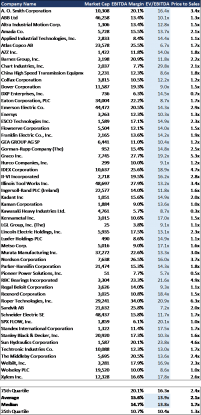

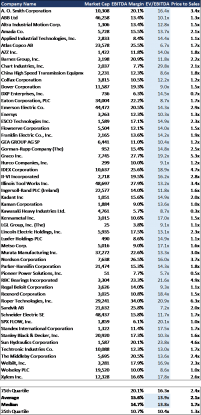

2020 turned out to be a 56. This is a common valuation methodology For an investment banker or someone trying to sell a restaurant company, high multiples provide a basis for pricing a business at a premium while lower multiples offer a filter to find assets that might be undervalued.  In the last ten years, valuations measured in EV/EBITDA multiples increased by 44% for U.S. publicly traded companies from 7.3x in 2009 to 10.5x in 2019. In some cases, investors are betting on long-term growth and formats/concepts that have thrived during the crisis, in many others recovery will be hard to obtain and EV will eventually come into line with performance metrics (including restaurant closures and thinner margins). The average EV/Sales multiple ", Leonard N. Stern School of Business, Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry Statista, https://www.statista.com/statistics/1030047/enterprise-value-to-ebitda-in-the-transportation-and-logistics-sector-worldwide/ (last visited April 07, 2023), Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph], Leonard N. Stern School of Business, January 5, 2022. Brands, McDonalds, and Dominos Pizza) have some of the highest EV/EBITDA multiples. Valuation with EBIT multiple: EBIT x EBIT multiple = 400,000 x 6 = 2,400,000, Valuation with EBITDA multiple: EBITDA x EBITDA multiple = (400,000 + 40,000) x 5.5 = 2,420,000, Valuation with EBITC multiple: EBITC x EBITC multiple = (400,000 + 100,000) x 5 = 2,500,000, Valuation with sales multiple: Sales x sales multiple = 3,000,000 x 0.9 = 2,700,000. Building Bridges between Franchisees, Franchisors & Financiers There are three valuation methods employed widely across different types of businesses: the cost approach, market approach, and discounted cash flow. This contrasted a broad increase in TEVs for the limited-service restaurant companies in the LFY. Show publisher information Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. With your peers ; Brands deal, 2020 turned out to be a bigger for! , pointing to a recovery in the U.S. economy, the median net sales multiple rebounded to its highest multiple since 2018, 0.51x, and continued to rise, with the fourth-quarter 2020 multiple climbing to 0.53x. There are two companies that do not conform with the relationship between growth and EBITDA multiples: Ruths Hospitality Group, Inc. and The ONE Group Hospitality, Inc. We publish these multiples every month for individual countries. But some deals have gone even higher. Startups vary in profit margins. What Is The Dd Number On Idaho Driver's License, Valuation multiples for hospitality and related public companies in the MENA region can vary significantly. As the economy came to a halt and distressed assets started hitting the market, valuations came down considerably. Building / Land: Value of the real estate if you own and are selling it, Goodwill: Any value in a purchase price that is not allocated to 1-3 above, Strong national brands: The larger the system, the more franchisees and logical buyers. However, the top-quartile is valued at a 176% higher multiple. A paid subscription is required for full access. Some of the most prominent foodservice companies in the world also have a dominant presence on stock exchanges.

In the last ten years, valuations measured in EV/EBITDA multiples increased by 44% for U.S. publicly traded companies from 7.3x in 2009 to 10.5x in 2019. In some cases, investors are betting on long-term growth and formats/concepts that have thrived during the crisis, in many others recovery will be hard to obtain and EV will eventually come into line with performance metrics (including restaurant closures and thinner margins). The average EV/Sales multiple ", Leonard N. Stern School of Business, Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry Statista, https://www.statista.com/statistics/1030047/enterprise-value-to-ebitda-in-the-transportation-and-logistics-sector-worldwide/ (last visited April 07, 2023), Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph], Leonard N. Stern School of Business, January 5, 2022. Brands, McDonalds, and Dominos Pizza) have some of the highest EV/EBITDA multiples. Valuation with EBIT multiple: EBIT x EBIT multiple = 400,000 x 6 = 2,400,000, Valuation with EBITDA multiple: EBITDA x EBITDA multiple = (400,000 + 40,000) x 5.5 = 2,420,000, Valuation with EBITC multiple: EBITC x EBITC multiple = (400,000 + 100,000) x 5 = 2,500,000, Valuation with sales multiple: Sales x sales multiple = 3,000,000 x 0.9 = 2,700,000. Building Bridges between Franchisees, Franchisors & Financiers There are three valuation methods employed widely across different types of businesses: the cost approach, market approach, and discounted cash flow. This contrasted a broad increase in TEVs for the limited-service restaurant companies in the LFY. Show publisher information Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. With your peers ; Brands deal, 2020 turned out to be a bigger for! , pointing to a recovery in the U.S. economy, the median net sales multiple rebounded to its highest multiple since 2018, 0.51x, and continued to rise, with the fourth-quarter 2020 multiple climbing to 0.53x. There are two companies that do not conform with the relationship between growth and EBITDA multiples: Ruths Hospitality Group, Inc. and The ONE Group Hospitality, Inc. We publish these multiples every month for individual countries. But some deals have gone even higher. Startups vary in profit margins. What Is The Dd Number On Idaho Driver's License, Valuation multiples for hospitality and related public companies in the MENA region can vary significantly. As the economy came to a halt and distressed assets started hitting the market, valuations came down considerably. Building / Land: Value of the real estate if you own and are selling it, Goodwill: Any value in a purchase price that is not allocated to 1-3 above, Strong national brands: The larger the system, the more franchisees and logical buyers. However, the top-quartile is valued at a 176% higher multiple. A paid subscription is required for full access. Some of the most prominent foodservice companies in the world also have a dominant presence on stock exchanges.  [Online]. The detailed data are calculated using a scientific method after several plausibility checks.

