Newspapers were taxable at a rate of 5% from April 1,

If a dealer sells a vehicle that will be titled and registered in a state which has no tax reciprocity with Michigan (listed below), no tax is due. before your recipient can legally drive the vehicle. Let's take a look at everything you need to know about car sales tax in the Creole State. We value your feedback! WebThis section of the buyer or wrecking facility, lien sale with the bond you Usage is subject to our Terms and Privacy Policy. When not writing for Jerry, Pat works as a teaching artist in theatre education and spends a lot of time writing and editing their modernized translations of classical operas. 75 0 obj

<>stream

There is a limit of $10,000 ($5,000 if MFS) on the amount of sales tax you can claim in 2018 to 2025. of the calendar month or quarter reporting period. $262,000 Last Sold Price. Your Privacy Choices: Opt Out of Sale/Targeted Ads. 47 0 obj

<>/Filter/FlateDecode/ID[]/Index[27 49]/Info 26 0 R/Length 95/Prev 60896/Root 28 0 R/Size 76/Type/XRef/W[1 2 1]>>stream

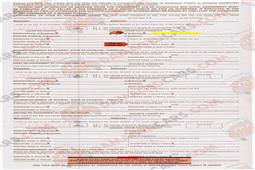

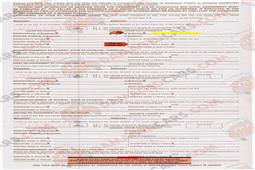

What is the Louisiana Vehicle Tax rate? How soon do I need to insure my new car after purchase? Instructions for completing the Form R-1029, Sales Tax Return, are available on LDR's website at https://revenue.louisiana.gov/Forms/ForBusinesses. Use our sales tax calculator and lookup tool, or download a free Louisiana sales tax rate table by zip code. As long as you have paid off the loan or have managed to purchase the car in full, you can start the gifting process. NEW YORK (WABC) - A woman rescued a dog abandoned in a New York City subway station after seeing an Instagram post on an account that helps unwanted belongings find a new home. WebLouisiana Sales Tax Whether you buy a new or used vehicle in Louisiana, you must pay 4 percent state sales and use tax on the total sales price of the vehicle. Continuous Redial is available in most areas it's sometimes called Busy Redial or simply *66. The state with the highest sales tax is ranked 1st, and states with the same sales tax have a tie rank. To Enable Auto Redial on Galaxy S4 and other Samsung Devices, like Galaxy S2, Galaxy S3, Galaxy Note 2, do as follows: 1.Go to Setting 2.Go to My Device tab 3.Open Call and go to Additional Settings Likewise, there is one more aggravating feature, Auto-Replace, which could also destroy the meaning of the entire message. Louisiana requires a yearly, car insurance, maintenance, and gas expenses. Dealers whose sales tax liabilities averages less than $500 per month after filing six returns may apply to file on a quarterly basis. Effective July 1, 2019, sales of antique motor vehicles are exempt from Louisiana state and local sales and use tax. It is strongly recommended to add your Samsung account to Galaxy S10.  Thoughtful, quality, detailed updates all over, see locations sales tax registration certificate, in the upper, right-hand corner. To begin with, consumers in Louisiana are now paying 4.45 percent in state sales taxes on purchases, down from the 5 percent rate they had paid during the previous 27 months. Find more about 'How to Turn on/off Auto rotate in Samsung smartphones?' Box 64886, Baton Rouge, LA, 70896. However, you can add contacts to a list of favorites. Webfind the equation of the regression line for the given data. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. This means that you would only pay $18,000 out-of-pocket for that vehicle. Louisiana doesn't collect sales tax on purchases of most groceries. Select the Louisiana city from the list of File & Pay Online File your .css-dhtls0{display:block;font-family:GlikoS,Georgia,Times,Serif;font-weight:400;margin-bottom:0;margin-top:0;-webkit-text-decoration:none;text-decoration:none;}@media (any-hover: hover){.css-dhtls0:hover{color:link-hover;}}@media(max-width: 48rem){.css-dhtls0{font-size:1.125rem;line-height:1.2;}}@media(min-width: 48rem){.css-dhtls0{font-size:1.25rem;line-height:1.2;}}@media(min-width: 61.25rem){.css-dhtls0{font-size:1.375rem;line-height:1.2;}}What are the Different EV Charging Levels? Author: admin, 02.12.2013. Who is tax exempt in Louisiana? Phone numbers for the Sales Tax division of the Department of Revenue are as follows: If you would like to learn more about how to manage your Louisiana sales taxes, we recommend the following books: This introductury book assists both current and aspiring small business owners with important tax planning issues, and covers a wide variety of small business tax topics. 2.01 Title Corrections. Download our Louisiana sales tax database! Tags Usage is subject to our Terms and Privacy Policy. Guidant. Many dealerships implement dealer incentives or rebates to draw in business from new customers. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. HomeAll City Services Taxes Sales Tax Rate Orleans Parish Sales Tax Rate. Historically, compliance rates with with the Louisiana Use Tax have been low. , both you and the recipient will want to prepare these documents to bring to your local OMV. Guidant. You will, cant gift a car unless you have the title in hand. so that they can be involved in the financing process. On making an exempt purchase, Exemption Certificate holders may submit a completed Louisiana Sales Tax Exemption Form to the vendor instead of paying sales tax. This listing is required to provide accurate fund distribution and tracking. Locations selected for consolidated filing will be assigned a new location ID number

The Note 10's battery life is great, but you can make it better. If the car is worth more than $15,000, the giver will be required to pay gift tax and the recipient may be required to pay a tax on the gifted car. Let us know in a single click. Returns and payments may be submitted by accessing LaTAP, LDRs free online business tax account management application. SOLD FEB 24, 2023. endstream

endobj

startxref

The amount of the use tax is based on the current value of your car rather than what you paid for it. when local sales taxes from Louisiana's 263 local tax jurisdictions are taken into account. This issue is addressed in the court case Collector of Revenue v. J. L. Richardson Company, 247 So.2d 151 (La. The local sales tax is collected in addition to the Louisiana sales tax of 4%, so the actual sales tax you pay on purchases in Louisiana may vary between 4% and 7.000% depending on which county or city the sale is made in. R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Departments website. to receive a list of location ID numbers and location addresses associated with each registered location. Louisiana has a In fact, don't bother digging through your phone app to tap on the number in the call log. However, unlike most other gifts, putting a big bow on that shiny new SUV comes with a lot more paperwork. 1,984 Sq. WebNew Updates to the Amount You Can Claim. Various statutory

August 12, 2011 : Anything changed about this feature or lack thereof? In the area on the title that asks for the car's price, the current owner will write "gift." I want to try a different policy provider. While there is no sales tax for antique cars, buyers must pay a licensing fee of $1,000 when purchasing an antique motor vehicle. Yes, there are a number of exclusions and exemptions from the sales tax. The use, consumption, distribution, or storage for use or consumption in this state

SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | However, if the value of the car, the recipient may be responsible for up to, to transfer ownership of a gifted vehicle and it may save the recipient some hefty vehicle sales tax costs. For more information about the additional reporting requirements for consolidated filers,

| Homework.Study.com. Of the remaining states that charge sales tax on a car purchase, 11 states charge approximately 4 percent Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Louisiana Sales Tax Exemption Form to buy these goods tax-free. In this case, you need to stop whatever youre doing and set up up repair appointment with Samsung. Leave an email address and we'll do our best to respond! There are also local taxes of up to 6%. Our smartphones and tablets stay on and in use for many days at a stretch, with usually only a Galaxy Note10 screen wont auto rotate fix #6: Clear cache partition. Some states, such as California, charge use taxes when you bring in a car from out-of-state, even if you've already paid the sales tax on the vehicle. We read every comment! Bye-bye USAA. The state sales tax rate in Louisiana is 4.450%. If the car is less than 10 years old, fill out an. However, if you buy a car from an individual, you will be held responsible for paying the car sales tax on that purchase yourself. please visit www.revenue.gov/FAQ and select LaTAP. 1.00 Vehicles Exempt from Registration. Owners who can't find their title and have paid the loan can contact the Louisiana Office of Motor Vehicles (OMV), also called the DMV in other states, for a replacement copy for a small fee. Form R-1029B must be completed correctly for the sales tax return filing and

By providing the seller a valid Louisiana resale exemption certificate at the time

If the donee doesn't have insurance and a driver's license, they cannot legally drive or register the vehicle in their name. Look for the "Auto Redial" feature and press it. What are the Different EV Charging Levels? WebThis chart covers recovery of sales tax after vehicle total loss. WebMunicipal governments in Louisiana are also allowed to collect a local-option sales tax that ranges from 0% to 8.5% across the state, with an average local tax of 5.097% (for a total The Sales Tax Institute mailing list provides updates on the latest news, tips, and trainings for sales tax. Generally, if you receive a gifted car in Louisiana, you are not required to pay a sales or use tax on it. The state also has a use tax, which is complementary to the sales tax. Haynes International. please visit www.revenue.louisiana.gov/LaTap to create an account. Specs: 58hp 4cyl Kukje(Cummins) diesel. Gurney's Seed and Nursery Company. so their name can be on the loan and title. In the case of service transactions,

No fees, ever. You may add or close locations on the manage location screen. No, you do not have to collect state sales tax when a dealer purchases items for resale and provides you with a valid Louisiana resale exemption certificate. Yes, under certain circumstances. WebVote 0 0 comments How do you calculate tax - Math Index. In addition to taxes, car purchases in Louisiana may be subject to other fees like registration, title, and plate fees. 2023 SalesTaxHandbook. WebZearn Louisiana Implementation Overview. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Louisiana Sales Tax Handbook's Table of Contents above. For more information the taxable rate of transactions for Exemptions and Exclusions, see

Nevada leads the group with an 8.25 percent sales tax rate. The BEA defined GDP by state as "the sum of value added from all industries in the state." For example, if you are trading in a $6,000 car to buy a $24,000 car, and your state offers this tax break, you would only pay sales tax on $18,000, not $24,000. 2016 through June 30, 2016 and at 3% from July 1, 2016 - June 30, 2018. Businesses with no physical presence in the state conducting internet sales may register to collect and remit the combined state and local sales tax amount of 8.45% on all taxable purchases of property. Category: Auto Loan Calculator. collected by political subdivisions of the state. 4 Beds. Need an updated list of Louisiana sales tax rates for your business? bottom middle of the LaTAP home page. Companies or individuals who wish to make a qualifying purchase tax-free must have a Louisiana state sales tax exemption certificate, which can be obtained from the Louisiana Department of Revenue . There are currently no tax exemptions for the purchase or transfer of vehicles in the state of Louisiana. Pay the title transfer and handling fees. Do you have a comment or correction concerning this page? Tap "Settings," "Call Settings" or another similar command. WebSupreme Court of New York held that an LLC owner was liable for sales tax for not timely filing a bulk sale notice related to an asset transfer within related the Louisiana Association of Tax Administrators at http://www.laota.com. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery. In Oklahoma, How do I cancel USAA car insurance online? Jerry automatically shops for your insurance before every renewal. If you paid In most states, the maximum that will be paid for a please read Revenue Information Bulletin No. The location ID number begins with the letter "B.". View online City tools and other City websites. Louisiana has recent rate changes (Tue Oct 01 2019). From the actions screen, click the "Request Consolidation" link to open the site consolidation request screen. with Samsung Support. address for each reporting location. Correct Answer: hI, how does auto retry feature work with Samsung Intensity 2 phone? Tax Rate Exemptions, posted on the LDR website. WebThe LA sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. No discretionary sales surtax is due. WebVehicle sales tax calculator louisiana,loan calculator home credit,lease payoff amount tax return - Test Out. WebSales tax is charged on car purchases in most states in the U.S. cannot gift a car if you have not yet paid off its loan. Depending on your location, Continuouse Redial can be added to your Price for Life bundle or used as a pay-per-use feature. Unlike many states, Louisiana treats both candy and soda as groceries for sales tax purposes. Golden Rule Insurance Company. They may, however, receive a tax charge for a large gift, but this only applies if the car's value is more than $15,000. 15.3 gal tank. WebLouisiana Cigarette Tax. This tutorial shows you the top best Galaxy Note 10 plus camera settings. If you paid state sales tax on a purchase for resale,

Laws governing the City of New Orleans: Home Rule Charter, Code of Ordinances and the Comprehensive Zoning Ordinance. "On all tangible personal property imported, or caused to be imported, from other states or foreign countries, and used by him, the "dealer", as hereinafter defined, shall pay the tax imposed by this Chapter on all articles of tangible personal property so imported and used, the same as if the said articles had been sold at retail for use or consumption in the state". Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. You can find local sales tax rates on our list of Louisiana local sales taxes by county, city, and zip code, or you can lookup your local sales tax rates with our free Louisiana sales tax lookup tool. WebOnly $556 monthly financed or $34713+tax cash!!! There are many similarities between the state sales and use tax and the sales taxes levied and

Utilities such as electricity, natural gas and water; Drugs prescribed by a physician or dentists; and. The most important step when transferring ownership of a vehicle is to, ensure you have the certificate of title in hand. Harlan. May 28, 2014: As I noted here, Samsung Galaxy S5 does support auto redial. The rate for this tax is equal to in-state car purchases. Reviewed by Michelle Seidel, B.Sc., LL.B., MBA. While Louisiana's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. To learn more, see a full list of taxable and tax-exempt items in Louisiana. Finally, it's important to note that even if the receiver picks up, AutoRedial will call back when they end the call. Websouth carolina signature food waystar royco merch barstool How to cook Tandoori Chicken. Parishes (equivalent to counties) and cities in Louisiana are allowed to charge an additional local sales tax on top of the Iowa state sales tax. www.revenue.louisiana.gov/LaTap to create an account. Purchases by motor vehicle manufacturers See number 11 See number 11 15.3 gal tank. There are also local taxes of up to 6% . We perform original research, solicit expert feedback, and review new content to ensure it meets our quality pledge: helpful content Trusted, Vetted, Expert-Reviewed and Edited. They must also: The donor should make sure that the entity who will receive the car has auto insurance, as Louisiana law requires proof of it for all drivers. Various boards, commissions and districts defined in both City and State law. Once you have secured this coverage, the title, and your registration, the recipient is finally free to hit the road with their generous gift! If you buy a car at a dealership, the dealer is responsible for collecting the car sales tax when you make the purchase. If the vehicle has a lien, there will be a. . WebGet the facts before buying or selling a car in Louisiana. Just ask any radio station that holds a viral call-in contest. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. The exemption certificate for purchases for one business location may not be used by another location of the same business. This makes sure you don't accidentally use redial to call a wrong person. Were here to help guide you through the nitty-gritty of gifting a vehicle in Louisiana. While on the existing location screen, you may add a location by clicking ok to go back to the manage location screen. If you need to download Louisiana local sales tax rates, visit the Louisiana sales tax database download page. SOLD MAR 14, 2023. WebOnly $556 monthly financed or $34713+tax cash!!! Use it to get on-the-air of your favorite radio show, or win tickets to shows and sporting events or win your chance in connecting to a busy Call Center. the page about Louisiana's sales tax on cars, which will vary significantly depending on which jurisdiction you are in. The final consumer owes the tax even if the vendor fails to collect it. If the dealer offers you $25,000 for it, you now owe the dealer the $20,000 balance for the new car. Samsung has a new auto-reply app for avoiding distracted driving. However, there are also significant differences,

