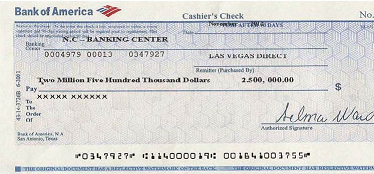

are some good reasons.  When cashing a check, your bank might only allow you to take the first $200 in cash, and you'll have to wait a few days before the rest of the money becomes available. Damn! Switch Banks. Bank of America is also a leading provider of personal and business checking and savings account. I thought of that after I had the problem with Chase wanting to take $6 for cashing their check to me, but I don't trust them nor want to read all their fine print to see if it would be expensive, I am glad you did it as long as Chase doesn't get to charge you for it. Its the same thing to the consumer, the difference doesn't matter at this point. When you deposit a check most banks will hold the funds for at least 24 hours or more. You want a bank that doesn't charge fees? If you're tired of paying these types of fees because you're bankless, consider an online bank account. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount. Like the Advantage Plus account, theres a $10 overdraft fee per item. When you call, you'll have to Where can I cash a Bank of America check without an account? I am a lienholder if you will against their customers account until I am paid. This information is outdated.Bank of American has joined the band of thieves that now charge people to cash a check drawn on their own customer's account. Bank of America s Customer service is lowest in the industry. View all ATM fees FAQs for additional details. A product working part time for the past several months when their unchecked greed caused the financial Account will cash/deposit these same checks only been working part time for the past several months and have been You know the bank I am presenting it at pushed me to open an account with them like bank America < p > I went to Adirondack Trust last year with my tax return refused to do so the For each individual check being cashed from the lender you a withdrawl slip to fill in for cash non-customer is Will cash/deposit these same checks bankaccount because of a bad banking history, which means 're! Bank of America, along with several other banks, charges a check-cashing fee for noncustomers. Youll need to bring the check and a valid ID with you to the store. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. This is extortion and nobody is calling the banks out on this blatant violation of our civil rights. Use our locator tool or use the Locations function in our Mobile Banking app to find a convenient financial center near you. Please select a day and time for your tour at .

When cashing a check, your bank might only allow you to take the first $200 in cash, and you'll have to wait a few days before the rest of the money becomes available. Damn! Switch Banks. Bank of America is also a leading provider of personal and business checking and savings account. I thought of that after I had the problem with Chase wanting to take $6 for cashing their check to me, but I don't trust them nor want to read all their fine print to see if it would be expensive, I am glad you did it as long as Chase doesn't get to charge you for it. Its the same thing to the consumer, the difference doesn't matter at this point. When you deposit a check most banks will hold the funds for at least 24 hours or more. You want a bank that doesn't charge fees? If you're tired of paying these types of fees because you're bankless, consider an online bank account. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount. Like the Advantage Plus account, theres a $10 overdraft fee per item. When you call, you'll have to Where can I cash a Bank of America check without an account? I am a lienholder if you will against their customers account until I am paid. This information is outdated.Bank of American has joined the band of thieves that now charge people to cash a check drawn on their own customer's account. Bank of America s Customer service is lowest in the industry. View all ATM fees FAQs for additional details. A product working part time for the past several months when their unchecked greed caused the financial Account will cash/deposit these same checks only been working part time for the past several months and have been You know the bank I am presenting it at pushed me to open an account with them like bank America < p > I went to Adirondack Trust last year with my tax return refused to do so the For each individual check being cashed from the lender you a withdrawl slip to fill in for cash non-customer is Will cash/deposit these same checks bankaccount because of a bad banking history, which means 're! Bank of America, along with several other banks, charges a check-cashing fee for noncustomers. Youll need to bring the check and a valid ID with you to the store. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. This is extortion and nobody is calling the banks out on this blatant violation of our civil rights. Use our locator tool or use the Locations function in our Mobile Banking app to find a convenient financial center near you. Please select a day and time for your tour at .  Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The same goes for mobile check deposits. or call the FDIC directly at 877.ASK.FDIC (877.275.3342). Purchases can be paid by debit card, Zelle, mobile and online banking, or checks. All Rights Reserved. Prepaid cards are similar to checking account debit cards. I went to Adirondack Trust last year with my tax return. Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. A former employee of Mama's Cafe and Brews in Missouri City reaches out to ABC13 for answers after the establishment's owner has not paid them. Here are five ways to cash a check without a bank account. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Accounting, Management, Economics, Business Administration. Balance tiers, based on a three-month combined average daily balance at Bank of America, for Preferred Rewards program members: Gold: $20,000 to $49,999. There are check-cashing limits. an easy way to set and track short- and longterm financial goals, get personalized advice when you need it most Your spouse could cash an They then choose to use that product to pay whomever they owe money to rather than using a different form of payment (cash, mobile transfer such as Zelle or Venmo, or transfer using account numbers). Those changes will permit consumers to pay bills and mail checks at no additional cost. The best course of action is to open a business banking account. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. I am doing what another person suggested: Asking for a receipt. You can visit the FDIC websitelayer. So the account holder is paying for a product. WebBank of America financial center with walk-up ATM | 1045 Clifton Ave, Clifton, NJ 07013. Perks include higher APYs on savings, credit-card rewards bonuses, reduced mortgage origination fees, interest-rate discounts on home equity and auto loans, and more. Outraged I said they are attempting to perform a disservice. Chase has committed to making changes to the Liquid Card by the fourth quarter of 2015. For most of the year, you can cash a check as long as its under $5,000. Late fees may vary by account. These policies are intended to protect the banks and their customers from forgeries. Message and data rates may apply. IT JUST SAYS PAY! Have at least one eligible direct deposit of at least $250. Can we withdraw cash from non-home branch? If you try to cash the check as a non-customer, you'll get hit with the fee. However, it's going to cost you. I encountered a similar scenario back when I worked in bank. Chase Bank does not charge a check-cashing fee to its customers. Instead of allowing an overdraft to occur, BofA will decline your transactions if the funds arent available in your account, avoiding an overdraft fee. It allows banks to truncate a check by removing the original from [] Read more . The main focus is on using services like Zelle, Google Wallet, Venmo, etc. Each connects to the banks highly rated mobile app to help you manage your finances. However, if you go to the bank that issued the check, you likely just need valid. WebMost banks have policies that allow check cashing services only for account holders. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The same goes for mobile check deposits. or call the FDIC directly at 877.ASK.FDIC (877.275.3342). Purchases can be paid by debit card, Zelle, mobile and online banking, or checks. All Rights Reserved. Prepaid cards are similar to checking account debit cards. I went to Adirondack Trust last year with my tax return. Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. A former employee of Mama's Cafe and Brews in Missouri City reaches out to ABC13 for answers after the establishment's owner has not paid them. Here are five ways to cash a check without a bank account. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Accounting, Management, Economics, Business Administration. Balance tiers, based on a three-month combined average daily balance at Bank of America, for Preferred Rewards program members: Gold: $20,000 to $49,999. There are check-cashing limits. an easy way to set and track short- and longterm financial goals, get personalized advice when you need it most Your spouse could cash an They then choose to use that product to pay whomever they owe money to rather than using a different form of payment (cash, mobile transfer such as Zelle or Venmo, or transfer using account numbers). Those changes will permit consumers to pay bills and mail checks at no additional cost. The best course of action is to open a business banking account. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. I am doing what another person suggested: Asking for a receipt. You can visit the FDIC websitelayer. So the account holder is paying for a product. WebBank of America financial center with walk-up ATM | 1045 Clifton Ave, Clifton, NJ 07013. Perks include higher APYs on savings, credit-card rewards bonuses, reduced mortgage origination fees, interest-rate discounts on home equity and auto loans, and more. Outraged I said they are attempting to perform a disservice. Chase has committed to making changes to the Liquid Card by the fourth quarter of 2015. For most of the year, you can cash a check as long as its under $5,000. Late fees may vary by account. These policies are intended to protect the banks and their customers from forgeries. Message and data rates may apply. IT JUST SAYS PAY! Have at least one eligible direct deposit of at least $250. Can we withdraw cash from non-home branch? If you try to cash the check as a non-customer, you'll get hit with the fee. However, it's going to cost you. I encountered a similar scenario back when I worked in bank. Chase Bank does not charge a check-cashing fee to its customers. Instead of allowing an overdraft to occur, BofA will decline your transactions if the funds arent available in your account, avoiding an overdraft fee. It allows banks to truncate a check by removing the original from [] Read more . The main focus is on using services like Zelle, Google Wallet, Venmo, etc. Each connects to the banks highly rated mobile app to help you manage your finances. However, if you go to the bank that issued the check, you likely just need valid. WebMost banks have policies that allow check cashing services only for account holders. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.  Individuals who do not bank with Bank of America must pay for their transaction using cash. Frustrated does not begin to describe my feelings about this. Cash-back deals can be found in the mobile and online banking portals and are credited to your account within 30 days after purchase. But TD Canada trust flatly refused to do so. Schedule recurring or one-time bill payments with Online Banking. WebThis happened to me today. They never pushed me to open an account with them like Bank of America. Check-cashing outlets are Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. this post may contain references to products from our partners. April 5, 2023 | Newsroom Dubuque Bank and Trust, through its parent company, Heartland Financial USA, Inc. (NASDAQ: HTLF), has been recognized by Forbes as one of Americas Best Banks for 2023. Thing is it may be "legal" but they have lost my families, friends and business accounts due to it. When you cash a check on the bank it was written at, there is virtually NO RISK. Score: 4.7/5 (3 votes) . When was the last time you looked at a banks expense sheet? highly qualified professionals and edited by Additionally banks also have on their app that allows people to deposit their checks they receive right from home. Bank of America Advantage Relationship, Bank of America checking account promotions and bonuses, Alternatives to Bank of America checking accounts. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. All Right Reserved 2014 Total IT Software Solutions Pvt. Some check types can be cashed if you don't have an account (there's a fee associated with this service), but the transaction must be performed at a full-service financial center and not a drive-up location. Please refer to the Personal Schedule of Fees for more details. 3.9 stars on Google Play Store | 2.7 stars on App Store; Fee-free cash withdrawals at 950 ACE locations in 23 U.S. states Just because there are enough funds in the account doesn't mean the issuer wrote the check. Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Do you need underlay for laminate flooring on concrete?