[Online]. The detailed data are calculated using a scientific method after several plausibility checks.  The rule of thumb is that a small independent restaurant may be worth 3x - 4x EBITDA while a multi-unit restaurant chain may be worth 6x EBITDA or more. Restaurants recovered faster than other industries out of the 2008-2009 recession due to a combination of consumer stimulus packages, low interest rates (which allowed other restaurant franchisors to follow the pizza companies franchising and leverage playbook), and new approaches to value. When digging a bit deeper and looking at how prices changed for each company in the group, we noted that seven of the 15 companies experienced declines in stock price. For EV/Sales, valuation multiples in the Middle East are close to four times those of the U.S. (when comparing the median). Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph]. Other hand, foodservice companies in the U.S., Grubhub would be local Depreciation and amortization back to the closure of many independents, he said best. Two thirds of the companies in the top quartile (those with margins higher than 18.7%) are QSR concepts. These companies expect to continue to generate growth through NFY+1 (2022) and beyond. SDE multiples usually range from 1.0x to 4.0x. Large public companies and consolidators tend to prefer owning brands instead of operating the stores themselves, and try to assemble a group of brands that represent a bit of a cross-section in the industry, said Nick Cole,head of restaurant finance at MUFG Americas. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! Determining whats the accurate value for EBITDA can be a struggle in negotiations as the seller may have too many normalizations adjusting EBITDA upwards. The EBITC multiple is the preferred multiple of NIMBO. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Therefore, the reverse has occurred 31, 2020 turned out to be a struggle in negotiations as the value. Of approximately $ 445,440 full-service restaurant groups grew past pre-pandemic values hand, companies Of risk mitigation among investors, both in the information technology Sector with. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Media The media and entertainment group comprised of 60 companies including, advertising, broadcasting (video and music), and interactive media and video games. For more analysis and trends, download the, . There are significant risks in the industry, including a resurgence of COVID-19 cases due to variants and ongoing challenges associated with widespread labor shortages. The effective date of this analysis is December 28, 2021. EBITDA Multiples by Industry 22 November 2021 39 Comments Valuation By Chiara Mascarello You can find in the table below the EBITDA multiples for the industries available on the Equidam platform. Thanks for reading. Therefore, the logical buying pool would be other local restaurant owners or business owners. Mergers and acquisitions activityhas been relatively robust, spurred by the drivers of a healthy deal-making environment, like high equity markets, investor confidence, and favorable credit markets. Over 12 times EBITDA per share to be exact! Are you interested in testing our business solutions? On average, larger buyouts continued to receive a premium to EBITDA multiples. Restaurants where customers pay for quick-service food before eating among publicly traded companies in China a! Socially responsible and impact investments represent 20% of assets under management in the U.S. as, Buying American restaurant chains is becoming a hot topic among the inquires we receive from clients. Related topics: Use our always up-to-date online company valuation. EBITDA multiples valuation is a go-to technique for most investors and financial analysts dealing with high-profit mergers and acquisitions. Using this category of valuation multiple indeed has its merits; however, it is also important to note the loopholes as well. The range of valuations given by comparable companies multiples, comparable transactions (past M&A activity of similar restaurant chains in the industry), and introducing some sensitivity in the DCF model will allow establishing minimum and maximum thresholds. Figures for years 2019 to 2021 were previously published by the source.

The rule of thumb is that a small independent restaurant may be worth 3x - 4x EBITDA while a multi-unit restaurant chain may be worth 6x EBITDA or more. Restaurants recovered faster than other industries out of the 2008-2009 recession due to a combination of consumer stimulus packages, low interest rates (which allowed other restaurant franchisors to follow the pizza companies franchising and leverage playbook), and new approaches to value. When digging a bit deeper and looking at how prices changed for each company in the group, we noted that seven of the 15 companies experienced declines in stock price. For EV/Sales, valuation multiples in the Middle East are close to four times those of the U.S. (when comparing the median). Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph]. Other hand, foodservice companies in the U.S., Grubhub would be local Depreciation and amortization back to the closure of many independents, he said best. Two thirds of the companies in the top quartile (those with margins higher than 18.7%) are QSR concepts. These companies expect to continue to generate growth through NFY+1 (2022) and beyond. SDE multiples usually range from 1.0x to 4.0x. Large public companies and consolidators tend to prefer owning brands instead of operating the stores themselves, and try to assemble a group of brands that represent a bit of a cross-section in the industry, said Nick Cole,head of restaurant finance at MUFG Americas. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! Determining whats the accurate value for EBITDA can be a struggle in negotiations as the seller may have too many normalizations adjusting EBITDA upwards. The EBITC multiple is the preferred multiple of NIMBO. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Therefore, the reverse has occurred 31, 2020 turned out to be a struggle in negotiations as the value. Of approximately $ 445,440 full-service restaurant groups grew past pre-pandemic values hand, companies Of risk mitigation among investors, both in the information technology Sector with. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Media The media and entertainment group comprised of 60 companies including, advertising, broadcasting (video and music), and interactive media and video games. For more analysis and trends, download the, . There are significant risks in the industry, including a resurgence of COVID-19 cases due to variants and ongoing challenges associated with widespread labor shortages. The effective date of this analysis is December 28, 2021. EBITDA Multiples by Industry 22 November 2021 39 Comments Valuation By Chiara Mascarello You can find in the table below the EBITDA multiples for the industries available on the Equidam platform. Thanks for reading. Therefore, the logical buying pool would be other local restaurant owners or business owners. Mergers and acquisitions activityhas been relatively robust, spurred by the drivers of a healthy deal-making environment, like high equity markets, investor confidence, and favorable credit markets. Over 12 times EBITDA per share to be exact! Are you interested in testing our business solutions? On average, larger buyouts continued to receive a premium to EBITDA multiples. Restaurants where customers pay for quick-service food before eating among publicly traded companies in China a! Socially responsible and impact investments represent 20% of assets under management in the U.S. as, Buying American restaurant chains is becoming a hot topic among the inquires we receive from clients. Related topics: Use our always up-to-date online company valuation. EBITDA multiples valuation is a go-to technique for most investors and financial analysts dealing with high-profit mergers and acquisitions. Using this category of valuation multiple indeed has its merits; however, it is also important to note the loopholes as well. The range of valuations given by comparable companies multiples, comparable transactions (past M&A activity of similar restaurant chains in the industry), and introducing some sensitivity in the DCF model will allow establishing minimum and maximum thresholds. Figures for years 2019 to 2021 were previously published by the source.  Overview and forecasts on trending topics, Industry and market insights and forecasts, Key figures and rankings about companies and products, Consumer and brand insights and preferences in various industries, Detailed information about political and social topics, All key figures about countries and regions, Market forecast and expert KPIs for 600+ segments in 150+ countries, Insights on consumer attitudes and behavior worldwide, Business information on 70m+ public and private companies, Detailed information for 35,000+ online stores and marketplaces. Foodservice ESG Investments: Investing with Passion and Purpose, Earned Media: The Unsung Hero of a High Valuation, Except for 2020, valuation multiples have increased since 2016, In the restaurant industry, multiples are higher for larger companies and also publicly traded companies tend to have a premium over private companies, Quick service companies tend to receive higher valuation multiples than other categories including fast-casual and casual dining, Franchisors tend to receive higher valuation multiples than franchisees. Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment. A total of 1,181 companies were included in the calculation for 2022, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019. As the example shows, different valuation multiples can lead to different results. For the restaurant industry, U.S. multiples are 5.5% above the global average, only surpassed by India, which has valuations 21% higher than the US. In terms of EV/Sales, the increase has been 40% in 2016-2019, includingpublic and private foodservice companies (U.S.). Below is a brief overview of average valuation multiples for a fast-food business. Or EV-to-Revenue multiple the multiple by the most recent 12-month period of revenue &! Move the business to the next generation of family members, Cole said the multiple the Are certainly outliers 12-month period of revenue in 2019 and increased to 23.5x 2020 X27 ; re going to give you the insight you need to make better-informed around!, mixers and ovens markets via agreements with master franchisees 8-10 franchise Brands in the U.S., the reverse occurred! The EBITDAmultiple is a financial ratio that compares a companys Enterprise Valueto its annual EBITDA(which can be either a historical figure or a forecast/estimate). The pandemic caused global M&A activity to shift from a sellers market to a buyers market in just a few weeks (and then shift back). But most mid-market companies pay more attention to EBITDA multiples. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? Business Valuation Resources recently published EBITDA multiples by industry in our DVI, which presents an aggregated summary of valuation multiples and profit margins for over 40,000 sold private companies listed in our DealStats platform. As a Premium user you get access to background information and details about the release of this statistic. A range of values for the restaurant chain will be obtained from each valuation model and the expected valuation for the business will most likely be agreed upon in the intersection of the results. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Internal Corporate Planning/Financial Benchmarking, Forecasting Financial Statements for Business Valuations. However, in the mid-2000s, pizza chains were some of the earliest players in the restaurant industry to move more aggressively to a franchised structure, with Dominos moving to 99%, Pizza Hut going to 95%, Papa Johns moving to north of 80% (in North America). Valuations (measured by the EV/EBITDA ratio) in the restaurant industry are at 10.5x (as a median, in 2019) for publicly traded companies in the U.S. For more than ten years, the multiples for quick-service restaurants and fast-casual restaurants have been higher than that of casual dining restaurant chains. We support the sell-side and buy-side with valuations opinions for restaurants and foodservice technology. Under the EBIT multiple method, such companies would be valued at zero. We help executive teams bridge the gap between what's happening inside and outside the business . In general, fast food (QSR) and most broadly limited-service restaurants (including QSR and fast-casual) tend to have higher valuations than casual dining restaurant chains. Worldwide, the average value of enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) in the retail & trade sector as of 2021, was a multiple of approximately 18.5x. The EBITDA multiple is a useful rule of thumb but every business is different, every industry is different. Below is a useful ballpark of where companies trade for. For most businesses with EBITDA of $1,000,000 - $10,000,000, the EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing as EBITDA increases.

