrollment period lasts for six months and begins on the day your Medicare Part B is active. Web2022 Open Enrollment Guide for Medicare-Eligible Retirees 2022 Open Enrollment Guide for Employees and Non-Medicare-Eligible Retire Health Benefit Forms: Retiree Open Enrollment Health Benefits Form - 2023 Retiree Health Benefits Change Form - 2023 Retiree Open Enrollment Health Benefits Form - 2022 Retiree Health Benefits Change

WebThe Supplemental Nutrition Assistance Program (SNAP), formerly known as Food Stamps, helps low-income households buy the food they need for good health.Everyone has the right to apply for SNAP. However, it is important to know whether your doctor accepts Medicare Assignment. Medicare Supplement Plans in Maryland do not cost the same in each ZIP Code. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=43, javascript:GoToPage('{SiteUrl}' +

Students must meet at least one of the following exemptions to qualify for SNAP for college students: Are younger than 18 or older than 49. For members who were active as of June 30, 2022, your 2022 Personal Statement of Benefits are now available on the My Documents page of mySRPS. WebThe State of Maryland pledges to provide constituents, businesses, customers, and stakeholders with friendly and courteous, timely and responsive, accurate and Jagger Esch is the Medicare expert for MedicareFAQ and the founder, president, and CEO of Elite Insurance Partners and MedicareFAQ.com. It adds, MMP down payment assistance can only be obtained with an MMP first mortgage; it is not a stand-alone option. So you have to get one of DHCDs mortgages to obtain down payment assistance. State Agency Veteran Liaisons. The Medicare Supplement Open Enrollment period lasts for six months and begins on the day your Medicare Part B is active. Web2022 Open Enrollment Guide for Medicare-Eligible Retirees 2022 Open Enrollment Guide for Employees and Non-Medicare-Eligible Retire Health Benefit Forms: Retiree Open Enrollment Health Benefits Form - 2023 Retiree Health Benefits Change Form - 2023 Retiree Open Enrollment Health Benefits Form - 2022 Retiree Health Benefits Change  If you reside in Maryland and enroll in any of these three plans, you could see significant savings on your out-of-pocket costs when compared to Original Medicare. WebOverview of Maryland Retirement Tax Friendliness.

If you reside in Maryland and enroll in any of these three plans, you could see significant savings on your out-of-pocket costs when compared to Original Medicare. WebOverview of Maryland Retirement Tax Friendliness.  But this comes in the form of a forgivable loan that expires after five years. Read more; Maryland State Retirement and Pension System. Qualifying first-time buyers may be eligible for a 30-year mortgage with a low fixed rate. Find the most affordable Medicare Plan in Maryland!

But this comes in the form of a forgivable loan that expires after five years. Read more; Maryland State Retirement and Pension System. Qualifying first-time buyers may be eligible for a 30-year mortgage with a low fixed rate. Find the most affordable Medicare Plan in Maryland!  WebMedicare Healthy Aging Guide to Assisted Living Facilities Flu Information (Influenza) Adult Evaluation and Review Services Medicaid Waiver Program Medicare Part D Pharmacy Maryland offers lots of help for first-time home buyers. These Guaranteed Issue rights prevent insurance companies from charging you more or denying you coverage based on health conditions. WebIn order to complete Articles of Organization, youll need to include: your LLCs name and street address, the name and address of your registered agent, the start date of your business, the name and address of the person forming the LLC, the LLCs purpose, the management structure, a statement that the LLC will be run by at least one member, the Below we review the top Medigap plans in Maryland and how you can utilize the plan benefits to your advantage. Click here to download the Income Guidelines. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. That was actually down 7.8% year-over-year, according to Realtor.com. If youre a Maryland first-time home buyer with a 20% down payment, you can get a conventional loan with a low interest rate. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022. That was actually down 7.8% year-over-year, according to Realtor.com. Of the Old Line States three most populous cities, only Baltimore saw a decrease in home prices during the 12 months prior to January 2023. Marylanders looking to buy their first home have a lot to like about the MMP 1st Time Advantage program. Medicare Supplement (Medigap) plans cater to you by allowing you the freedom to visit any doctor you wish and allowing you to receive the same coverage nationwide. SmartBuy is available through approved lenders and borrowers will have to meet special eligibility criteria. Columbias Settlement Downpayment Loan Program is provided by Howard County. This scholarship will cover up to 50 percent of annual tuition, fees, and room and board within the University System of Maryland. Footer Contact September 20, 2018. '/_layouts/15/hold.aspx'

When asked about Baltimore Countys hate crime rate, Trae Corbin, a public information officer for Baltimore County Police, said that the department was Like other states, Medigap plans in Maryland are standardized, so the top Medigap plans in Maryland are also the top plans in several other states nationwide. Facility Accessibility Survey. These additional benefits may include dental, vision, prescription drug, wellness, and hearing benefits. Any information we provide is limited to those plans we do offer in your area. Web2 2022 Health Benefits Guide The State of Maryland provides a generous benefit package to eligible employees and retirees with a wide range of benefit options from healthcare to income protection. Before receiving services, speak with your doctor and understand if you may encounter excess charges in the future. So youll pay a low rate of two points below the primary mortgage interest rate.