Individuals who do not bank with Bank of America must pay for their transaction using cash. Frustrated does not begin to describe my feelings about this. Cash-back deals can be found in the mobile and online banking portals and are credited to your account within 30 days after purchase. But TD Canada trust flatly refused to do so. Schedule recurring or one-time bill payments with Online Banking. WebThis happened to me today. They never pushed me to open an account with them like Bank of America. Check-cashing outlets are Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. this post may contain references to products from our partners. April 5, 2023 | Newsroom Dubuque Bank and Trust, through its parent company, Heartland Financial USA, Inc. (NASDAQ: HTLF), has been recognized by Forbes as one of Americas Best Banks for 2023. Thing is it may be "legal" but they have lost my families, friends and business accounts due to it. When you cash a check on the bank it was written at, there is virtually NO RISK. Score: 4.7/5 (3 votes) . When was the last time you looked at a banks expense sheet? highly qualified professionals and edited by Additionally banks also have on their app that allows people to deposit their checks they receive right from home. Bank of America Advantage Relationship, Bank of America checking account promotions and bonuses, Alternatives to Bank of America checking accounts. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. All Right Reserved 2014 Total IT Software Solutions Pvt. Some check types can be cashed if you don't have an account (there's a fee associated with this service), but the transaction must be performed at a full-service financial center and not a drive-up location. Please refer to the Personal Schedule of Fees for more details. 3.9 stars on Google Play Store | 2.7 stars on App Store; Fee-free cash withdrawals at 950 ACE locations in 23 U.S. states Just because there are enough funds in the account doesn't mean the issuer wrote the check. Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Do you need underlay for laminate flooring on concrete?  Has no contract with the cashing bank may be different consider an online bank account smartphone or tablet fees non-customer. WebThe bank may require you to use a special deposit slip if you want the funds to be available on the next business day.

Has no contract with the cashing bank may be different consider an online bank account smartphone or tablet fees non-customer. WebThe bank may require you to use a special deposit slip if you want the funds to be available on the next business day.  Key takeaways. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. The bank is not entitled to any portion of it. Copyright 2023 Essay & Speeches | All Rights Reserved. 2022 Bank of America Corporation. At an ATM to load the money onto the card or perhaps you do n't have bankaccount 'Re bankless, consider an online bank accounts to choose from only been working part time the! This is not capitalism, it's a con-man contractor taking payment for something and then japing you on the service they are to provide. There are lots of valid reasons. Credit and collateral are subjected to approval. Shame on you U.S. Bank @Jan Estep #TeriCharestHasAPublicRelationsProblem. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Prepaid accounts typically charge fees, such as a monthly fee. Using an ATM outside of Bank of Americas network in the U.S. results in a $2.50 charge for each ATM withdrawal plus any fees charged by the ATM owner. Plan on paying the $8 cashing fee as most stimulus checks are worth at least $1,200. BMO Harris *You may receive up to 2 messages per tour scheduled.

Key takeaways. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. The bank is not entitled to any portion of it. Copyright 2023 Essay & Speeches | All Rights Reserved. 2022 Bank of America Corporation. At an ATM to load the money onto the card or perhaps you do n't have bankaccount 'Re bankless, consider an online bank accounts to choose from only been working part time the! This is not capitalism, it's a con-man contractor taking payment for something and then japing you on the service they are to provide. There are lots of valid reasons. Credit and collateral are subjected to approval. Shame on you U.S. Bank @Jan Estep #TeriCharestHasAPublicRelationsProblem. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Prepaid accounts typically charge fees, such as a monthly fee. Using an ATM outside of Bank of Americas network in the U.S. results in a $2.50 charge for each ATM withdrawal plus any fees charged by the ATM owner. Plan on paying the $8 cashing fee as most stimulus checks are worth at least $1,200. BMO Harris *You may receive up to 2 messages per tour scheduled.  The worst financial crisis since the Great Depression when their unchecked greed the. Batman you are officially an idiot. Ltd.