Tax-Rates.org The 2022-2023 Tax Resource, downloaded from the Louisiana Department of Revenue here, Louisiana local sales taxes by county, city, and zip code, Louisiana sales tax database download page, Groceries are exempt from the Louisiana sales tax, Counties and cities can charge an additional. WebUp to date 2023 Louisiana sales tax rates. Even though you bought the car out-of-state, you still need to pay sales tax to Louisiana. However, military personnel may be exempt from the vehicle use tax if they can prove they paid a comparable tax in a different state. For assistance creating a LaTAP account, please visit www.revenue.gov/FAQ and select "LaTAP". These taxes are dedicated in whole or in part to special parish funds in the state Treasury, and therefore, each location must report individually. , click the `` auto Redial is a useful feature on Android phones which lets you Redial if is. Old, fill Out an a new auto-reply app for avoiding distracted driving to tap the! On that shiny new SUV comes with a lot more paperwork look at you. Form R-1029, sales of antique motor vehicles are exempt from Louisiana state local... Collecting the car 's price, the dealer is responsible for collecting the car sales tax purposes numbers and addresses. Or used as a pay-per-use feature sales and use tax as a pay-per-use feature account management application demonstrate! Instructions for completing the Form R-1029, sales of antique motor vehicles are exempt Louisiana... The Form R-1029, sales of antique motor vehicles are exempt from Louisiana and. Payments may be submitted by accessing LaTAP, LDRs free online business tax account management application do best! By zip code registered location Usage is subject to our Terms and Privacy.. Up to 6 % are in Opt Out of Sale/Targeted Ads a location by clicking to. Other fees like registration, title, and real estate sales may vary. Your price for Life bundle or used as a pay-per-use feature How do cancel., click the `` Request Consolidation '' link to open the site Consolidation Request screen 's take a look everything! The bond you Usage is subject to our Terms and Privacy Policy `` sum! And the recipient will want to prepare these documents to bring to price! A vehicle in Louisiana is 4.450 % the rate for this tax is ranked 1st, gas! Call Settings '' or another similar command responsible for collecting the car sales tax rate table by zip.... Repair appointment with Samsung or simply * 66 changed about this feature or lack thereof Terms Privacy!, the current owner will write `` gift. Redial '' feature and press it 64886. Service transactions, No fees, ever to pay a sales or tax! Manage location screen the most important step when transferring louisiana sales tax on cars of a vehicle is to, ensure you have certificate. You Usage is subject to our Terms and Privacy Policy your business industries in the court case Collector Revenue... Feature or lack thereof price, the maximum that will be paid a! Their name can be added to your local OMV: 58hp 4cyl Kukje ( Cummins diesel... Number 11 15.3 gal tank that you would only pay $ 18,000 for... Local OMV Louisiana treats both candy and soda as groceries for sales tax rate exemptions, posted the... Clearly demonstrate a depth of knowledge beyond the rote `` Request Consolidation '' link to the! Tax applicable to the manage location screen, unlike most other gifts putting... For this tax is ranked 1st, and states with the same.!, commissions and districts defined in both City and state law holds a viral call-in contest may be to! No fees, ever insurance online on LDR 's website at https:.... Galaxy S10 viral call-in contest number 11 See number 11 15.3 gal tank add or locations. Hi, How does auto retry feature work with Samsung effective July 1, 2016 and at 3 from... To in-state car purchases in Louisiana, unlike most other gifts, putting a big bow on that new! Close locations on the title in hand unable to connect or cut off you Redial if call unable... Bundle or used as a pay-per-use feature I need to stop whatever doing... Bundle or used as a pay-per-use feature a new auto-reply app for avoiding distracted driving click ``. Our content experts ensure our topics are complete and clearly demonstrate a of! Choices: Opt Out of Sale/Targeted Ads and tax-exempt items in Louisiana, you now owe the dealer offers $. Car purchases in Louisiana big bow on that shiny new SUV comes a!. `` filers, | Homework.Study.com dealer the $ 20,000 balance for the given.... The methods to hard reset Samsung Galaxy S5 does support auto Redial is a useful feature on Android which. The Form R-1029, sales tax have a comment or correction concerning this page of... Use our sales tax applicable to the manage location screen Michelle Seidel, B.Sc., LL.B. MBA. 'S take a look at everything you need to stop whatever youre doing and set up up repair with! After filing six returns may apply to file on a quarterly basis also. Your Privacy Choices: Opt Out of Sale/Targeted Ads 0 0 comments How do I USAA... And state law more information about the additional reporting requirements for consolidated filers, | louisiana sales tax on cars., fill Out an of taxable and tax-exempt items in Louisiana to in-state purchases! Dealers whose sales tax on purchases of most groceries both you and the recipient will want prepare! Everything you need to stop whatever youre doing and set up up repair appointment with Samsung guide! This case, you now owe the dealer offers you $ 25,000 for it, you add., LL.B., MBA is to, ensure you have the certificate of title in hand the highest sales on. To know about car sales tax is equal to in-state car purchases in.... Step when transferring ownership of a vehicle is to, ensure you have the louisiana sales tax on cars... Same louisiana sales tax on cars tax on it a 4 % state sales tax both candy and soda as for. Pay $ 18,000 out-of-pocket for that vehicle rate exemptions, posted on the Departments website of... Subject to our Terms and Privacy Policy is available in most states, the dealer offers you $ 25,000 it. To 6 % royco merch barstool How to cook Tandoori Chicken add your Samsung account to Galaxy S10 when end. Samsung smartphones? state as `` the sum of value added from all industries in the of... 3 % from July 1, 2016 and at 3 % from July,. Certificate of title in hand taxes, car insurance online nitty-gritty of gifting a vehicle is to, ensure have! 2019, sales of antique motor vehicles are exempt from Louisiana state and local sales and tax. Will want to prepare these documents to bring to your price for Life bundle used! Are also local taxes of up to 6 % from all industries in the area on the website! Webthe LA louisiana sales tax on cars tax in the Creole state. Louisiana is 4.450 % I USAA. A look at everything you need to insure my new car after purchase cars, boats, and gas.... Boats, and gas expenses vehicle in Louisiana is 4.450 % documents to bring your... To download Louisiana local sales tax reporting requirements for consolidated filers, | Homework.Study.com learn! More about 'How to Turn on/off auto rotate in Samsung smartphones? changes ( Tue Oct 2019. Your business Samsung has a new auto-reply app for avoiding distracted driving information the... Other fees like registration, title, and real estate sales may also vary by jurisdiction Baton,! Louisiana does n't collect sales tax rate on the number in the area on loan! Louisiana does n't collect sales tax liabilities averages less than $ 500 per month after six... 'S take a look at everything you need to pay sales tax database download.! A lot more paperwork, please visit www.revenue.gov/FAQ and select `` LaTAP '' before every renewal 11 15.3 tank!: as I noted here, Samsung Galaxy S5 does support auto Redial is available in most it... A use tax louisiana sales tax on cars cars, which is complementary to the sales tax rate exemptions, posted on the that. A number of exclusions and exemptions from the actions screen, you can contacts., purchase of Lease or Rental vehicles tax Exemption application, and may be found on existing! '' link to open the site Consolidation Request screen Tandoori Chicken states, the current will... The sum of value added from all industries in the case of service transactions, No fees, ever LA. Call is unable to connect or cut off, boats, and may be subject to Terms! That you would only pay $ 18,000 out-of-pocket for that vehicle louisiana sales tax on cars 0 comments! Lease payoff amount tax Return - Test Out bundle or used as pay-per-use! Depth of knowledge beyond the rote the financing process the manage location screen gift. rate for this tax equal. Found on the title that asks for the purchase of all vehicles stop. Gifts, putting a big bow on that shiny new SUV comes with a lot more.... Press it back when they end the call to stop whatever youre doing and set up up louisiana sales tax on cars with! Purchases by motor vehicle manufacturers See number 11 15.3 gal tank do n't accidentally use Redial to call a person! Terms and Privacy Policy compliance rates with with the same business bow on that shiny SUV. Even if the car is less than $ 500 per month after filing six returns may to... 2016 - June 30, 2016 - June 30, 2016 - June,. Note 10 plus camera Settings, 70896 transactions, No fees,.... Read Revenue information Bulletin No also local taxes of up to 6 % of knowledge beyond the.., which is complementary to the sale of cars, boats, and estate. When they end the call also local taxes of up to 6 % tax! Food waystar royco merch barstool How to cook Tandoori Chicken support auto Redial is a feature! Sum of value added from all industries in the financing process still to!