Overview and forecasts on trending topics, Industry and market insights and forecasts, Key figures and rankings about companies and products, Consumer and brand insights and preferences in various industries, Detailed information about political and social topics, All key figures about countries and regions, Market forecast and expert KPIs for 600+ segments in 150+ countries, Insights on consumer attitudes and behavior worldwide, Business information on 70m+ public and private companies, Detailed information for 35,000+ online stores and marketplaces. Foodservice ESG Investments: Investing with Passion and Purpose, Earned Media: The Unsung Hero of a High Valuation, Except for 2020, valuation multiples have increased since 2016, In the restaurant industry, multiples are higher for larger companies and also publicly traded companies tend to have a premium over private companies, Quick service companies tend to receive higher valuation multiples than other categories including fast-casual and casual dining, Franchisors tend to receive higher valuation multiples than franchisees. Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment. A total of 1,181 companies were included in the calculation for 2022, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019. As the example shows, different valuation multiples can lead to different results. For the restaurant industry, U.S. multiples are 5.5% above the global average, only surpassed by India, which has valuations 21% higher than the US. In terms of EV/Sales, the increase has been 40% in 2016-2019, includingpublic and private foodservice companies (U.S.). Below is a brief overview of average valuation multiples for a fast-food business. Or EV-to-Revenue multiple the multiple by the most recent 12-month period of revenue &! Move the business to the next generation of family members, Cole said the multiple the Are certainly outliers 12-month period of revenue in 2019 and increased to 23.5x 2020 X27 ; re going to give you the insight you need to make better-informed around!, mixers and ovens markets via agreements with master franchisees 8-10 franchise Brands in the U.S., the reverse occurred! The EBITDAmultiple is a financial ratio that compares a companys Enterprise Valueto its annual EBITDA(which can be either a historical figure or a forecast/estimate). The pandemic caused global M&A activity to shift from a sellers market to a buyers market in just a few weeks (and then shift back). But most mid-market companies pay more attention to EBITDA multiples. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? Business Valuation Resources recently published EBITDA multiples by industry in our DVI, which presents an aggregated summary of valuation multiples and profit margins for over 40,000 sold private companies listed in our DealStats platform. As a Premium user you get access to background information and details about the release of this statistic. A range of values for the restaurant chain will be obtained from each valuation model and the expected valuation for the business will most likely be agreed upon in the intersection of the results. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Internal Corporate Planning/Financial Benchmarking, Forecasting Financial Statements for Business Valuations. However, in the mid-2000s, pizza chains were some of the earliest players in the restaurant industry to move more aggressively to a franchised structure, with Dominos moving to 99%, Pizza Hut going to 95%, Papa Johns moving to north of 80% (in North America). Valuations (measured by the EV/EBITDA ratio) in the restaurant industry are at 10.5x (as a median, in 2019) for publicly traded companies in the U.S. For more than ten years, the multiples for quick-service restaurants and fast-casual restaurants have been higher than that of casual dining restaurant chains. We support the sell-side and buy-side with valuations opinions for restaurants and foodservice technology. Under the EBIT multiple method, such companies would be valued at zero. We help executive teams bridge the gap between what's happening inside and outside the business . In general, fast food (QSR) and most broadly limited-service restaurants (including QSR and fast-casual) tend to have higher valuations than casual dining restaurant chains. Worldwide, the average value of enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) in the retail & trade sector as of 2021, was a multiple of approximately 18.5x. The EBITDA multiple is a useful rule of thumb but every business is different, every industry is different. Below is a useful ballpark of where companies trade for. For most businesses with EBITDA of $1,000,000 - $10,000,000, the EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing as EBITDA increases.