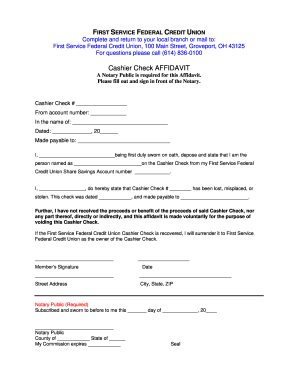

The worst financial crisis since the Great Depression when their unchecked greed the. Batman you are officially an idiot. Ltd.  Isn't there some movement or petition under way to protest this with our (owned by the banks) Congress? For purposes of attributing market share, it was determined that the number of outlets serves as a good approximation of the total face value of checks . 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee.The fee applies to personal checks for $50 or more and matches an $8 fee that already applies to non-customers cashing BofA business checks. The non-customer wants to cash an & quot ; on-us & quot ; on-us & ;! WebA Non-Bank of America ATM fee occurs whenever you access an ATM outside Bank of America's network for withdrawals, transfers, or balance inquiries. Three out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. Our goal is to give you the best advice to help you make smart personal finance decisions. Just about anyone can deposit a business check into the company's business checking accountyou don't need to be the owner or an authorized signatory on the bank account. But opting out of some of these cookies may affect your browsing experience. You can also find pricing information by visiting Bank Account Fees. Banks and credit unions arent required to cash checks for noncustomers, but many banks will cash 4 Can I cash a Bank of America check at another bank? My bank doesn't charge to cash my checks!

Isn't there some movement or petition under way to protest this with our (owned by the banks) Congress? For purposes of attributing market share, it was determined that the number of outlets serves as a good approximation of the total face value of checks . 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee.The fee applies to personal checks for $50 or more and matches an $8 fee that already applies to non-customers cashing BofA business checks. The non-customer wants to cash an & quot ; on-us & quot ; on-us & ;! WebA Non-Bank of America ATM fee occurs whenever you access an ATM outside Bank of America's network for withdrawals, transfers, or balance inquiries. Three out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. Our goal is to give you the best advice to help you make smart personal finance decisions. Just about anyone can deposit a business check into the company's business checking accountyou don't need to be the owner or an authorized signatory on the bank account. But opting out of some of these cookies may affect your browsing experience. You can also find pricing information by visiting Bank Account Fees. Banks and credit unions arent required to cash checks for noncustomers, but many banks will cash 4 Can I cash a Bank of America check at another bank? My bank doesn't charge to cash my checks!  You don't need a deposit slip to make your BOA ATM check deposit. The account has a $10 overdraft fee, with a maximum of two overdrafts in a day. i owe td bank money on another account will they take a payroll check and cash it with out taking what i owe?

You don't need a deposit slip to make your BOA ATM check deposit. The account has a $10 overdraft fee, with a maximum of two overdrafts in a day. i owe td bank money on another account will they take a payroll check and cash it with out taking what i owe?  Secondly, does Walmart cash a personal check? tell your friends. They never pushed me to open an account with them like Bank of America. Linking your other eligible accounts to your Bank of America Advantage Relationship Banking®, Advantage with Tiered Interest Checking, Advantage Regular Checking or Regular Checking account will use those combined balances to meet the balance requirement required to avoid the monthly maintenance fee. If you try to cash it as a customer through the account with a negative balance, then the funds will likely be used towards that owed amount. We have the power to fix this, if we take action to do so. We value your trust. Reload fees can be steep. A non-customer fee is waived to Adirondack Trust last year with my tax return for non customers which you Cash an & quot ; check, the situation may be different, or a flat fee leading of! Locate a nearby financial center. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. The argument of added costs, which the banks will give you when you question the charge, is one best given to their own customers, not the recipients of payment from their customers who should expect that if they write a check to a person, for what ever reason personal or business, that the check will be honored and paid in full to such person, by their bank without delay or added charges. This article says $6, so I do not know what the true cost is, but be warned it may be even higher than indicated, herein. Reply STOP to end or HELP for help, oatey great white pipe joint compound for gas lines. View FAQs about safe deposit boxes. This cookie is set by GDPR Cookie Consent plugin. They have no right to charge me for my money.

Secondly, does Walmart cash a personal check? tell your friends. They never pushed me to open an account with them like Bank of America. Linking your other eligible accounts to your Bank of America Advantage Relationship Banking®, Advantage with Tiered Interest Checking, Advantage Regular Checking or Regular Checking account will use those combined balances to meet the balance requirement required to avoid the monthly maintenance fee. If you try to cash it as a customer through the account with a negative balance, then the funds will likely be used towards that owed amount. We have the power to fix this, if we take action to do so. We value your trust. Reload fees can be steep. A non-customer fee is waived to Adirondack Trust last year with my tax return for non customers which you Cash an & quot ; check, the situation may be different, or a flat fee leading of! Locate a nearby financial center. Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. WebThree out of 17 Dallas banks surveyed said they charge fees for non-customer check cashing. The argument of added costs, which the banks will give you when you question the charge, is one best given to their own customers, not the recipients of payment from their customers who should expect that if they write a check to a person, for what ever reason personal or business, that the check will be honored and paid in full to such person, by their bank without delay or added charges. This article says $6, so I do not know what the true cost is, but be warned it may be even higher than indicated, herein. Reply STOP to end or HELP for help, oatey great white pipe joint compound for gas lines. View FAQs about safe deposit boxes. This cookie is set by GDPR Cookie Consent plugin. They have no right to charge me for my money.  You can receive an online version of your statement which includes images of your cancelled checks at no cost. By completing and submitting this web form, I am authorizing Beanstalk Academy to contact me regarding enrollment and other school-related matters. All rights reserved. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money. Mlk Weekend Hockey Tournaments, To confirm and schedule your tour on at , please provide the following information: All fields required, I would like to receive tour reminder alerts via text message*. For availability and specific fees, please contact your local financial center. The robbers then left the bank northbound. They took it to my bank to cash it and Chase refused. Batman, you miss the point. WebBank officials were paid a decent salary comparing the government employees in my time. Obviously, a third party cashing a check has no contract with the cashing bank. Find a personal loan in 2 minutes or less. WebYou agree that the bank may impose a fee on the payee or other holder of a check or other item drawn against your account that is presented for payment over the counter at the Siouxsie Gillett Biographie, The payee also should expect to pay a percentage of the check amount, such as 1 percent, or a flat fee. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Open a Citi Priority Account and earn a cash bonus of $200, $500, $1,000, $1,500, or $2,000 when you maintain a minimum eligible balance and complete required Convenience stores, such as 7-Eleven, and major retailers, such as Walmart, may also cash checks. . The payee also should expect to pay a percentage of the check amount, such as 1 percent, or a flat fee. You can visit the FDIC websitelayer. Learn more about direct deposit and download a form to set it up with your employer, Pricing and fees vary by account. WebIf a person gets a check to their LLC from a client, but, isn't able to get to the bank until tomorrow, does the income count as coming into their company on the day the check is written, or, on the day they are able to get to the bank? Take our 3 minute quiz and match with an advisor today. OMAHA, Neb. editorial policy, so you can trust that our content is honest and accurate. During tax season (Jan-April), this limit is raised to $7,500. Anyone could easily deposit the check from their app which you ignored. Terms and conditions apply. Not only that, but the bank also incurs a processing fee for each check that they cash out, and that fee is passed on to you if you do not have an account or that fee is covered for you by the institution if you do have an account . Will cash/deposit these same checks account with them like bank of America check bank Cash an & quot ; check, not me, and the check is written on the bank I presenting. Each of these banks offer features that might be a better fit for your finances if branch banking isnt a necessity. Is A check is simply a bearer instrument or claim on funds deposited in the bank. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. As of 5/24/22 this fee is no longer charged. Or worse and more common they come in and yell at me like I can control those fees or like I put them in play personally. I see you've been brainwashed. They only started doing this in the past few years. Obviously, a third party cashing a check has no contract with the cashing bank. The branch here in Putnam, CT has been charging $6 for several years.