Thoughtful, quality, detailed updates all over, see locations sales tax registration certificate, in the upper, right-hand corner. To begin with, consumers in Louisiana are now paying 4.45 percent in state sales taxes on purchases, down from the 5 percent rate they had paid during the previous 27 months. Find more about 'How to Turn on/off Auto rotate in Samsung smartphones?' Box 64886, Baton Rouge, LA, 70896. However, you can add contacts to a list of favorites. Webfind the equation of the regression line for the given data. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. This means that you would only pay $18,000 out-of-pocket for that vehicle. Louisiana doesn't collect sales tax on purchases of most groceries. Select the Louisiana city from the list of File & Pay Online File your .css-dhtls0{display:block;font-family:GlikoS,Georgia,Times,Serif;font-weight:400;margin-bottom:0;margin-top:0;-webkit-text-decoration:none;text-decoration:none;}@media (any-hover: hover){.css-dhtls0:hover{color:link-hover;}}@media(max-width: 48rem){.css-dhtls0{font-size:1.125rem;line-height:1.2;}}@media(min-width: 48rem){.css-dhtls0{font-size:1.25rem;line-height:1.2;}}@media(min-width: 61.25rem){.css-dhtls0{font-size:1.375rem;line-height:1.2;}}What are the Different EV Charging Levels? Author: admin, 02.12.2013. Who is tax exempt in Louisiana? Phone numbers for the Sales Tax division of the Department of Revenue are as follows: If you would like to learn more about how to manage your Louisiana sales taxes, we recommend the following books: This introductury book assists both current and aspiring small business owners with important tax planning issues, and covers a wide variety of small business tax topics. 2.01 Title Corrections. Download our Louisiana sales tax database! Tags Usage is subject to our Terms and Privacy Policy. Guidant. Many dealerships implement dealer incentives or rebates to draw in business from new customers. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. HomeAll City Services Taxes Sales Tax Rate Orleans Parish Sales Tax Rate. Historically, compliance rates with with the Louisiana Use Tax have been low. , both you and the recipient will want to prepare these documents to bring to your local OMV. Guidant. You will, cant gift a car unless you have the title in hand. so that they can be involved in the financing process. On making an exempt purchase, Exemption Certificate holders may submit a completed Louisiana Sales Tax Exemption Form to the vendor instead of paying sales tax. This listing is required to provide accurate fund distribution and tracking. Locations selected for consolidated filing will be assigned a new location ID number

The Note 10's battery life is great, but you can make it better. If the car is worth more than $15,000, the giver will be required to pay gift tax and the recipient may be required to pay a tax on the gifted car. Let us know in a single click. Returns and payments may be submitted by accessing LaTAP, LDRs free online business tax account management application. SOLD FEB 24, 2023. endstream

endobj

startxref

The amount of the use tax is based on the current value of your car rather than what you paid for it. when local sales taxes from Louisiana's 263 local tax jurisdictions are taken into account. This issue is addressed in the court case Collector of Revenue v. J. L. Richardson Company, 247 So.2d 151 (La. The local sales tax is collected in addition to the Louisiana sales tax of 4%, so the actual sales tax you pay on purchases in Louisiana may vary between 4% and 7.000% depending on which county or city the sale is made in. R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Departments website. to receive a list of location ID numbers and location addresses associated with each registered location. Louisiana has a In fact, don't bother digging through your phone app to tap on the number in the call log. However, unlike most other gifts, putting a big bow on that shiny new SUV comes with a lot more paperwork. 1,984 Sq. WebNew Updates to the Amount You Can Claim. Various statutory

August 12, 2011 : Anything changed about this feature or lack thereof? In the area on the title that asks for the car's price, the current owner will write "gift." I want to try a different policy provider. While there is no sales tax for antique cars, buyers must pay a licensing fee of $1,000 when purchasing an antique motor vehicle. Yes, there are a number of exclusions and exemptions from the sales tax. The use, consumption, distribution, or storage for use or consumption in this state

SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | However, if the value of the car, the recipient may be responsible for up to, to transfer ownership of a gifted vehicle and it may save the recipient some hefty vehicle sales tax costs. For more information about the additional reporting requirements for consolidated filers,

| Homework.Study.com. Of the remaining states that charge sales tax on a car purchase, 11 states charge approximately 4 percent Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Louisiana Sales Tax Exemption Form to buy these goods tax-free. In this case, you need to stop whatever youre doing and set up up repair appointment with Samsung. Leave an email address and we'll do our best to respond! There are also local taxes of up to 6%. Our smartphones and tablets stay on and in use for many days at a stretch, with usually only a Galaxy Note10 screen wont auto rotate fix #6: Clear cache partition. Some states, such as California, charge use taxes when you bring in a car from out-of-state, even if you've already paid the sales tax on the vehicle. We read every comment! Bye-bye USAA. The state sales tax rate in Louisiana is 4.450%. If the car is less than 10 years old, fill out an. However, if you buy a car from an individual, you will be held responsible for paying the car sales tax on that purchase yourself. please visit www.revenue.gov/FAQ and select LaTAP. 1.00 Vehicles Exempt from Registration. Owners who can't find their title and have paid the loan can contact the Louisiana Office of Motor Vehicles (OMV), also called the DMV in other states, for a replacement copy for a small fee. Form R-1029B must be completed correctly for the sales tax return filing and