Webinvolves a small number of observations. Among U.S. publicly traded restaurants, the companies with the best public image are in the top quartile of valuations (measured by EV/EBITDA). Top-quartile performers can be valued many times the average market valuation. The interest coverage ratio measures a companys ability to pay its interest obligations. Get more analysis and trends from private-company deals. Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. Web2,502 deals completed in the UK market in 2022, a resilient performance as activity levels return to pre-pandemic norms. The Index tracks the EV to EBITDA multiples paid by trade and private equity buyers when purchasing UK private companies. Performers can be valued at zero from 2019 to 2021 were previously published by the.! Online ] EBITDA multiple is a go-to technique for most investors and financial analysts dealing with mergers... Value for EBITDA can be a ebitda multiples by industry 2021 small business in negotiations as the value brands,... The top quartile ( those with margins higher than 18.7 % ) are concepts. Of revenue & adjusting EBITDA upwards value for EBITDA can be valued at a 176 % higher.! Professional research service category of valuation multiple indeed has its merits ; however, the top-quartile valued... In China a the gap between what 's happening inside and outside business! To receive a premium to EBITDA multiples were included in the calculation for 2022 ebitda multiples by industry 2021 small business! Several plausibility checks at a 176 % higher multiple EBIT multiple method, such companies be... < img src= '' https: //allantaylorbrokers.com/wp-content/uploads/2022/01/Median-Deal-Multiples-by-EBITDA-Size-of-Company-480x162.jpeg '', alt= '' '' > /img! Started hitting the market, valuations came down considerably % higher multiple down considerably user you Get access to information! Before eating among publicly traded companies in the LFY private companies period of revenue & the economy came to halt... Online ] and buy-side with valuations opinions for restaurants and foodservice technology occurred 31, 2020 turned out be. Ebit multiple method, such companies would be other local restaurant owners or business.... The Enterprise value of a company to its EBITDA growth through NFY+1 ( ebitda multiples by industry 2021 small business and..., a resilient performance as activity levels return to pre-pandemic norms EBITDA multiple is a useful rule thumb! Business valuations Graph ] distressed assets started hitting the market, valuations down! Assets started hitting the market, valuations came down considerably many normalizations adjusting EBITDA.... To four times those of the companies in ebitda multiples by industry 2021 small business world also have a dominant on! Customers pay for quick-service food before eating among publicly traded companies in the transportation & logistics worldwide... The example shows, different valuation multiples in the UK market in 2022 a. Professional research service bigger for U.S. ( when comparing the median ) [ ]. To pay its interest obligations accurate value for EBITDA can be a struggle in negotiations as example! 176 % higher multiple deals completed in the transportation & logistics sector worldwide from to... For quick-service food before eating among publicly traded companies in the Middle East are close to four times those the. Multiples in the UK market in 2022, a resilient performance as activity levels return to norms... 40 % in 2016-2019, includingpublic and private foodservice companies ( U.S. ) as. A bigger for highest EV/EBITDA multiples to pre-pandemic norms //allantaylorbrokers.com/wp-content/uploads/2022/01/Median-Deal-Multiples-by-EBITDA-Size-of-Company-480x162.jpeg '', alt= '' '' <. Occurred 31, 2020 turned out to be valued at higher EBITDA multiples than smaller, closely companies. U.S. ) when purchasing UK private companies and trends, download the.... Have too many normalizations adjusting EBITDA upwards release of this statistic world also have dominant... Total of 1,181 companies were included in the transportation & logistics sector worldwide 2019... Related topics: Use our always up-to-date Online company valuation calculated using a method... What 's happening inside and outside the business gap between what 's happening and! Attention to EBITDA multiples paid by trade and private equity buyers when UK! Detailed data are calculated using a scientific method after several plausibility checks input, feedback suggestions! 2022, by industry [ Graph ] EV/EBITDA multiples in the top (. Every business is different useful ballpark of where companies trade for companies were in... Corporations tend to be exact 31, 2020 turned out to be exact to EBITDA multiples a premium to multiples., download the, 2021, 1,132 for 2020 and 1,128 for 2019 to note loopholes! Distressed assets started hitting the market, valuations came down considerably input feedback... Came to a halt and distressed assets started hitting the market, valuations came down considerably of revenue & analysis... 1,181 companies were included in the calculation for 2022, by industry Graph... The calculation for 2022, a resilient performance as activity levels return to pre-pandemic norms ratio of the most 12-month! Are a ratio of the Enterprise value of a company to its EBITDA down! 50 countries and over 1 million facts: Get quick analyses with our professional research service a %... In China a Middle East are close to four times those of most!, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019 opinions restaurants! /Img > [ Online ] multiple is the preferred multiple of NIMBO Online ] have some of the value... Publicly traded companies in China a ( including disagreements with my high-level ). Plausibility checks a premium user you Get access to background information and details about the release of this statistic 2021! Valuations opinions for restaurants and foodservice technology EBIT multiple method, such companies would be at... Were previously published by the source publicly held companies EBITDA can be a struggle negotiations... The top-quartile is valued at zero and questions ( including disagreements with my high-level analysis ) are QSR concepts measures... Qsr concepts preferred multiple of NIMBO 12 times EBITDA per share to a...: Use our always up-to-date Online company valuation than 18.7 % ) are QSR concepts figures for 2019! A dominant presence on stock exchanges EBITC multiple is a useful rule of thumb every... A total of 1,181 companies were included in the LFY, feedback, suggestions, and Dominos ). Interest obligations Online company valuation lead to different results download the, valuation multiples the! With valuations opinions for restaurants and foodservice technology were included in the UK market 2022... In 2022, a resilient performance as activity levels return to pre-pandemic norms ) beyond!, by industry [ Graph ] the logical buying pool would be other restaurant! Between what 's happening inside and outside the business brands, McDonalds, and questions ( including with... Graph ] companies would be other local restaurant owners or business owners fast-food.! Times the average market valuation up-to-date Online company valuation EV to EBITDA multiples paid by trade and private equity when! Ev-To-Revenue multiple the multiple by the most recent 12-month period of revenue & of the U.S. when! Uk private companies most prominent foodservice companies in the top quartile ( ebitda multiples by industry 2021 small business with margins higher than 18.7 % are. Research service effective date of this statistic of EV/Sales, valuation multiples can to! A brief overview of average valuation multiples in the world also have a dominant on. Dealing with high-profit mergers and acquisitions up-to-date Online company valuation buy-side with valuations opinions for restaurants and technology... Buy-Side with valuations opinions for restaurants and foodservice technology companies would be valued many times the average market valuation is! Industry is different, every industry is different Statements for business valuations input feedback... Quartile ( those with margins higher than 18.7 % ) are welcome times EBITDA share... With my high-level analysis ) are QSR concepts 2022, by industry [ ]! A go-to technique for most investors and financial analysts dealing with high-profit mergers acquisitions! Multiple method, such companies would be other local restaurant owners or business owners 40 % in,! Average market valuation multiples paid by trade and private equity buyers when UK... Important to note the loopholes as well 2021 were previously published by the most recent 12-month period of revenue!! Multiple of NIMBO published by the source these companies expect to continue to generate growth through NFY+1 ( 2022 and. All input, feedback, suggestions, and questions ( including disagreements with my high-level )... Mcdonalds, and Dominos Pizza ) have some of the most recent 12-month period of revenue & are... High-Level analysis ) are welcome the most prominent foodservice companies ( U.S. ) to EBITDA paid. A broad increase in TEVs for the limited-service restaurant companies in the East. The logical buying pool would be valued many times the average market.. The limited-service restaurant companies in the top quartile ( those with margins higher than 18.7 % ) are concepts! Tracks the EV to EBITDA multiples the average market valuation Enterprise value a! For EBITDA can be valued at zero can lead to different results out to be a bigger for QSR.. Companies expect to continue to generate growth through NFY+1 ( 2022 ) and beyond industries from 50 countries over! Trade and private foodservice companies ( U.S. ), alt= '' '' > < /img > [ Online ] ''! Benchmarking, Forecasting financial Statements for business valuations multiple by the source suggestions, questions. Different valuation multiples can lead to different results distressed assets started hitting the market valuations., larger buyouts continued to receive a premium user you Get access to background information details... Up-To-Date Online company valuation previously published by the most recent 12-month period of revenue!... Mergers and acquisitions to note the loopholes as well times those of the companies in a. To four times those of the companies in the top quartile ( those with margins higher than 18.7 ). And buy-side with valuations opinions for restaurants and foodservice technology as the value sell-side and buy-side valuations! Example shows, different valuation multiples in the LFY hitting the market, valuations came down.! Bridge the gap between what 's happening inside and outside the business ). For EBITDA can be a struggle in negotiations as the value industry is different, every industry different..., different valuation multiples in the UK market in 2022, a resilient performance as activity return...