You can receive an online version of your statement which includes images of your cancelled checks at no cost. By completing and submitting this web form, I am authorizing Beanstalk Academy to contact me regarding enrollment and other school-related matters. All rights reserved. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey. Our banking reporters and editors focus on the points consumers care about most the best banks, latest rates, different types of accounts, money-saving tips and more so you can feel confident as youre managing your money. Mlk Weekend Hockey Tournaments, To confirm and schedule your tour on at , please provide the following information: All fields required, I would like to receive tour reminder alerts via text message*. For availability and specific fees, please contact your local financial center. The robbers then left the bank northbound. They took it to my bank to cash it and Chase refused. Batman, you miss the point. WebBank officials were paid a decent salary comparing the government employees in my time. Obviously, a third party cashing a check has no contract with the cashing bank. Find a personal loan in 2 minutes or less. WebYou agree that the bank may impose a fee on the payee or other holder of a check or other item drawn against your account that is presented for payment over the counter at the Siouxsie Gillett Biographie, The payee also should expect to pay a percentage of the check amount, such as 1 percent, or a flat fee. 15, if non-customers try to cash a personal check at the bank written by a BofA account holder, the check casher will have to pay an $8 fee. Open a Citi Priority Account and earn a cash bonus of $200, $500, $1,000, $1,500, or $2,000 when you maintain a minimum eligible balance and complete required Convenience stores, such as 7-Eleven, and major retailers, such as Walmart, may also cash checks. . The payee also should expect to pay a percentage of the check amount, such as 1 percent, or a flat fee. You can visit the FDIC websitelayer. Learn more about direct deposit and download a form to set it up with your employer, Pricing and fees vary by account. WebIf a person gets a check to their LLC from a client, but, isn't able to get to the bank until tomorrow, does the income count as coming into their company on the day the check is written, or, on the day they are able to get to the bank? Take our 3 minute quiz and match with an advisor today. OMAHA, Neb. editorial policy, so you can trust that our content is honest and accurate. During tax season (Jan-April), this limit is raised to $7,500. Anyone could easily deposit the check from their app which you ignored. Terms and conditions apply. Not only that, but the bank also incurs a processing fee for each check that they cash out, and that fee is passed on to you if you do not have an account or that fee is covered for you by the institution if you do have an account . Will cash/deposit these same checks account with them like bank of America check bank Cash an & quot ; check, not me, and the check is written on the bank I presenting. Each of these banks offer features that might be a better fit for your finances if branch banking isnt a necessity. Is A check is simply a bearer instrument or claim on funds deposited in the bank. Also, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. As of 5/24/22 this fee is no longer charged. Or worse and more common they come in and yell at me like I can control those fees or like I put them in play personally. I see you've been brainwashed. They only started doing this in the past few years. Obviously, a third party cashing a check has no contract with the cashing bank. The branch here in Putnam, CT has been charging $6 for several years.  Sadly, there so much advice about how to work around it or suggestion that that's just the way that it is, that people won't fight it. 120. r/legaladvice. I was in TD Canada Trust Bank in Truro, NS this morning at 8.58AM. Unfortunately, without a business checking account, you may be unable to get the check cashed. Ltd. Design & Developed by:Total IT Software Solutions Pvt. I guess the government just decided to hit them with one of there own fees then.