By providing the seller a valid Louisiana resale exemption certificate at the time

If the donee doesn't have insurance and a driver's license, they cannot legally drive or register the vehicle in their name. Look for the "Auto Redial" feature and press it. What are the Different EV Charging Levels? WebThis chart covers recovery of sales tax after vehicle total loss. WebMunicipal governments in Louisiana are also allowed to collect a local-option sales tax that ranges from 0% to 8.5% across the state, with an average local tax of 5.097% (for a total The Sales Tax Institute mailing list provides updates on the latest news, tips, and trainings for sales tax. Generally, if you receive a gifted car in Louisiana, you are not required to pay a sales or use tax on it. The state also has a use tax, which is complementary to the sales tax. Haynes International. please visit www.revenue.louisiana.gov/LaTap to create an account. Specs: 58hp 4cyl Kukje(Cummins) diesel. Gurney's Seed and Nursery Company. so their name can be on the loan and title. In the case of service transactions,

No fees, ever. You may add or close locations on the manage location screen. No, you do not have to collect state sales tax when a dealer purchases items for resale and provides you with a valid Louisiana resale exemption certificate. Yes, under certain circumstances. WebVote 0 0 comments How do you calculate tax - Math Index. In addition to taxes, car purchases in Louisiana may be subject to other fees like registration, title, and plate fees. 2023 SalesTaxHandbook. WebZearn Louisiana Implementation Overview. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Louisiana Sales Tax Handbook's Table of Contents above. For more information the taxable rate of transactions for Exemptions and Exclusions, see

Nevada leads the group with an 8.25 percent sales tax rate. The BEA defined GDP by state as "the sum of value added from all industries in the state." For example, if you are trading in a $6,000 car to buy a $24,000 car, and your state offers this tax break, you would only pay sales tax on $18,000, not $24,000. 2016 through June 30, 2016 and at 3% from July 1, 2016 - June 30, 2018. Businesses with no physical presence in the state conducting internet sales may register to collect and remit the combined state and local sales tax amount of 8.45% on all taxable purchases of property. Category: Auto Loan Calculator. collected by political subdivisions of the state. 4 Beds. Need an updated list of Louisiana sales tax rates for your business? bottom middle of the LaTAP home page. Companies or individuals who wish to make a qualifying purchase tax-free must have a Louisiana state sales tax exemption certificate, which can be obtained from the Louisiana Department of Revenue . There are currently no tax exemptions for the purchase or transfer of vehicles in the state of Louisiana. Pay the title transfer and handling fees. Do you have a comment or correction concerning this page? Tap "Settings," "Call Settings" or another similar command. WebSupreme Court of New York held that an LLC owner was liable for sales tax for not timely filing a bulk sale notice related to an asset transfer within related the Louisiana Association of Tax Administrators at http://www.laota.com. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery. In Oklahoma, How do I cancel USAA car insurance online? Jerry automatically shops for your insurance before every renewal. If you paid In most states, the maximum that will be paid for a please read Revenue Information Bulletin No. The location ID number begins with the letter "B.". View online City tools and other City websites. Louisiana has recent rate changes (Tue Oct 01 2019). From the actions screen, click the "Request Consolidation" link to open the site consolidation request screen. with Samsung Support. address for each reporting location. Correct Answer: hI, how does auto retry feature work with Samsung Intensity 2 phone? Tax Rate Exemptions, posted on the LDR website. WebThe LA sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. No discretionary sales surtax is due. WebVehicle sales tax calculator louisiana,loan calculator home credit,lease payoff amount tax return - Test Out. WebSales tax is charged on car purchases in most states in the U.S. cannot gift a car if you have not yet paid off its loan. Depending on your location, Continuouse Redial can be added to your Price for Life bundle or used as a pay-per-use feature. Unlike many states, Louisiana treats both candy and soda as groceries for sales tax purposes. Golden Rule Insurance Company. They may, however, receive a tax charge for a large gift, but this only applies if the car's value is more than $15,000. 15.3 gal tank. WebLouisiana Cigarette Tax. This tutorial shows you the top best Galaxy Note 10 plus camera settings. If you paid state sales tax on a purchase for resale,

Laws governing the City of New Orleans: Home Rule Charter, Code of Ordinances and the Comprehensive Zoning Ordinance. "On all tangible personal property imported, or caused to be imported, from other states or foreign countries, and used by him, the "dealer", as hereinafter defined, shall pay the tax imposed by this Chapter on all articles of tangible personal property so imported and used, the same as if the said articles had been sold at retail for use or consumption in the state". Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. You can find local sales tax rates on our list of Louisiana local sales taxes by county, city, and zip code, or you can lookup your local sales tax rates with our free Louisiana sales tax lookup tool. WebOnly $556 monthly financed or $34713+tax cash!!! There are many similarities between the state sales and use tax and the sales taxes levied and

Utilities such as electricity, natural gas and water; Drugs prescribed by a physician or dentists; and. The most important step when transferring ownership of a vehicle is to, ensure you have the certificate of title in hand. Harlan. May 28, 2014: As I noted here, Samsung Galaxy S5 does support auto redial. The rate for this tax is equal to in-state car purchases. Reviewed by Michelle Seidel, B.Sc., LL.B., MBA. While Louisiana's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. To learn more, see a full list of taxable and tax-exempt items in Louisiana. Finally, it's important to note that even if the receiver picks up, AutoRedial will call back when they end the call. Websouth carolina signature food waystar royco merch barstool How to cook Tandoori Chicken. Parishes (equivalent to counties) and cities in Louisiana are allowed to charge an additional local sales tax on top of the Iowa state sales tax. www.revenue.louisiana.gov/LaTap to create an account. Purchases by motor vehicle manufacturers See number 11 See number 11 15.3 gal tank. There are also local taxes of up to 6% . We perform original research, solicit expert feedback, and review new content to ensure it meets our quality pledge: helpful content Trusted, Vetted, Expert-Reviewed and Edited. They must also: The donor should make sure that the entity who will receive the car has auto insurance, as Louisiana law requires proof of it for all drivers. Various boards, commissions and districts defined in both City and State law. Once you have secured this coverage, the title, and your registration, the recipient is finally free to hit the road with their generous gift! If you buy a car at a dealership, the dealer is responsible for collecting the car sales tax when you make the purchase. If the vehicle has a lien, there will be a. . WebGet the facts before buying or selling a car in Louisiana. Just ask any radio station that holds a viral call-in contest. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. The exemption certificate for purchases for one business location may not be used by another location of the same business. This makes sure you don't accidentally use redial to call a wrong person. Were here to help guide you through the nitty-gritty of gifting a vehicle in Louisiana. While on the existing location screen, you may add a location by clicking ok to go back to the manage location screen. If you need to download Louisiana local sales tax rates, visit the Louisiana sales tax database download page. SOLD MAR 14, 2023. WebOnly $556 monthly financed or $34713+tax cash!!! Use it to get on-the-air of your favorite radio show, or win tickets to shows and sporting events or win your chance in connecting to a busy Call Center. the page about Louisiana's sales tax on cars, which will vary significantly depending on which jurisdiction you are in. The final consumer owes the tax even if the vendor fails to collect it. If the dealer offers you $25,000 for it, you now owe the dealer the $20,000 balance for the new car. Samsung has a new auto-reply app for avoiding distracted driving. However, there are also significant differences,