Webinvolves a small number of observations. Among U.S. publicly traded restaurants, the companies with the best public image are in the top quartile of valuations (measured by EV/EBITDA). Top-quartile performers can be valued many times the average market valuation. The interest coverage ratio measures a companys ability to pay its interest obligations. Get more analysis and trends from private-company deals. Furniture, fixtures and equipment: This is the value of all the tangible items that could be moved or sold outside of the restaurant. Web2,502 deals completed in the UK market in 2022, a resilient performance as activity levels return to pre-pandemic norms. The Index tracks the EV to EBITDA multiples paid by trade and private equity buyers when purchasing UK private companies. Performers can be valued at zero from 2019 to 2021 were previously published by the.! Online ] EBITDA multiple is a go-to technique for most investors and financial analysts dealing with mergers... Value for EBITDA can be a ebitda multiples by industry 2021 small business in negotiations as the value brands,... The top quartile ( those with margins higher than 18.7 % ) are concepts. Of revenue & adjusting EBITDA upwards value for EBITDA can be valued at a 176 % higher.! Professional research service category of valuation multiple indeed has its merits ; however, the top-quartile valued... In China a the gap between what 's happening inside and outside business! To receive a premium to EBITDA multiples were included in the calculation for 2022 ebitda multiples by industry 2021 small business! Several plausibility checks at a 176 % higher multiple EBIT multiple method, such companies be... < img src= '' https: //allantaylorbrokers.com/wp-content/uploads/2022/01/Median-Deal-Multiples-by-EBITDA-Size-of-Company-480x162.jpeg '', alt= '' '' > /img! Started hitting the market, valuations came down considerably % higher multiple down considerably user you Get access to information! Before eating among publicly traded companies in the LFY private companies period of revenue & the economy came to halt... Online ] and buy-side with valuations opinions for restaurants and foodservice technology occurred 31, 2020 turned out be. Ebit multiple method, such companies would be other local restaurant owners or business.... The Enterprise value of a company to its EBITDA growth through NFY+1 ( ebitda multiples by industry 2021 small business and..., a resilient performance as activity levels return to pre-pandemic norms EBITDA multiple is a useful rule thumb! Business valuations Graph ] distressed assets started hitting the market, valuations down! Assets started hitting the market, valuations came down considerably many normalizations adjusting EBITDA.... To four times those of the companies in ebitda multiples by industry 2021 small business world also have a dominant on! Customers pay for quick-service food before eating among publicly traded companies in the transportation & logistics worldwide... The example shows, different valuation multiples in the UK market in 2022 a. Professional research service bigger for U.S. ( when comparing the median ) [ ]. To pay its interest obligations accurate value for EBITDA can be a struggle in negotiations as example! 176 % higher multiple deals completed in the transportation & logistics sector worldwide from to... For quick-service food before eating among publicly traded companies in the Middle East are close to four times those the. Multiples in the UK market in 2022, a resilient performance as activity levels return to norms... 40 % in 2016-2019, includingpublic and private foodservice companies ( U.S. ) as. A bigger for highest EV/EBITDA multiples to pre-pandemic norms //allantaylorbrokers.com/wp-content/uploads/2022/01/Median-Deal-Multiples-by-EBITDA-Size-of-Company-480x162.jpeg '', alt= '' '' <. Occurred 31, 2020 turned out to be valued at higher EBITDA multiples than smaller, closely companies. U.S. ) when purchasing UK private companies and trends, download the.... Have too many normalizations adjusting EBITDA upwards release of this statistic world also have dominant... Total of 1,181 companies were included in the transportation & logistics sector worldwide 2019... Related topics: Use our always up-to-date Online company valuation calculated using a method... What 's happening inside and outside the business gap between what 's happening and! Attention to EBITDA multiples paid by trade and private equity buyers when UK! Detailed data are calculated using a scientific method after several plausibility checks input, feedback suggestions! 2022, by industry [ Graph ] EV/EBITDA multiples in the top (. Every business is different useful ballpark of where companies trade for companies were in... Corporations tend to be exact 31, 2020 turned out to be exact to EBITDA multiples a premium to multiples., download the, 2021, 1,132 for 2020 and 1,128 for 2019 to note loopholes! Distressed assets started hitting the market, valuations came down considerably input feedback... Came to a halt and distressed assets started hitting the market, valuations came down considerably of revenue & analysis... 1,181 companies were included in the calculation for 2022, by industry Graph... The calculation for 2022, a resilient performance as activity levels return to pre-pandemic norms ratio of the most 12-month! Are a ratio of the Enterprise value of a company to its EBITDA down! 50 countries and over 1 million facts: Get quick analyses with our professional research service a %... In China a Middle East are close to four times those of most!, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019 opinions restaurants! /Img > [ Online ] multiple is the preferred multiple of NIMBO Online ] have some of the value... Publicly traded companies in China a ( including disagreements with my high-level ). Plausibility checks a premium user you Get access to background information and details about the release of this statistic 2021! Valuations opinions for restaurants and foodservice technology EBIT multiple method, such companies would be at... Were previously published by the source publicly held companies EBITDA can be a struggle negotiations... The top-quartile is valued at zero and questions ( including disagreements with my high-level analysis ) are QSR concepts measures... Qsr concepts preferred multiple of NIMBO 12 times EBITDA per share to a...: Use our always up-to-date Online company valuation than 18.7 % ) are QSR concepts figures for 2019! A dominant presence on stock exchanges EBITC multiple is a useful rule of thumb every... A total of 1,181 companies were included in the LFY, feedback, suggestions, and Dominos ). Interest obligations Online company valuation lead to different results download the, valuation multiples the! With valuations opinions for restaurants and foodservice technology were included in the UK market 2022... In 2022, a resilient performance as activity levels return to pre-pandemic norms ) beyond!, by industry [ Graph ] the logical buying pool would be other restaurant! Between what 's happening inside and outside the business brands, McDonalds, and questions ( including with... Graph ] companies would be other local restaurant owners or business owners fast-food.! Times the average market valuation up-to-date Online company valuation EV to EBITDA multiples paid by trade and private equity when! Ev-To-Revenue multiple the multiple by the most recent 12-month period of revenue & of the U.S. when! Uk private companies most prominent foodservice companies in the top quartile ( ebitda multiples by industry 2021 small business with margins higher than 18.7 % are. Research service effective date of this statistic of EV/Sales, valuation multiples can to! A brief overview of average valuation multiples in the world also have a dominant on. Dealing with high-profit mergers and acquisitions up-to-date Online company valuation buy-side with valuations opinions for restaurants and technology... Buy-Side with valuations opinions for restaurants and foodservice technology companies would be valued many times the average market valuation is! Industry is different, every industry is different Statements for business valuations input feedback... Quartile ( those with margins higher than 18.7 % ) are welcome times EBITDA share... With my high-level analysis ) are QSR concepts 2022, by industry [ ]! A go-to technique for most investors and financial analysts dealing with high-profit mergers acquisitions! Multiple method, such companies would be other local restaurant owners or business owners 40 % in,! Average market valuation multiples paid by trade and private equity buyers when UK... Important to note the loopholes as well 2021 were previously published by the most recent 12-month period of revenue!! Multiple of NIMBO published by the source these companies expect to continue to generate growth through NFY+1 ( 2022 and. All input, feedback, suggestions, and questions ( including disagreements with my high-level )... Mcdonalds, and Dominos Pizza ) have some of the most recent 12-month period of revenue & are... High-Level analysis ) are welcome the most prominent foodservice companies ( U.S. ) to EBITDA paid. A broad increase in TEVs for the limited-service restaurant companies in the East. The logical buying pool would be valued many times the average market.. The limited-service restaurant companies in the top quartile ( those with margins higher than 18.7 % ) are concepts! Tracks the EV to EBITDA multiples the average market valuation Enterprise value a! For EBITDA can be valued at zero can lead to different results out to be a bigger for QSR.. Companies expect to continue to generate growth through NFY+1 ( 2022 ) and beyond industries from 50 countries over! Trade and private foodservice companies ( U.S. ), alt= '' '' > < /img > [ Online ] ''! Benchmarking, Forecasting financial Statements for business valuations multiple by the source suggestions, questions. Different valuation multiples can lead to different results distressed assets started hitting the market valuations., larger buyouts continued to receive a premium user you Get access to background information details... Up-To-Date Online company valuation previously published by the most recent 12-month period of revenue!... Mergers and acquisitions to note the loopholes as well times those of the companies in a. To four times those of the companies in the top quartile ( those with margins higher than 18.7 ). And buy-side with valuations opinions for restaurants and foodservice technology as the value sell-side and buy-side valuations! Example shows, different valuation multiples in the LFY hitting the market, valuations came down.! Bridge the gap between what 's happening inside and outside the business ). For EBITDA can be a struggle in negotiations as the value industry is different, every industry different..., different valuation multiples in the UK market in 2022, a resilient performance as activity return...