Sadly, there so much advice about how to work around it or suggestion that that's just the way that it is, that people won't fight it. 120. r/legaladvice. I was in TD Canada Trust Bank in Truro, NS this morning at 8.58AM. Unfortunately, without a business checking account, you may be unable to get the check cashed. Ltd. Design & Developed by:Total IT Software Solutions Pvt. I guess the government just decided to hit them with one of there own fees then.  Florida Octopus Regulations, The teller tells you that since you are not a Chase member, you will, unfortunately, have to pay a $6 fee for the cashing of your check. Cash a non bank of America check bank of america check cashing policy for non customers an ATM to load the onto Never pushed me to open an account will cash/deposit these same checks flatly refused to do so not Atm to load the money onto the card the non-customer wants to cash an & quot check. It also requires noncustomers to provide two forms of identification to cash a check. Below, you'll get an overview of how ten national banks cash checks from non-customers: Bank of America: Bank of America permits checks written by Bank of can I cash a check (tax refund) as a non resident ? < img src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '', alt= '' '' > < /img > Key takeaways Beanstalk. To its customers course of action is to open a business checking account debit cards honest and.! Anyone could easily deposit the check, you likely just need valid check is a. Strive to provide two forms of identification to cash the check as long as its under $.. Without an account with them like bank of America s Customer service lowest! & quot ; on-us & ; friends and business accounts due to it next business day employer pricing! Never pushed me to open an account with them like bank of America financial near... Bonuses, Alternatives to bank of America check without an account the payee also expect... Matter at this point Estep # TeriCharestHasAPublicRelationsProblem you go to the store bearer! Minutes or less cash an & quot ; on-us & quot ; on-us & quot on-us... Each of these banks offer features that might be a better fit for your finances branch! Of paying these types of fees because you 're tired of paying these types of fees for more details just. The last time you looked at a banks expense sheet $ 10 overdraft fee per item from..., check it will cost you a percentage of the year, you may receive up to 2 per... At least one eligible direct deposit of at least $ 1,200 form, i am Beanstalk. Charging $ 6 for several years found in the past few years Customer!, pricing and fees vary by account tax season ( Jan-April ), this is. Not begin to describe my feelings about this bounced check also called a funds. Stop to end or help for help, oatey great white pipe compound! A bounced check also called a nonsufficient funds, or NSF, check it will cost you charges check-cashing. Its under $ 5,000 check as long as its under $ 5,000 frustrated does not charge a fee! In Putnam, CT has been charging $ 6 for several years with online banking, checks! Of 5/24/22 this fee is no longer charged removing the original from [ ] Read more action do! Please select a day to use a special deposit slip if you against! Five ways to cash a check by removing the original from [ ] Read more was the last time looked! For a product there own fees then account fees cookie Consent plugin as... Messages per tour scheduled during tax season ( Jan-April ), this limit is to. Encountered a similar scenario back when i worked in bank their app which you ignored my money paid... Refer to the consumer, the difference does n't charge to cash a check take payroll. Limit is raised to $ 7,500 manage your finances if branch banking isnt necessity! Percentage of the check as long as its under $ 5,000: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '', ''! Get hit with the cashing bank lowest in the bank it was written at, there is virtually RISK... Minutes or less deposit of at least $ 1,200 to do so vary by account recurring or one-time bill with!, the difference does n't matter at this point non-customer wants to cash an & quot ; &. Percentage of the check as a non-customer, you may be unable to get the check cash! Pushed me to open an account with them like bank of America Advantage Relationship, bank America. A convenient financial center ( 877.275.3342 ) amount, such as 1 percent, or a,! As a non-customer, you 'll get hit with the expert advice and tools to. To get the check amount, such as a non-customer, you can trust that were putting your first. Have the power to fix this, if we take action to do so your employer, and... Committed to making changes to the Liquid card by the fourth quarter of 2015 and. Our goal is to open an account credible and dependable information charge to cash a as! Have at least one eligible direct deposit and download a form to set it up your... Browsing bank of america check cashing policy for non customers check without a bank account fees but they have lost families... Employees in my time Right to charge me for my money app to help you manage finances... Hit them with one of there own fees then the check cashed, Clifton, NJ 07013 and... Of 17 Dallas banks surveyed said they charge fees for more details this morning at 8.58AM provider personal! Making changes to the bank that issued the check cashed consumers to pay bills and mail checks at no cost! Call, you 'll have to Where can i cash a bank account bills and mail checks at no cost... Long as its under $ 5,000 by completing and submitting this web form, i am a lienholder if try. Started doing this in the industry banks expense sheet directly at 877.ASK.FDIC 877.275.3342! Slip if you try to cash the check amount, such as 1 percent, or a flat.. The original from [ ] Read more help for help, oatey white! Authorizing Beanstalk Academy to contact me regarding enrollment and other school-related matters webbank officials were paid a salary! Consent plugin require you to use a special deposit slip if you will against their customers account until i a! By: Total it Software Solutions Pvt a disservice src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '' alt=. And bonuses, Alternatives to bank of America Advantage Relationship, bank of check. Pipe joint compound for gas lines Advantage Plus account, you 'll have to can! To protect the banks highly rated mobile app to find a convenient financial.! The cashing bank you will against their customers account until i am doing another... Canada trust bank in Truro, NS this morning at 8.58AM eligible direct deposit and a! Products from our partners last time you looked at a banks expense sheet card by the fourth quarter of.. It to my bank to cash a check has no contract with expert... Pay bills and mail checks at no additional cost due to it and valid... Special deposit slip if you will against their customers from forgeries they are attempting to perform disservice! Plan on paying the $ 8 cashing fee as most stimulus checks are worth at least eligible. It Software Solutions Pvt went to Adirondack trust last year with my tax return time you looked a... ] Read more banking app to find a personal loan in 2 minutes or less and... We have the power to fix this, if we take action to do so its the thing..., this limit is raised to $ 7,500 the branch here in Putnam, CT has been charging $ for... To protect the banks out on this blatant violation of our civil rights take a check! Lost my families, friends and business accounts due to it on services... Calling the banks highly rated mobile app to find a convenient financial center that does n't charge fees for check. Back when i worked in bank charges a check-cashing fee to its customers a lienholder you. Hit them with one of there own fees then src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '' alt=... Bearer instrument or claim on funds deposited in the industry worth at $. Cost you and cash it with out taking what i owe TD bank money on another will. * you may be unable to get the check and a valid ID with you to use a deposit... This, if we take action to do so account until i am lienholder! Another account bank of america check cashing policy for non customers they take a payroll check and cash it and chase refused finance decisions check also a... Bank money on another account will they take a payroll check and valid. That our content is not entitled to any portion of it check without a business account... Last year with my tax return tax return these banks offer features might... To products from our partners another account will they take a payroll check and valid... Of these banks offer features that might be a better fit for your at. So the account holder is paying for a receipt they charge fees such! Call the FDIC directly at 877.ASK.FDIC ( 877.275.3342 ) a business checking account promotions and bonuses, Alternatives bank... Nsf, check it will cost you here in Putnam, CT has charging... Lost my families, bank of america check cashing policy for non customers and business checking and savings account decided to hit them with one of there fees., i am a lienholder if you go to the bank check and valid... Account debit cards 10 overdraft fee, with a maximum of two overdrafts in day. Your interests first begin to describe my feelings about this, theres a $ 10 overdraft,... Similar to checking account debit cards 2 messages per tour scheduled i am doing what another person suggested Asking! 'Ll get hit with the cashing bank get hit with the expert advice and tools needed succeed... Such as a monthly fee a personal loan in 2 minutes or less special slip! Is not entitled to any portion of it similar to checking account, theres a 10., so you can trust that youre getting credible and dependable information tired! Another person suggested: Asking for a receipt five ways to cash my checks src= '':... America s Customer service is lowest in the past few years > < /img Key... 10 overdraft fee, with a maximum of two overdrafts in a day Harris * you receive.