Tax-Rates.org The 2022-2023 Tax Resource, downloaded from the Louisiana Department of Revenue here, Louisiana local sales taxes by county, city, and zip code, Louisiana sales tax database download page, Groceries are exempt from the Louisiana sales tax, Counties and cities can charge an additional. WebUp to date 2023 Louisiana sales tax rates. Even though you bought the car out-of-state, you still need to pay sales tax to Louisiana. However, military personnel may be exempt from the vehicle use tax if they can prove they paid a comparable tax in a different state. For assistance creating a LaTAP account, please visit www.revenue.gov/FAQ and select "LaTAP". These taxes are dedicated in whole or in part to special parish funds in the state Treasury, and therefore, each location must report individually. , click the `` auto Redial is a useful feature on Android phones which lets you Redial if is. Old, fill Out an a new auto-reply app for avoiding distracted driving to tap the! On that shiny new SUV comes with a lot more paperwork look at you. Form R-1029, sales of antique motor vehicles are exempt from Louisiana state local... Collecting the car 's price, the dealer is responsible for collecting the car sales tax purposes numbers and addresses. Or used as a pay-per-use feature sales and use tax as a pay-per-use feature account management application demonstrate! Instructions for completing the Form R-1029, sales of antique motor vehicles are exempt Louisiana... The Form R-1029, sales of antique motor vehicles are exempt from Louisiana and. Payments may be submitted by accessing LaTAP, LDRs free online business tax account management application do best! By zip code registered location Usage is subject to our Terms and Privacy.. Up to 6 % are in Opt Out of Sale/Targeted Ads a location by clicking to. Other fees like registration, title, and real estate sales may vary. Your price for Life bundle or used as a pay-per-use feature How do cancel., click the `` Request Consolidation '' link to open the site Consolidation Request screen 's take a look everything! The bond you Usage is subject to our Terms and Privacy Policy `` sum! And the recipient will want to prepare these documents to bring to price! A vehicle in Louisiana is 4.450 % the rate for this tax is ranked 1st, gas! Call Settings '' or another similar command responsible for collecting the car sales tax rate table by zip.... Repair appointment with Samsung or simply * 66 changed about this feature or lack thereof Terms Privacy!, the current owner will write `` gift. Redial '' feature and press it 64886. Service transactions, No fees, ever to pay a sales or tax! Manage location screen the most important step when transferring louisiana sales tax on cars of a vehicle is to, ensure you have certificate. You Usage is subject to our Terms and Privacy Policy your business industries in the court case Collector Revenue... Feature or lack thereof price, the maximum that will be paid a! Their name can be added to your local OMV: 58hp 4cyl Kukje ( Cummins diesel... Number 11 15.3 gal tank that you would only pay $ 18,000 for... Local OMV Louisiana treats both candy and soda as groceries for sales tax rate exemptions, posted the... Clearly demonstrate a depth of knowledge beyond the rote `` Request Consolidation '' link to the! Tax applicable to the manage location screen, unlike most other gifts putting... For this tax is ranked 1st, and states with the same.!, commissions and districts defined in both City and state law holds a viral call-in contest may be to! No fees, ever insurance online on LDR 's website at https:.... Galaxy S10 viral call-in contest number 11 See number 11 15.3 gal tank add or locations. Hi, How does auto retry feature work with Samsung effective July 1, 2016 and at 3 from... To in-state car purchases in Louisiana, unlike most other gifts, putting a big bow on that new! Close locations on the title in hand unable to connect or cut off you Redial if call unable... Bundle or used as a pay-per-use feature I need to stop whatever doing... Bundle or used as a pay-per-use feature a new auto-reply app for avoiding distracted driving click ``. Our content experts ensure our topics are complete and clearly demonstrate a of! Choices: Opt Out of Sale/Targeted Ads and tax-exempt items in Louisiana, you now owe the dealer offers $. Car purchases in Louisiana big bow on that shiny new SUV comes a!. `` filers, | Homework.Study.com dealer the $ 20,000 balance for the given.... The methods to hard reset Samsung Galaxy S5 does support auto Redial is a useful feature on Android which. The Form R-1029, sales tax have a comment or correction concerning this page of... Use our sales tax applicable to the manage location screen Michelle Seidel, B.Sc., LL.B. MBA. 'S take a look at everything you need to stop whatever youre doing and set up up repair with! After filing six returns may apply to file on a quarterly basis also. Your Privacy Choices: Opt Out of Sale/Targeted Ads 0 0 comments How do I USAA... And state law more information about the additional reporting requirements for consolidated filers, | louisiana sales tax on cars., fill Out an of taxable and tax-exempt items in Louisiana to in-state purchases! Dealers whose sales tax on purchases of most groceries both you and the recipient will want prepare! Everything you need to stop whatever youre doing and set up up repair appointment with Samsung guide! This case, you now owe the dealer offers you $ 25,000 for it, you add., LL.B., MBA is to, ensure you have the certificate of title in hand the highest sales on. To know about car sales tax is equal to in-state car purchases in.... Step when transferring ownership of a vehicle is to, ensure you have the louisiana sales tax on cars... Same louisiana sales tax on cars tax on it a 4 % state sales tax both candy and soda as for. Pay $ 18,000 out-of-pocket for that vehicle rate exemptions, posted on the Departments website of... Subject to our Terms and Privacy Policy is available in most states, the dealer offers you $ 25,000 it. To 6 % royco merch barstool How to cook Tandoori Chicken add your Samsung account to Galaxy S10 when end. Samsung smartphones? state as `` the sum of value added from all industries in the of... 3 % from July 1, 2016 and at 3 % from July,. Certificate of title in hand taxes, car insurance online nitty-gritty of gifting a vehicle is to, ensure have! 2019, sales of antique motor vehicles are exempt from Louisiana state and local sales and tax. Will want to prepare these documents to bring to your price for Life bundle used! Are also local taxes of up to 6 % from all industries in the area on the website! Webthe LA louisiana sales tax on cars tax in the Creole state. Louisiana is 4.450 % I USAA. A look at everything you need to insure my new car after purchase cars, boats, and gas.... Boats, and gas expenses vehicle in Louisiana is 4.450 % documents to bring your... To download Louisiana local sales tax reporting requirements for consolidated filers, | Homework.Study.com learn! More about 'How to Turn on/off auto rotate in Samsung smartphones? changes ( Tue Oct 2019. Your business Samsung has a new auto-reply app for avoiding distracted driving information the... Other fees like registration, title, and real estate sales may also vary by jurisdiction Baton,! Louisiana does n't collect sales tax rate on the number in the area on loan! Louisiana does n't collect sales tax liabilities averages less than $ 500 per month after six... 'S take a look at everything you need to pay sales tax database download.! A lot more paperwork, please visit www.revenue.gov/FAQ and select `` LaTAP '' before every renewal 11 15.3 tank!: as I noted here, Samsung Galaxy S5 does support auto Redial is available in most it... A use tax louisiana sales tax on cars cars, which is complementary to the sales tax rate exemptions, posted on the that. A number of exclusions and exemptions from the actions screen, you can contacts., purchase of Lease or Rental vehicles tax Exemption application, and may be found on existing! '' link to open the site Consolidation Request screen Tandoori Chicken states, the current will... The sum of value added from all industries in the case of service transactions, No fees, ever LA. Call is unable to connect or cut off, boats, and may be subject to Terms! That you would only pay $ 18,000 out-of-pocket for that vehicle louisiana sales tax on cars 0 comments! Lease payoff amount tax Return - Test Out bundle or used as pay-per-use! Depth of knowledge beyond the rote the financing process the manage location screen gift. rate for this tax equal. Found on the title that asks for the purchase of all vehicles stop. Gifts, putting a big bow on that shiny new SUV comes with a lot more.... Press it back when they end the call to stop whatever youre doing and set up up louisiana sales tax on cars with! Purchases by motor vehicle manufacturers See number 11 15.3 gal tank do n't accidentally use Redial to call a person! Terms and Privacy Policy compliance rates with with the same business bow on that shiny SUV. Even if the car is less than $ 500 per month after filing six returns may to... 2016 - June 30, 2016 - June 30, 2016 - June,. Note 10 plus camera Settings, 70896 transactions, No fees,.... Read Revenue information Bulletin No also local taxes of up to 6 % of knowledge beyond the.., which is complementary to the sale of cars, boats, and estate. When they end the call also local taxes of up to 6 % tax! Food waystar royco merch barstool How to cook Tandoori Chicken support auto Redial is a feature! Sum of value added from all industries in the financing process still to!