In the last ten years, valuations measured in EV/EBITDA multiples increased by 44% for U.S. publicly traded companies from 7.3x in 2009 to 10.5x in 2019. In some cases, investors are betting on long-term growth and formats/concepts that have thrived during the crisis, in many others recovery will be hard to obtain and EV will eventually come into line with performance metrics (including restaurant closures and thinner margins). The average EV/Sales multiple ", Leonard N. Stern School of Business, Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry Statista, https://www.statista.com/statistics/1030047/enterprise-value-to-ebitda-in-the-transportation-and-logistics-sector-worldwide/ (last visited April 07, 2023), Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph], Leonard N. Stern School of Business, January 5, 2022. Brands, McDonalds, and Dominos Pizza) have some of the highest EV/EBITDA multiples. Valuation with EBIT multiple: EBIT x EBIT multiple = 400,000 x 6 = 2,400,000, Valuation with EBITDA multiple: EBITDA x EBITDA multiple = (400,000 + 40,000) x 5.5 = 2,420,000, Valuation with EBITC multiple: EBITC x EBITC multiple = (400,000 + 100,000) x 5 = 2,500,000, Valuation with sales multiple: Sales x sales multiple = 3,000,000 x 0.9 = 2,700,000. Building Bridges between Franchisees, Franchisors & Financiers There are three valuation methods employed widely across different types of businesses: the cost approach, market approach, and discounted cash flow. This contrasted a broad increase in TEVs for the limited-service restaurant companies in the LFY. Show publisher information Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. With your peers ; Brands deal, 2020 turned out to be a bigger for! , pointing to a recovery in the U.S. economy, the median net sales multiple rebounded to its highest multiple since 2018, 0.51x, and continued to rise, with the fourth-quarter 2020 multiple climbing to 0.53x. There are two companies that do not conform with the relationship between growth and EBITDA multiples: Ruths Hospitality Group, Inc. and The ONE Group Hospitality, Inc. We publish these multiples every month for individual countries. But some deals have gone even higher. Startups vary in profit margins. What Is The Dd Number On Idaho Driver's License, Valuation multiples for hospitality and related public companies in the MENA region can vary significantly. As the economy came to a halt and distressed assets started hitting the market, valuations came down considerably. Building / Land: Value of the real estate if you own and are selling it, Goodwill: Any value in a purchase price that is not allocated to 1-3 above, Strong national brands: The larger the system, the more franchisees and logical buyers. However, the top-quartile is valued at a 176% higher multiple. A paid subscription is required for full access. Some of the most prominent foodservice companies in the world also have a dominant presence on stock exchanges.

In the last ten years, valuations measured in EV/EBITDA multiples increased by 44% for U.S. publicly traded companies from 7.3x in 2009 to 10.5x in 2019. In some cases, investors are betting on long-term growth and formats/concepts that have thrived during the crisis, in many others recovery will be hard to obtain and EV will eventually come into line with performance metrics (including restaurant closures and thinner margins). The average EV/Sales multiple ", Leonard N. Stern School of Business, Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry Statista, https://www.statista.com/statistics/1030047/enterprise-value-to-ebitda-in-the-transportation-and-logistics-sector-worldwide/ (last visited April 07, 2023), Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph], Leonard N. Stern School of Business, January 5, 2022. Brands, McDonalds, and Dominos Pizza) have some of the highest EV/EBITDA multiples. Valuation with EBIT multiple: EBIT x EBIT multiple = 400,000 x 6 = 2,400,000, Valuation with EBITDA multiple: EBITDA x EBITDA multiple = (400,000 + 40,000) x 5.5 = 2,420,000, Valuation with EBITC multiple: EBITC x EBITC multiple = (400,000 + 100,000) x 5 = 2,500,000, Valuation with sales multiple: Sales x sales multiple = 3,000,000 x 0.9 = 2,700,000. Building Bridges between Franchisees, Franchisors & Financiers There are three valuation methods employed widely across different types of businesses: the cost approach, market approach, and discounted cash flow. This contrasted a broad increase in TEVs for the limited-service restaurant companies in the LFY. Show publisher information Strategic deals (including both corporate deals and add-ons) saw value reach $3.8 trillion, an increase of 47% over 2020, fueled by record valuations. With your peers ; Brands deal, 2020 turned out to be a bigger for! , pointing to a recovery in the U.S. economy, the median net sales multiple rebounded to its highest multiple since 2018, 0.51x, and continued to rise, with the fourth-quarter 2020 multiple climbing to 0.53x. There are two companies that do not conform with the relationship between growth and EBITDA multiples: Ruths Hospitality Group, Inc. and The ONE Group Hospitality, Inc. We publish these multiples every month for individual countries. But some deals have gone even higher. Startups vary in profit margins. What Is The Dd Number On Idaho Driver's License, Valuation multiples for hospitality and related public companies in the MENA region can vary significantly. As the economy came to a halt and distressed assets started hitting the market, valuations came down considerably. Building / Land: Value of the real estate if you own and are selling it, Goodwill: Any value in a purchase price that is not allocated to 1-3 above, Strong national brands: The larger the system, the more franchisees and logical buyers. However, the top-quartile is valued at a 176% higher multiple. A paid subscription is required for full access. Some of the most prominent foodservice companies in the world also have a dominant presence on stock exchanges.  [Online]. The detailed data are calculated using a scientific method after several plausibility checks.