WebMedicare Healthy Aging Guide to Assisted Living Facilities Flu Information (Influenza) Adult Evaluation and Review Services Medicaid Waiver Program Medicare Part D Pharmacy Maryland offers lots of help for first-time home buyers. These Guaranteed Issue rights prevent insurance companies from charging you more or denying you coverage based on health conditions. WebIn order to complete Articles of Organization, youll need to include: your LLCs name and street address, the name and address of your registered agent, the start date of your business, the name and address of the person forming the LLC, the LLCs purpose, the management structure, a statement that the LLC will be run by at least one member, the Below we review the top Medigap plans in Maryland and how you can utilize the plan benefits to your advantage. Click here to download the Income Guidelines. Since the inception of his first company in 2012, he has been dedicated to helping those eligible for Medicare by providing them with resources to educate themselves on all their Medicare options. That was actually down 7.8% year-over-year, according to Realtor.com. If youre a Maryland first-time home buyer with a 20% down payment, you can get a conventional loan with a low interest rate. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022. That was actually down 7.8% year-over-year, according to Realtor.com. Of the Old Line States three most populous cities, only Baltimore saw a decrease in home prices during the 12 months prior to January 2023. Marylanders looking to buy their first home have a lot to like about the MMP 1st Time Advantage program. Medicare Supplement (Medigap) plans cater to you by allowing you the freedom to visit any doctor you wish and allowing you to receive the same coverage nationwide. SmartBuy is available through approved lenders and borrowers will have to meet special eligibility criteria. Columbias Settlement Downpayment Loan Program is provided by Howard County. This scholarship will cover up to 50 percent of annual tuition, fees, and room and board within the University System of Maryland. Footer Contact September 20, 2018. '/_layouts/15/hold.aspx'

When asked about Baltimore Countys hate crime rate, Trae Corbin, a public information officer for Baltimore County Police, said that the department was Like other states, Medigap plans in Maryland are standardized, so the top Medigap plans in Maryland are also the top plans in several other states nationwide. Facility Accessibility Survey. These additional benefits may include dental, vision, prescription drug, wellness, and hearing benefits. Any information we provide is limited to those plans we do offer in your area. Web2 2022 Health Benefits Guide The State of Maryland provides a generous benefit package to eligible employees and retirees with a wide range of benefit options from healthcare to income protection. Before receiving services, speak with your doctor and understand if you may encounter excess charges in the future. So youll pay a low rate of two points below the primary mortgage interest rate.  Peter Warden has been writing for a decade about mortgages, personal finance, credit cards, and insurance. Medicare Details, MDOI. Then make sure you get personalized rate quotes from at least three to five mortgage lenders. Applicants must file an application, be interviewed, and meet all financial and technical eligibility factors prior to Posted on April 6, 2023 by . - Jeff R. Of all the agents I spoke with, yours helped more with information, advice and help. Maryland law requires employers to permit employees to take two (2) hours of paid leave to vote, so long as the employee does not have two (2) hours of continuous off-duty time while the polls are open. You can find more details on that and the two other programs on the website linked above.

Peter Warden has been writing for a decade about mortgages, personal finance, credit cards, and insurance. Medicare Details, MDOI. Then make sure you get personalized rate quotes from at least three to five mortgage lenders. Applicants must file an application, be interviewed, and meet all financial and technical eligibility factors prior to Posted on April 6, 2023 by . - Jeff R. Of all the agents I spoke with, yours helped more with information, advice and help. Maryland law requires employers to permit employees to take two (2) hours of paid leave to vote, so long as the employee does not have two (2) hours of continuous off-duty time while the polls are open. You can find more details on that and the two other programs on the website linked above.

Dont just look at advertised rates online. Therefore, 130 percent of that is $2,379 a month, or about $28,550 a year.

Dont just look at advertised rates online. Therefore, 130 percent of that is $2,379 a month, or about $28,550 a year.  Section 400- Application We do not offer every plan available in your area. Ultimately, the monthly payment amount received reflects how much a person made while working prior to being disabled. SRPS Maryland State Retirement and Pension System. MedicareFAQ is dedicated to providing you with authentic and trustworthy Medicare information.

Section 400- Application We do not offer every plan available in your area. Ultimately, the monthly payment amount received reflects how much a person made while working prior to being disabled. SRPS Maryland State Retirement and Pension System. MedicareFAQ is dedicated to providing you with authentic and trustworthy Medicare information.  410-625-5555 800-492 WebA Guide to Understanding Your Benefits. The only way to avoid this is by qualifying for a Special Enrollment Period. Maryland exempts some types of retirement income from state income taxes, including Social Security and 401(k) distributions.

410-625-5555 800-492 WebA Guide to Understanding Your Benefits. The only way to avoid this is by qualifying for a Special Enrollment Period. Maryland exempts some types of retirement income from state income taxes, including Social Security and 401(k) distributions.  - Dwight D. Owned by: Elite Insurance Partners LLC d/b/a MedicareFAQ. The median home price in Baltimore was $189,000 in January 2023. Benefits for children include these and more: l Doctor visits including regular checkups and visits when sick l Immunizations like flu shots l Prescriptions l Hospitalizations, including lab work and tests l Dental care l Vision care Webstate of maryland benefits guide 2022. Anyone enrolled in Original Medicare (Medicare Part A and Medicare Part B) is eligible for Medigap Plans in Maryland in 2022.