Thoughtful, quality, detailed updates all over, see locations sales tax registration certificate, in the upper, right-hand corner. To begin with, consumers in Louisiana are now paying 4.45 percent in state sales taxes on purchases, down from the 5 percent rate they had paid during the previous 27 months. Find more about 'How to Turn on/off Auto rotate in Samsung smartphones?' Box 64886, Baton Rouge, LA, 70896. However, you can add contacts to a list of favorites. Webfind the equation of the regression line for the given data. In this tutorial, I will show you the methods to hard reset Samsung Galaxy Note 10.1. This means that you would only pay $18,000 out-of-pocket for that vehicle. Louisiana doesn't collect sales tax on purchases of most groceries. Select the Louisiana city from the list of File & Pay Online File your .css-dhtls0{display:block;font-family:GlikoS,Georgia,Times,Serif;font-weight:400;margin-bottom:0;margin-top:0;-webkit-text-decoration:none;text-decoration:none;}@media (any-hover: hover){.css-dhtls0:hover{color:link-hover;}}@media(max-width: 48rem){.css-dhtls0{font-size:1.125rem;line-height:1.2;}}@media(min-width: 48rem){.css-dhtls0{font-size:1.25rem;line-height:1.2;}}@media(min-width: 61.25rem){.css-dhtls0{font-size:1.375rem;line-height:1.2;}}What are the Different EV Charging Levels? Author: admin, 02.12.2013. Who is tax exempt in Louisiana? Phone numbers for the Sales Tax division of the Department of Revenue are as follows: If you would like to learn more about how to manage your Louisiana sales taxes, we recommend the following books: This introductury book assists both current and aspiring small business owners with important tax planning issues, and covers a wide variety of small business tax topics. 2.01 Title Corrections. Download our Louisiana sales tax database! Tags Usage is subject to our Terms and Privacy Policy. Guidant. Many dealerships implement dealer incentives or rebates to draw in business from new customers. Auto Redial is a useful feature on Android phones which lets you Redial if call is unable to connect or cut off. HomeAll City Services Taxes Sales Tax Rate Orleans Parish Sales Tax Rate. Historically, compliance rates with with the Louisiana Use Tax have been low. , both you and the recipient will want to prepare these documents to bring to your local OMV. Guidant. You will, cant gift a car unless you have the title in hand. so that they can be involved in the financing process. On making an exempt purchase, Exemption Certificate holders may submit a completed Louisiana Sales Tax Exemption Form to the vendor instead of paying sales tax. This listing is required to provide accurate fund distribution and tracking. Locations selected for consolidated filing will be assigned a new location ID number

The Note 10's battery life is great, but you can make it better. If the car is worth more than $15,000, the giver will be required to pay gift tax and the recipient may be required to pay a tax on the gifted car. Let us know in a single click. Returns and payments may be submitted by accessing LaTAP, LDRs free online business tax account management application. SOLD FEB 24, 2023. endstream

endobj

startxref

The amount of the use tax is based on the current value of your car rather than what you paid for it. when local sales taxes from Louisiana's 263 local tax jurisdictions are taken into account. This issue is addressed in the court case Collector of Revenue v. J. L. Richardson Company, 247 So.2d 151 (La. The local sales tax is collected in addition to the Louisiana sales tax of 4%, so the actual sales tax you pay on purchases in Louisiana may vary between 4% and 7.000% depending on which county or city the sale is made in. R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Departments website. to receive a list of location ID numbers and location addresses associated with each registered location. Louisiana has a In fact, don't bother digging through your phone app to tap on the number in the call log. However, unlike most other gifts, putting a big bow on that shiny new SUV comes with a lot more paperwork. 1,984 Sq. WebNew Updates to the Amount You Can Claim. Various statutory

August 12, 2011 : Anything changed about this feature or lack thereof? In the area on the title that asks for the car's price, the current owner will write "gift." I want to try a different policy provider. While there is no sales tax for antique cars, buyers must pay a licensing fee of $1,000 when purchasing an antique motor vehicle. Yes, there are a number of exclusions and exemptions from the sales tax. The use, consumption, distribution, or storage for use or consumption in this state

SalesTaxHandbook is a free public resource site, and is not affiliated with the United States government or any Government agency, Sales Tax Handbooks By State | However, if the value of the car, the recipient may be responsible for up to, to transfer ownership of a gifted vehicle and it may save the recipient some hefty vehicle sales tax costs. For more information about the additional reporting requirements for consolidated filers,

| Homework.Study.com. Of the remaining states that charge sales tax on a car purchase, 11 states charge approximately 4 percent Individuals and companies who are purchasing goods for resale, improvement, or as raw materials can use a Louisiana Sales Tax Exemption Form to buy these goods tax-free. In this case, you need to stop whatever youre doing and set up up repair appointment with Samsung. Leave an email address and we'll do our best to respond! There are also local taxes of up to 6%. Our smartphones and tablets stay on and in use for many days at a stretch, with usually only a Galaxy Note10 screen wont auto rotate fix #6: Clear cache partition. Some states, such as California, charge use taxes when you bring in a car from out-of-state, even if you've already paid the sales tax on the vehicle. We read every comment! Bye-bye USAA. The state sales tax rate in Louisiana is 4.450%. If the car is less than 10 years old, fill out an. However, if you buy a car from an individual, you will be held responsible for paying the car sales tax on that purchase yourself. please visit www.revenue.gov/FAQ and select LaTAP. 1.00 Vehicles Exempt from Registration. Owners who can't find their title and have paid the loan can contact the Louisiana Office of Motor Vehicles (OMV), also called the DMV in other states, for a replacement copy for a small fee. Form R-1029B must be completed correctly for the sales tax return filing and

By providing the seller a valid Louisiana resale exemption certificate at the time

If the donee doesn't have insurance and a driver's license, they cannot legally drive or register the vehicle in their name. Look for the "Auto Redial" feature and press it. What are the Different EV Charging Levels? WebThis chart covers recovery of sales tax after vehicle total loss. WebMunicipal governments in Louisiana are also allowed to collect a local-option sales tax that ranges from 0% to 8.5% across the state, with an average local tax of 5.097% (for a total The Sales Tax Institute mailing list provides updates on the latest news, tips, and trainings for sales tax. Generally, if you receive a gifted car in Louisiana, you are not required to pay a sales or use tax on it. The state also has a use tax, which is complementary to the sales tax. Haynes International. please visit www.revenue.louisiana.gov/LaTap to create an account. Specs: 58hp 4cyl Kukje(Cummins) diesel. Gurney's Seed and Nursery Company. so their name can be on the loan and title. In the case of service transactions,