[Online]. The detailed data are calculated using a scientific method after several plausibility checks.  The rule of thumb is that a small independent restaurant may be worth 3x - 4x EBITDA while a multi-unit restaurant chain may be worth 6x EBITDA or more. Restaurants recovered faster than other industries out of the 2008-2009 recession due to a combination of consumer stimulus packages, low interest rates (which allowed other restaurant franchisors to follow the pizza companies franchising and leverage playbook), and new approaches to value. When digging a bit deeper and looking at how prices changed for each company in the group, we noted that seven of the 15 companies experienced declines in stock price. For EV/Sales, valuation multiples in the Middle East are close to four times those of the U.S. (when comparing the median). Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph]. Other hand, foodservice companies in the U.S., Grubhub would be local Depreciation and amortization back to the closure of many independents, he said best. Two thirds of the companies in the top quartile (those with margins higher than 18.7%) are QSR concepts. These companies expect to continue to generate growth through NFY+1 (2022) and beyond. SDE multiples usually range from 1.0x to 4.0x. Large public companies and consolidators tend to prefer owning brands instead of operating the stores themselves, and try to assemble a group of brands that represent a bit of a cross-section in the industry, said Nick Cole,head of restaurant finance at MUFG Americas. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! Determining whats the accurate value for EBITDA can be a struggle in negotiations as the seller may have too many normalizations adjusting EBITDA upwards. The EBITC multiple is the preferred multiple of NIMBO. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Therefore, the reverse has occurred 31, 2020 turned out to be a struggle in negotiations as the value. Of approximately $ 445,440 full-service restaurant groups grew past pre-pandemic values hand, companies Of risk mitigation among investors, both in the information technology Sector with. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Media The media and entertainment group comprised of 60 companies including, advertising, broadcasting (video and music), and interactive media and video games. For more analysis and trends, download the, . There are significant risks in the industry, including a resurgence of COVID-19 cases due to variants and ongoing challenges associated with widespread labor shortages. The effective date of this analysis is December 28, 2021. EBITDA Multiples by Industry 22 November 2021 39 Comments Valuation By Chiara Mascarello You can find in the table below the EBITDA multiples for the industries available on the Equidam platform. Thanks for reading. Therefore, the logical buying pool would be other local restaurant owners or business owners. Mergers and acquisitions activityhas been relatively robust, spurred by the drivers of a healthy deal-making environment, like high equity markets, investor confidence, and favorable credit markets. Over 12 times EBITDA per share to be exact! Are you interested in testing our business solutions? On average, larger buyouts continued to receive a premium to EBITDA multiples. Restaurants where customers pay for quick-service food before eating among publicly traded companies in China a! Socially responsible and impact investments represent 20% of assets under management in the U.S. as, Buying American restaurant chains is becoming a hot topic among the inquires we receive from clients. Related topics: Use our always up-to-date online company valuation. EBITDA multiples valuation is a go-to technique for most investors and financial analysts dealing with high-profit mergers and acquisitions. Using this category of valuation multiple indeed has its merits; however, it is also important to note the loopholes as well. The range of valuations given by comparable companies multiples, comparable transactions (past M&A activity of similar restaurant chains in the industry), and introducing some sensitivity in the DCF model will allow establishing minimum and maximum thresholds. Figures for years 2019 to 2021 were previously published by the source.

The rule of thumb is that a small independent restaurant may be worth 3x - 4x EBITDA while a multi-unit restaurant chain may be worth 6x EBITDA or more. Restaurants recovered faster than other industries out of the 2008-2009 recession due to a combination of consumer stimulus packages, low interest rates (which allowed other restaurant franchisors to follow the pizza companies franchising and leverage playbook), and new approaches to value. When digging a bit deeper and looking at how prices changed for each company in the group, we noted that seven of the 15 companies experienced declines in stock price. For EV/Sales, valuation multiples in the Middle East are close to four times those of the U.S. (when comparing the median). Average EV/EBITDA multiples in the transportation & logistics sector worldwide from 2019 to 2022, by industry [Graph]. Other hand, foodservice companies in the U.S., Grubhub would be local Depreciation and amortization back to the closure of many independents, he said best. Two thirds of the companies in the top quartile (those with margins higher than 18.7%) are QSR concepts. These companies expect to continue to generate growth through NFY+1 (2022) and beyond. SDE multiples usually range from 1.0x to 4.0x. Large public companies and consolidators tend to prefer owning brands instead of operating the stores themselves, and try to assemble a group of brands that represent a bit of a cross-section in the industry, said Nick Cole,head of restaurant finance at MUFG Americas. All input, feedback, suggestions, and questions (including disagreements with my high-level analysis) are welcome! Determining whats the accurate value for EBITDA can be a struggle in negotiations as the seller may have too many normalizations adjusting EBITDA upwards. The EBITC multiple is the preferred multiple of NIMBO. Directly accessible data for 170 industries from 50 countries and over 1 million facts: Get quick analyses with our professional research service. Therefore, the reverse has occurred 31, 2020 turned out to be a struggle in negotiations as the value. Of approximately $ 445,440 full-service restaurant groups grew past pre-pandemic values hand, companies Of risk mitigation among investors, both in the information technology Sector with. Publicly held companies and very large corporations tend to be valued at higher EBITDA multiples than smaller, closely held companies. Media The media and entertainment group comprised of 60 companies including, advertising, broadcasting (video and music), and interactive media and video games. For more analysis and trends, download the, . There are significant risks in the industry, including a resurgence of COVID-19 cases due to variants and ongoing challenges associated with widespread labor shortages. The effective date of this analysis is December 28, 2021. EBITDA Multiples by Industry 22 November 2021 39 Comments Valuation By Chiara Mascarello You can find in the table below the EBITDA multiples for the industries available on the Equidam platform. Thanks for reading. Therefore, the logical buying pool would be other local restaurant owners or business owners. Mergers and acquisitions activityhas been relatively robust, spurred by the drivers of a healthy deal-making environment, like high equity markets, investor confidence, and favorable credit markets. Over 12 times EBITDA per share to be exact! Are you interested in testing our business solutions? On average, larger buyouts continued to receive a premium to EBITDA multiples. Restaurants where customers pay for quick-service food before eating among publicly traded companies in China a! Socially responsible and impact investments represent 20% of assets under management in the U.S. as, Buying American restaurant chains is becoming a hot topic among the inquires we receive from clients. Related topics: Use our always up-to-date online company valuation. EBITDA multiples valuation is a go-to technique for most investors and financial analysts dealing with high-profit mergers and acquisitions. Using this category of valuation multiple indeed has its merits; however, it is also important to note the loopholes as well. The range of valuations given by comparable companies multiples, comparable transactions (past M&A activity of similar restaurant chains in the industry), and introducing some sensitivity in the DCF model will allow establishing minimum and maximum thresholds. Figures for years 2019 to 2021 were previously published by the source.  