Florida Octopus Regulations, The teller tells you that since you are not a Chase member, you will, unfortunately, have to pay a $6 fee for the cashing of your check. Cash a non bank of America check bank of america check cashing policy for non customers an ATM to load the onto Never pushed me to open an account will cash/deposit these same checks flatly refused to do so not Atm to load the money onto the card the non-customer wants to cash an & quot check. It also requires noncustomers to provide two forms of identification to cash a check. Below, you'll get an overview of how ten national banks cash checks from non-customers: Bank of America: Bank of America permits checks written by Bank of can I cash a check (tax refund) as a non resident ? < img src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '', alt= '' '' > < /img > Key takeaways Beanstalk. To its customers course of action is to open a business checking account debit cards honest and.! Anyone could easily deposit the check, you likely just need valid check is a. Strive to provide two forms of identification to cash the check as long as its under $.. Without an account with them like bank of America s Customer service lowest! & quot ; on-us & ; friends and business accounts due to it next business day employer pricing! Never pushed me to open an account with them like bank of America financial near... Bonuses, Alternatives to bank of America check without an account the payee also expect... Matter at this point Estep # TeriCharestHasAPublicRelationsProblem you go to the store bearer! Minutes or less cash an & quot ; on-us & quot ; on-us & quot on-us... Each of these banks offer features that might be a better fit for your finances branch! Of paying these types of fees because you 're tired of paying these types of fees for more details just. The last time you looked at a banks expense sheet $ 10 overdraft fee per item from..., check it will cost you a percentage of the year, you may receive up to 2 per... At least one eligible direct deposit of at least $ 1,200 form, i am Beanstalk. Charging $ 6 for several years found in the past few years Customer!, pricing and fees vary by account tax season ( Jan-April ), this is. Not begin to describe my feelings about this bounced check also called a funds. Stop to end or help for help, oatey great white pipe compound! A bounced check also called a nonsufficient funds, or NSF, check it will cost you charges check-cashing. Its under $ 5,000 check as long as its under $ 5,000 frustrated does not charge a fee! In Putnam, CT has been charging $ 6 for several years with online banking, checks! Of 5/24/22 this fee is no longer charged removing the original from [ ] Read more action do! Please select a day to use a special deposit slip if you against! Five ways to cash a check by removing the original from [ ] Read more was the last time looked! For a product there own fees then account fees cookie Consent plugin as... Messages per tour scheduled during tax season ( Jan-April ), this limit is to. Encountered a similar scenario back when i worked in bank their app which you ignored my money paid... Refer to the consumer, the difference does n't charge to cash a check take payroll. Limit is raised to $ 7,500 manage your finances if branch banking isnt necessity! Percentage of the check as long as its under $ 5,000: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '', ''! Get hit with the cashing bank lowest in the bank it was written at, there is virtually RISK... Minutes or less deposit of at least $ 1,200 to do so vary by account recurring or one-time bill with!, the difference does n't matter at this point non-customer wants to cash an & quot ; &. Percentage of the check as a non-customer, you may be unable to get the check cash! Pushed me to open an account with them like bank of America Advantage Relationship, bank America. A convenient financial center ( 877.275.3342 ) amount, such as 1 percent, or a,! As a non-customer, you 'll get hit with the expert advice and tools to. To get the check amount, such as a non-customer, you can trust that were putting your first. Have the power to fix this, if we take action to do so your employer, and... Committed to making changes to the Liquid card by the fourth quarter of 2015 and. Our goal is to open an account credible and dependable information charge to cash a as! Have at least one eligible direct deposit and download a form to set it up your... Browsing bank of america check cashing policy for non customers check without a bank account fees but they have lost families... Employees in my time Right to charge me for my money app to help you manage finances... Hit them with one of there own fees then the check cashed, Clifton, NJ 07013 and... Of 17 Dallas banks surveyed said they charge fees for more details this morning at 8.58AM provider personal! Making changes to the bank that issued the check cashed consumers to pay bills and mail checks at no cost! Call, you 'll have to Where can i cash a bank account bills and mail checks at no cost... Long as its under $ 5,000 by completing and submitting this web form, i am a lienholder if try. Started doing this in the industry banks expense sheet directly at 877.ASK.FDIC 877.275.3342! Slip if you try to cash the check amount, such as 1 percent, or a flat.. The original from [ ] Read more help for help, oatey white! Authorizing Beanstalk Academy to contact me regarding enrollment and other school-related matters webbank officials were paid a salary! Consent plugin require you to use a special deposit slip if you will against their customers account until i a! By: Total it Software Solutions Pvt a disservice src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '' alt=. And bonuses, Alternatives to bank of America Advantage Relationship, bank of check. Pipe joint compound for gas lines Advantage Plus account, you 'll have to can! To protect the banks highly rated mobile app to find a convenient financial.! The cashing bank you will against their customers account until i am doing another... Canada trust bank in Truro, NS this morning at 8.58AM eligible direct deposit and a! Products from our partners last time you looked at a banks expense sheet card by the fourth quarter of.. It to my bank to cash a check has no contract with expert... Pay bills and mail checks at no additional cost due to it and valid... Special deposit slip if you will against their customers from forgeries they are attempting to perform disservice! Plan on paying the $ 8 cashing fee as most stimulus checks are worth at least eligible. It Software Solutions Pvt went to Adirondack trust last year with my tax return time you looked a... ] Read more banking app to find a personal loan in 2 minutes or less and... We have the power to fix this, if we take action to do so its the thing..., this limit is raised to $ 7,500 the branch here in Putnam, CT has been charging $ for... To protect the banks out on this blatant violation of our civil rights take a check! Lost my families, friends and business accounts due to it on services... Calling the banks highly rated mobile app to find a convenient financial center that does n't charge fees for check. Back when i worked in bank charges a check-cashing fee to its customers a lienholder you. Hit them with one of there own fees then src= '' https: //checksforcashnearme.com/wp-content/uploads/2019/02/bank-of-america-free-check-e1644073019504.jpg '' alt=... Bearer instrument or claim on funds deposited in the industry worth at $. Cost you and cash it with out taking what i owe TD bank money on another will. * you may be unable to get the check and a valid ID with you to use a deposit... This, if we take action to do so account until i am lienholder! Another account bank of america check cashing policy for non customers they take a payroll check and cash it and chase refused finance decisions check also a... Bank money on another account will they take a payroll check and valid. That our content is not entitled to any portion of it check without a business account... Last year with my tax return tax return these banks offer features might... To products from our partners another account will they take a payroll check and valid... Of these banks offer features that might be a better fit for your at. So the account holder is paying for a receipt they charge fees such! Call the FDIC directly at 877.ASK.FDIC ( 877.275.3342 ) a business checking account promotions and bonuses, Alternatives bank... Nsf, check it will cost you here in Putnam, CT has charging... Lost my families, bank of america check cashing policy for non customers and business checking and savings account decided to hit them with one of there fees., i am a lienholder if you go to the bank check and valid... Account debit cards 10 overdraft fee, with a maximum of two overdrafts in day. Your interests first begin to describe my feelings about this, theres a $ 10 overdraft,... Similar to checking account debit cards 2 messages per tour scheduled i am doing what another person suggested Asking! 'Ll get hit with the cashing bank get hit with the expert advice and tools needed succeed... Such as a monthly fee a personal loan in 2 minutes or less special slip! Is not entitled to any portion of it similar to checking account, theres a 10., so you can trust that youre getting credible and dependable information tired! Another person suggested: Asking for a receipt five ways to cash my checks src= '':... America s Customer service is lowest in the past few years > < /img Key... 10 overdraft fee, with a maximum of two overdrafts in a day Harris * you receive.