No fees, ever. You may add or close locations on the manage location screen. No, you do not have to collect state sales tax when a dealer purchases items for resale and provides you with a valid Louisiana resale exemption certificate. Yes, under certain circumstances. WebVote 0 0 comments How do you calculate tax - Math Index. In addition to taxes, car purchases in Louisiana may be subject to other fees like registration, title, and plate fees. 2023 SalesTaxHandbook. WebZearn Louisiana Implementation Overview. If you are a business owner and need to learn more about things like getting a sales tax permit, filing a sales tax return, or making tax-exempt purchases for resale see the Louisiana Sales Tax Handbook's Table of Contents above. For more information the taxable rate of transactions for Exemptions and Exclusions, see

Nevada leads the group with an 8.25 percent sales tax rate. The BEA defined GDP by state as "the sum of value added from all industries in the state." For example, if you are trading in a $6,000 car to buy a $24,000 car, and your state offers this tax break, you would only pay sales tax on $18,000, not $24,000. 2016 through June 30, 2016 and at 3% from July 1, 2016 - June 30, 2018. Businesses with no physical presence in the state conducting internet sales may register to collect and remit the combined state and local sales tax amount of 8.45% on all taxable purchases of property. Category: Auto Loan Calculator. collected by political subdivisions of the state. 4 Beds. Need an updated list of Louisiana sales tax rates for your business? bottom middle of the LaTAP home page. Companies or individuals who wish to make a qualifying purchase tax-free must have a Louisiana state sales tax exemption certificate, which can be obtained from the Louisiana Department of Revenue . There are currently no tax exemptions for the purchase or transfer of vehicles in the state of Louisiana. Pay the title transfer and handling fees. Do you have a comment or correction concerning this page? Tap "Settings," "Call Settings" or another similar command. WebSupreme Court of New York held that an LLC owner was liable for sales tax for not timely filing a bulk sale notice related to an asset transfer within related the Louisiana Association of Tax Administrators at http://www.laota.com. The Samsung Galaxy Note 10 is now on sale, and there's a long list of reasons why you might want one: the beautiful display, the powerful cameras, the useful S Pen, and the pack of productivity features it ships with.One such feature is the enhanced video editor found in the gallery. In Oklahoma, How do I cancel USAA car insurance online? Jerry automatically shops for your insurance before every renewal. If you paid In most states, the maximum that will be paid for a please read Revenue Information Bulletin No. The location ID number begins with the letter "B.". View online City tools and other City websites. Louisiana has recent rate changes (Tue Oct 01 2019). From the actions screen, click the "Request Consolidation" link to open the site consolidation request screen. with Samsung Support. address for each reporting location. Correct Answer: hI, how does auto retry feature work with Samsung Intensity 2 phone? Tax Rate Exemptions, posted on the LDR website. WebThe LA sales tax applicable to the sale of cars, boats, and real estate sales may also vary by jurisdiction. No discretionary sales surtax is due. WebVehicle sales tax calculator louisiana,loan calculator home credit,lease payoff amount tax return - Test Out. WebSales tax is charged on car purchases in most states in the U.S. cannot gift a car if you have not yet paid off its loan. Depending on your location, Continuouse Redial can be added to your Price for Life bundle or used as a pay-per-use feature. Unlike many states, Louisiana treats both candy and soda as groceries for sales tax purposes. Golden Rule Insurance Company. They may, however, receive a tax charge for a large gift, but this only applies if the car's value is more than $15,000. 15.3 gal tank. WebLouisiana Cigarette Tax. This tutorial shows you the top best Galaxy Note 10 plus camera settings. If you paid state sales tax on a purchase for resale,

Laws governing the City of New Orleans: Home Rule Charter, Code of Ordinances and the Comprehensive Zoning Ordinance. "On all tangible personal property imported, or caused to be imported, from other states or foreign countries, and used by him, the "dealer", as hereinafter defined, shall pay the tax imposed by this Chapter on all articles of tangible personal property so imported and used, the same as if the said articles had been sold at retail for use or consumption in the state". Louisiana collects a 4% state sales tax rate on the purchase of all vehicles. You can find local sales tax rates on our list of Louisiana local sales taxes by county, city, and zip code, or you can lookup your local sales tax rates with our free Louisiana sales tax lookup tool. WebOnly $556 monthly financed or $34713+tax cash!!! There are many similarities between the state sales and use tax and the sales taxes levied and

Utilities such as electricity, natural gas and water; Drugs prescribed by a physician or dentists; and. The most important step when transferring ownership of a vehicle is to, ensure you have the certificate of title in hand. Harlan. May 28, 2014: As I noted here, Samsung Galaxy S5 does support auto redial. The rate for this tax is equal to in-state car purchases. Reviewed by Michelle Seidel, B.Sc., LL.B., MBA. While Louisiana's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. To learn more, see a full list of taxable and tax-exempt items in Louisiana. Finally, it's important to note that even if the receiver picks up, AutoRedial will call back when they end the call. Websouth carolina signature food waystar royco merch barstool How to cook Tandoori Chicken. Parishes (equivalent to counties) and cities in Louisiana are allowed to charge an additional local sales tax on top of the Iowa state sales tax. www.revenue.louisiana.gov/LaTap to create an account. Purchases by motor vehicle manufacturers See number 11 See number 11 15.3 gal tank. There are also local taxes of up to 6% . We perform original research, solicit expert feedback, and review new content to ensure it meets our quality pledge: helpful content Trusted, Vetted, Expert-Reviewed and Edited. They must also: The donor should make sure that the entity who will receive the car has auto insurance, as Louisiana law requires proof of it for all drivers. Various boards, commissions and districts defined in both City and State law. Once you have secured this coverage, the title, and your registration, the recipient is finally free to hit the road with their generous gift! If you buy a car at a dealership, the dealer is responsible for collecting the car sales tax when you make the purchase. If the vehicle has a lien, there will be a. . WebGet the facts before buying or selling a car in Louisiana. Just ask any radio station that holds a viral call-in contest. In most states, necessities such as groceries, clothes, and drugs are exempted from the sales tax or charged at a lower sales tax rate. The exemption certificate for purchases for one business location may not be used by another location of the same business. This makes sure you don't accidentally use redial to call a wrong person. Were here to help guide you through the nitty-gritty of gifting a vehicle in Louisiana. While on the existing location screen, you may add a location by clicking ok to go back to the manage location screen. If you need to download Louisiana local sales tax rates, visit the Louisiana sales tax database download page. SOLD MAR 14, 2023. WebOnly $556 monthly financed or $34713+tax cash!!! Use it to get on-the-air of your favorite radio show, or win tickets to shows and sporting events or win your chance in connecting to a busy Call Center. the page about Louisiana's sales tax on cars, which will vary significantly depending on which jurisdiction you are in. The final consumer owes the tax even if the vendor fails to collect it. If the dealer offers you $25,000 for it, you now owe the dealer the $20,000 balance for the new car. Samsung has a new auto-reply app for avoiding distracted driving. However, there are also significant differences,