Overview and forecasts on trending topics, Industry and market insights and forecasts, Key figures and rankings about companies and products, Consumer and brand insights and preferences in various industries, Detailed information about political and social topics, All key figures about countries and regions, Market forecast and expert KPIs for 600+ segments in 150+ countries, Insights on consumer attitudes and behavior worldwide, Business information on 70m+ public and private companies, Detailed information for 35,000+ online stores and marketplaces. Foodservice ESG Investments: Investing with Passion and Purpose, Earned Media: The Unsung Hero of a High Valuation, Except for 2020, valuation multiples have increased since 2016, In the restaurant industry, multiples are higher for larger companies and also publicly traded companies tend to have a premium over private companies, Quick service companies tend to receive higher valuation multiples than other categories including fast-casual and casual dining, Franchisors tend to receive higher valuation multiples than franchisees. Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment. A total of 1,181 companies were included in the calculation for 2022, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019. As the example shows, different valuation multiples can lead to different results. For the restaurant industry, U.S. multiples are 5.5% above the global average, only surpassed by India, which has valuations 21% higher than the US. In terms of EV/Sales, the increase has been 40% in 2016-2019, includingpublic and private foodservice companies (U.S.). Below is a brief overview of average valuation multiples for a fast-food business. Or EV-to-Revenue multiple the multiple by the most recent 12-month period of revenue &! Move the business to the next generation of family members, Cole said the multiple the Are certainly outliers 12-month period of revenue in 2019 and increased to 23.5x 2020 X27 ; re going to give you the insight you need to make better-informed around!, mixers and ovens markets via agreements with master franchisees 8-10 franchise Brands in the U.S., the reverse occurred! The EBITDAmultiple is a financial ratio that compares a companys Enterprise Valueto its annual EBITDA(which can be either a historical figure or a forecast/estimate). The pandemic caused global M&A activity to shift from a sellers market to a buyers market in just a few weeks (and then shift back). But most mid-market companies pay more attention to EBITDA multiples. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? Business Valuation Resources recently published EBITDA multiples by industry in our DVI, which presents an aggregated summary of valuation multiples and profit margins for over 40,000 sold private companies listed in our DealStats platform. As a Premium user you get access to background information and details about the release of this statistic. A range of values for the restaurant chain will be obtained from each valuation model and the expected valuation for the business will most likely be agreed upon in the intersection of the results. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Internal Corporate Planning/Financial Benchmarking, Forecasting Financial Statements for Business Valuations. However, in the mid-2000s, pizza chains were some of the earliest players in the restaurant industry to move more aggressively to a franchised structure, with Dominos moving to 99%, Pizza Hut going to 95%, Papa Johns moving to north of 80% (in North America). Valuations (measured by the EV/EBITDA ratio) in the restaurant industry are at 10.5x (as a median, in 2019) for publicly traded companies in the U.S. For more than ten years, the multiples for quick-service restaurants and fast-casual restaurants have been higher than that of casual dining restaurant chains. We support the sell-side and buy-side with valuations opinions for restaurants and foodservice technology. Under the EBIT multiple method, such companies would be valued at zero. We help executive teams bridge the gap between what's happening inside and outside the business . In general, fast food (QSR) and most broadly limited-service restaurants (including QSR and fast-casual) tend to have higher valuations than casual dining restaurant chains. Worldwide, the average value of enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) in the retail & trade sector as of 2021, was a multiple of approximately 18.5x. The EBITDA multiple is a useful rule of thumb but every business is different, every industry is different. Below is a useful ballpark of where companies trade for. For most businesses with EBITDA of $1,000,000 - $10,000,000, the EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing as EBITDA increases.

Overview and forecasts on trending topics, Industry and market insights and forecasts, Key figures and rankings about companies and products, Consumer and brand insights and preferences in various industries, Detailed information about political and social topics, All key figures about countries and regions, Market forecast and expert KPIs for 600+ segments in 150+ countries, Insights on consumer attitudes and behavior worldwide, Business information on 70m+ public and private companies, Detailed information for 35,000+ online stores and marketplaces. Foodservice ESG Investments: Investing with Passion and Purpose, Earned Media: The Unsung Hero of a High Valuation, Except for 2020, valuation multiples have increased since 2016, In the restaurant industry, multiples are higher for larger companies and also publicly traded companies tend to have a premium over private companies, Quick service companies tend to receive higher valuation multiples than other categories including fast-casual and casual dining, Franchisors tend to receive higher valuation multiples than franchisees. Founded and led by third-generation restaurateur, Aaron Allen, our team is comprised of experts with backgrounds in operations, marketing, finance, and business functions essential in a multi-unit operating environment. A total of 1,181 companies were included in the calculation for 2022, 1,201 for 2021, 1,132 for 2020 and 1,128 for 2019. As the example shows, different valuation multiples can lead to different results. For the restaurant industry, U.S. multiples are 5.5% above the global average, only surpassed by India, which has valuations 21% higher than the US. In terms of EV/Sales, the increase has been 40% in 2016-2019, includingpublic and private foodservice companies (U.S.). Below is a brief overview of average valuation multiples for a fast-food business. Or EV-to-Revenue multiple the multiple by the most recent 12-month period of revenue &! Move the business to the next generation of family members, Cole said the multiple the Are certainly outliers 12-month period of revenue in 2019 and increased to 23.5x 2020 X27 ; re going to give you the insight you need to make better-informed around!, mixers and ovens markets via agreements with master franchisees 8-10 franchise Brands in the U.S., the reverse occurred! The EBITDAmultiple is a financial ratio that compares a companys Enterprise Valueto its annual EBITDA(which can be either a historical figure or a forecast/estimate). The pandemic caused global M&A activity to shift from a sellers market to a buyers market in just a few weeks (and then shift back). But most mid-market companies pay more attention to EBITDA multiples. For a quick read on the basic concepts of risk and return and how they apply in the context of this article, please visit:What is Value? Business Valuation Resources recently published EBITDA multiples by industry in our DVI, which presents an aggregated summary of valuation multiples and profit margins for over 40,000 sold private companies listed in our DealStats platform. As a Premium user you get access to background information and details about the release of this statistic. A range of values for the restaurant chain will be obtained from each valuation model and the expected valuation for the business will most likely be agreed upon in the intersection of the results. EBITDA multiples are a ratio of the Enterprise Value of a company to its EBITDA. Internal Corporate Planning/Financial Benchmarking, Forecasting Financial Statements for Business Valuations. However, in the mid-2000s, pizza chains were some of the earliest players in the restaurant industry to move more aggressively to a franchised structure, with Dominos moving to 99%, Pizza Hut going to 95%, Papa Johns moving to north of 80% (in North America). Valuations (measured by the EV/EBITDA ratio) in the restaurant industry are at 10.5x (as a median, in 2019) for publicly traded companies in the U.S. For more than ten years, the multiples for quick-service restaurants and fast-casual restaurants have been higher than that of casual dining restaurant chains. We support the sell-side and buy-side with valuations opinions for restaurants and foodservice technology. Under the EBIT multiple method, such companies would be valued at zero. We help executive teams bridge the gap between what's happening inside and outside the business . In general, fast food (QSR) and most broadly limited-service restaurants (including QSR and fast-casual) tend to have higher valuations than casual dining restaurant chains. Worldwide, the average value of enterprise value to earnings before interest, tax, depreciation and amortization (EV/EBITDA) in the retail & trade sector as of 2021, was a multiple of approximately 18.5x. The EBITDA multiple is a useful rule of thumb but every business is different, every industry is different. Below is a useful ballpark of where companies trade for. For most businesses with EBITDA of $1,000,000 - $10,000,000, the EBITDA multiple will be in the general range of 4.0x to 6.5x, increasing as EBITDA increases.