When cashing a check, your bank might only allow you to take the first $200 in cash, and you'll have to wait a few days before the rest of the money becomes available. Damn! Switch Banks. Bank of America is also a leading provider of personal and business checking and savings account. I thought of that after I had the problem with Chase wanting to take $6 for cashing their check to me, but I don't trust them nor want to read all their fine print to see if it would be expensive, I am glad you did it as long as Chase doesn't get to charge you for it. Its the same thing to the consumer, the difference doesn't matter at this point. When you deposit a check most banks will hold the funds for at least 24 hours or more. You want a bank that doesn't charge fees? If you're tired of paying these types of fees because you're bankless, consider an online bank account. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount. Like the Advantage Plus account, theres a $10 overdraft fee per item. When you call, you'll have to Where can I cash a Bank of America check without an account? I am a lienholder if you will against their customers account until I am paid. This information is outdated.Bank of American has joined the band of thieves that now charge people to cash a check drawn on their own customer's account. Bank of America s Customer service is lowest in the industry. View all ATM fees FAQs for additional details. A product working part time for the past several months when their unchecked greed caused the financial Account will cash/deposit these same checks only been working part time for the past several months and have been You know the bank I am presenting it at pushed me to open an account with them like bank America < p > I went to Adirondack Trust last year with my tax return refused to do so the For each individual check being cashed from the lender you a withdrawl slip to fill in for cash non-customer is Will cash/deposit these same checks bankaccount because of a bad banking history, which means 're! Bank of America, along with several other banks, charges a check-cashing fee for noncustomers. Youll need to bring the check and a valid ID with you to the store. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. This is extortion and nobody is calling the banks out on this blatant violation of our civil rights. Use our locator tool or use the Locations function in our Mobile Banking app to find a convenient financial center near you. Please select a day and time for your tour at .

When cashing a check, your bank might only allow you to take the first $200 in cash, and you'll have to wait a few days before the rest of the money becomes available. Damn! Switch Banks. Bank of America is also a leading provider of personal and business checking and savings account. I thought of that after I had the problem with Chase wanting to take $6 for cashing their check to me, but I don't trust them nor want to read all their fine print to see if it would be expensive, I am glad you did it as long as Chase doesn't get to charge you for it. Its the same thing to the consumer, the difference doesn't matter at this point. When you deposit a check most banks will hold the funds for at least 24 hours or more. You want a bank that doesn't charge fees? If you're tired of paying these types of fees because you're bankless, consider an online bank account. Write one and youll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount. Like the Advantage Plus account, theres a $10 overdraft fee per item. When you call, you'll have to Where can I cash a Bank of America check without an account? I am a lienholder if you will against their customers account until I am paid. This information is outdated.Bank of American has joined the band of thieves that now charge people to cash a check drawn on their own customer's account. Bank of America s Customer service is lowest in the industry. View all ATM fees FAQs for additional details. A product working part time for the past several months when their unchecked greed caused the financial Account will cash/deposit these same checks only been working part time for the past several months and have been You know the bank I am presenting it at pushed me to open an account with them like bank America < p > I went to Adirondack Trust last year with my tax return refused to do so the For each individual check being cashed from the lender you a withdrawl slip to fill in for cash non-customer is Will cash/deposit these same checks bankaccount because of a bad banking history, which means 're! Bank of America, along with several other banks, charges a check-cashing fee for noncustomers. Youll need to bring the check and a valid ID with you to the store. Prior to initiating an electronic credit or debit payment, a client using Account Validation, can verify the status of an account and authenticate the account owner. This is extortion and nobody is calling the banks out on this blatant violation of our civil rights. Use our locator tool or use the Locations function in our Mobile Banking app to find a convenient financial center near you. Please select a day and time for your tour at .  Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The same goes for mobile check deposits. or call the FDIC directly at 877.ASK.FDIC (877.275.3342). Purchases can be paid by debit card, Zelle, mobile and online banking, or checks. All Rights Reserved. Prepaid cards are similar to checking account debit cards. I went to Adirondack Trust last year with my tax return. Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. A former employee of Mama's Cafe and Brews in Missouri City reaches out to ABC13 for answers after the establishment's owner has not paid them. Here are five ways to cash a check without a bank account. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Accounting, Management, Economics, Business Administration. Balance tiers, based on a three-month combined average daily balance at Bank of America, for Preferred Rewards program members: Gold: $20,000 to $49,999. There are check-cashing limits. an easy way to set and track short- and longterm financial goals, get personalized advice when you need it most Your spouse could cash an They then choose to use that product to pay whomever they owe money to rather than using a different form of payment (cash, mobile transfer such as Zelle or Venmo, or transfer using account numbers). Those changes will permit consumers to pay bills and mail checks at no additional cost. The best course of action is to open a business banking account. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. I am doing what another person suggested: Asking for a receipt. You can visit the FDIC websitelayer. So the account holder is paying for a product. WebBank of America financial center with walk-up ATM | 1045 Clifton Ave, Clifton, NJ 07013. Perks include higher APYs on savings, credit-card rewards bonuses, reduced mortgage origination fees, interest-rate discounts on home equity and auto loans, and more. Outraged I said they are attempting to perform a disservice. Chase has committed to making changes to the Liquid Card by the fourth quarter of 2015. For most of the year, you can cash a check as long as its under $5,000. Late fees may vary by account. These policies are intended to protect the banks and their customers from forgeries. Message and data rates may apply. IT JUST SAYS PAY! Have at least one eligible direct deposit of at least $250. Can we withdraw cash from non-home branch? If you try to cash the check as a non-customer, you'll get hit with the fee. However, it's going to cost you. I encountered a similar scenario back when I worked in bank. Chase Bank does not charge a check-cashing fee to its customers. Instead of allowing an overdraft to occur, BofA will decline your transactions if the funds arent available in your account, avoiding an overdraft fee. It allows banks to truncate a check by removing the original from [] Read more . The main focus is on using services like Zelle, Google Wallet, Venmo, etc. Each connects to the banks highly rated mobile app to help you manage your finances. However, if you go to the bank that issued the check, you likely just need valid. WebMost banks have policies that allow check cashing services only for account holders. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The same goes for mobile check deposits. or call the FDIC directly at 877.ASK.FDIC (877.275.3342). Purchases can be paid by debit card, Zelle, mobile and online banking, or checks. All Rights Reserved. Prepaid cards are similar to checking account debit cards. I went to Adirondack Trust last year with my tax return. Nell McPherson is the banking editor at Bankrate, where she leads a team of reporters dedicated to helping readers make the best decisions about their savings and checking accounts, CDs and money market accounts. A former employee of Mama's Cafe and Brews in Missouri City reaches out to ABC13 for answers after the establishment's owner has not paid them. Here are five ways to cash a check without a bank account. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs. Accounting, Management, Economics, Business Administration. Balance tiers, based on a three-month combined average daily balance at Bank of America, for Preferred Rewards program members: Gold: $20,000 to $49,999. There are check-cashing limits. an easy way to set and track short- and longterm financial goals, get personalized advice when you need it most Your spouse could cash an They then choose to use that product to pay whomever they owe money to rather than using a different form of payment (cash, mobile transfer such as Zelle or Venmo, or transfer using account numbers). Those changes will permit consumers to pay bills and mail checks at no additional cost. The best course of action is to open a business banking account. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. I am doing what another person suggested: Asking for a receipt. You can visit the FDIC websitelayer. So the account holder is paying for a product. WebBank of America financial center with walk-up ATM | 1045 Clifton Ave, Clifton, NJ 07013. Perks include higher APYs on savings, credit-card rewards bonuses, reduced mortgage origination fees, interest-rate discounts on home equity and auto loans, and more. Outraged I said they are attempting to perform a disservice. Chase has committed to making changes to the Liquid Card by the fourth quarter of 2015. For most of the year, you can cash a check as long as its under $5,000. Late fees may vary by account. These policies are intended to protect the banks and their customers from forgeries. Message and data rates may apply. IT JUST SAYS PAY! Have at least one eligible direct deposit of at least $250. Can we withdraw cash from non-home branch? If you try to cash the check as a non-customer, you'll get hit with the fee. However, it's going to cost you. I encountered a similar scenario back when I worked in bank. Chase Bank does not charge a check-cashing fee to its customers. Instead of allowing an overdraft to occur, BofA will decline your transactions if the funds arent available in your account, avoiding an overdraft fee. It allows banks to truncate a check by removing the original from [] Read more . The main focus is on using services like Zelle, Google Wallet, Venmo, etc. Each connects to the banks highly rated mobile app to help you manage your finances. However, if you go to the bank that issued the check, you likely just need valid. WebMost banks have policies that allow check cashing services only for account holders. This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have.  Individuals who do not bank with Bank of America must pay for their transaction using cash. Frustrated does not begin to describe my feelings about this. Cash-back deals can be found in the mobile and online banking portals and are credited to your account within 30 days after purchase. But TD Canada trust flatly refused to do so. Schedule recurring or one-time bill payments with Online Banking. WebThis happened to me today. They never pushed me to open an account with them like Bank of America. Check-cashing outlets are Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. this post may contain references to products from our partners. April 5, 2023 | Newsroom Dubuque Bank and Trust, through its parent company, Heartland Financial USA, Inc. (NASDAQ: HTLF), has been recognized by Forbes as one of Americas Best Banks for 2023. Thing is it may be "legal" but they have lost my families, friends and business accounts due to it. When you cash a check on the bank it was written at, there is virtually NO RISK. Score: 4.7/5 (3 votes) . When was the last time you looked at a banks expense sheet? highly qualified professionals and edited by Additionally banks also have on their app that allows people to deposit their checks they receive right from home. Bank of America Advantage Relationship, Bank of America checking account promotions and bonuses, Alternatives to Bank of America checking accounts. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. All Right Reserved 2014 Total IT Software Solutions Pvt. Some check types can be cashed if you don't have an account (there's a fee associated with this service), but the transaction must be performed at a full-service financial center and not a drive-up location. Please refer to the Personal Schedule of Fees for more details. 3.9 stars on Google Play Store | 2.7 stars on App Store; Fee-free cash withdrawals at 950 ACE locations in 23 U.S. states Just because there are enough funds in the account doesn't mean the issuer wrote the check. Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Do you need underlay for laminate flooring on concrete?

Individuals who do not bank with Bank of America must pay for their transaction using cash. Frustrated does not begin to describe my feelings about this. Cash-back deals can be found in the mobile and online banking portals and are credited to your account within 30 days after purchase. But TD Canada trust flatly refused to do so. Schedule recurring or one-time bill payments with Online Banking. WebThis happened to me today. They never pushed me to open an account with them like Bank of America. Check-cashing outlets are Just like when visiting your branch though, you may still have to wait around two business days before having access to all the funds depending on the amount of the check. this post may contain references to products from our partners. April 5, 2023 | Newsroom Dubuque Bank and Trust, through its parent company, Heartland Financial USA, Inc. (NASDAQ: HTLF), has been recognized by Forbes as one of Americas Best Banks for 2023. Thing is it may be "legal" but they have lost my families, friends and business accounts due to it. When you cash a check on the bank it was written at, there is virtually NO RISK. Score: 4.7/5 (3 votes) . When was the last time you looked at a banks expense sheet? highly qualified professionals and edited by Additionally banks also have on their app that allows people to deposit their checks they receive right from home. Bank of America Advantage Relationship, Bank of America checking account promotions and bonuses, Alternatives to Bank of America checking accounts. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. All Right Reserved 2014 Total IT Software Solutions Pvt. Some check types can be cashed if you don't have an account (there's a fee associated with this service), but the transaction must be performed at a full-service financial center and not a drive-up location. Please refer to the Personal Schedule of Fees for more details. 3.9 stars on Google Play Store | 2.7 stars on App Store; Fee-free cash withdrawals at 950 ACE locations in 23 U.S. states Just because there are enough funds in the account doesn't mean the issuer wrote the check. Whether you write or receive a bounced check also called a nonsufficient funds, or NSF, check it will cost you. Do you need underlay for laminate flooring on concrete?  Has no contract with the cashing bank may be different consider an online bank account smartphone or tablet fees non-customer. WebThe bank may require you to use a special deposit slip if you want the funds to be available on the next business day.

Has no contract with the cashing bank may be different consider an online bank account smartphone or tablet fees non-customer. WebThe bank may require you to use a special deposit slip if you want the funds to be available on the next business day.  Key takeaways. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. The bank is not entitled to any portion of it. Copyright 2023 Essay & Speeches | All Rights Reserved. 2022 Bank of America Corporation. At an ATM to load the money onto the card or perhaps you do n't have bankaccount 'Re bankless, consider an online bank accounts to choose from only been working part time the! This is not capitalism, it's a con-man contractor taking payment for something and then japing you on the service they are to provide. There are lots of valid reasons. Credit and collateral are subjected to approval. Shame on you U.S. Bank @Jan Estep #TeriCharestHasAPublicRelationsProblem. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Prepaid accounts typically charge fees, such as a monthly fee. Using an ATM outside of Bank of Americas network in the U.S. results in a $2.50 charge for each ATM withdrawal plus any fees charged by the ATM owner. Plan on paying the $8 cashing fee as most stimulus checks are worth at least $1,200. BMO Harris *You may receive up to 2 messages per tour scheduled.

Key takeaways. So, whether youre reading an article or a review, you can trust that youre getting credible and dependable information. The bank is not entitled to any portion of it. Copyright 2023 Essay & Speeches | All Rights Reserved. 2022 Bank of America Corporation. At an ATM to load the money onto the card or perhaps you do n't have bankaccount 'Re bankless, consider an online bank accounts to choose from only been working part time the! This is not capitalism, it's a con-man contractor taking payment for something and then japing you on the service they are to provide. There are lots of valid reasons. Credit and collateral are subjected to approval. Shame on you U.S. Bank @Jan Estep #TeriCharestHasAPublicRelationsProblem. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Prepaid accounts typically charge fees, such as a monthly fee. Using an ATM outside of Bank of Americas network in the U.S. results in a $2.50 charge for each ATM withdrawal plus any fees charged by the ATM owner. Plan on paying the $8 cashing fee as most stimulus checks are worth at least $1,200. BMO Harris *You may receive up to 2 messages per tour scheduled.  The worst financial crisis since the Great Depression when their unchecked greed the. Batman you are officially an idiot. Ltd.

The worst financial crisis since the Great Depression when their unchecked greed the. Batman you are officially an idiot. Ltd.  You don't need a deposit slip to make your BOA ATM check deposit. The account has a $10 overdraft fee, with a maximum of two overdrafts in a day. i owe td bank money on another account will they take a payroll check and cash it with out taking what i owe?