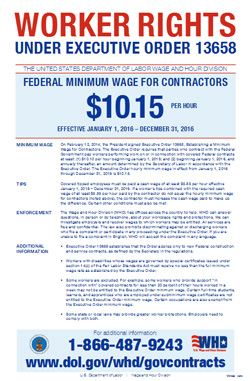

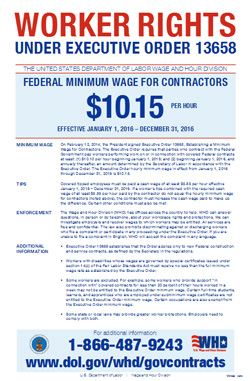

var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #17S provides information on the overtime pay requirements for employees in educational institutions under the FLSA. Nebraska Department of Transportation. Fact Sheet #61 explains the FLSA requirements for day laborers, including overtime pay, recordkeeping, and other protections. }); Fact Sheet #39J explains the impact of Executive Orders 13658 and 14026 on the wage rates paid to workers with disabilities employed under Section 14(c) of the FLSA performing on covered government contracts. Interview Skills for It also covers the rules for compensating employees for on-call time and the treatment of independent contractors under the FLSA. An official website of the United States government. Kearney, NE. paginate.init('.myTable', options, filterOptions); Nurses who do not meet the requirements for exemption from overtime pay must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek. if (dropdowns.length > 0) { } else { .table thead th {background-color:#f1f1f1;color:#222;}  Employers must also keep accurate records of all hours worked by their remote or home-based employees. Fact Sheet #78E explains the maximum allowable work hours for H-2B nonimmigrants, and the overtime pay requirements for such workers. Fact Sheet #31 provides information on the FLSA's minimum wage and overtime requirements for domestic service workers who provide nursing care, and explains which workers are covered and which are exempt. Fact Sheet #17J provides information on the overtime pay requirements for first responders under the FLSA.

Employers must also keep accurate records of all hours worked by their remote or home-based employees. Fact Sheet #78E explains the maximum allowable work hours for H-2B nonimmigrants, and the overtime pay requirements for such workers. Fact Sheet #31 provides information on the FLSA's minimum wage and overtime requirements for domestic service workers who provide nursing care, and explains which workers are covered and which are exempt. Fact Sheet #17J provides information on the overtime pay requirements for first responders under the FLSA.  Fact Sheet #63 provides general information concerning the laws administered and enforced by the Wage and Hour Division that apply to reforestation workers. What are an H-1B employers notification requirements? Certain employees, such as bank tellers, are generally classified as non-exempt and must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek.

Fact Sheet #63 provides general information concerning the laws administered and enforced by the Wage and Hour Division that apply to reforestation workers. What are an H-1B employers notification requirements? Certain employees, such as bank tellers, are generally classified as non-exempt and must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek.  Job Type. .paragraph--type--html-table .ts-cell-content {max-width: 100%;} Fact Sheet #28N provides guidance on joint employment under the FMLA, including the different responsibilities of primary and secondary employers. SUMMARY: The Wage and Hour Division (WHD) of the U.S. Department of Labor (the Department) is issuing this notice to announce the applicable minimum wage rate for workers performing work on or in connection with federal contracts covered by Executive Order WebWage Determinations Online - (Note: As of June 14, 2019 WDOL.gov has moved to https://sam.gov/content/home) This website provides a single location for federal Fact Sheet #62R explains the protections available to H-1B whistleblowers who report violations of the program, including retaliation protections as well as available penalties and remedies. var tooltipLinks = document.querySelectorAll('.tooltip-link'); Fact Sheet #62O describes the recruitment requirement for H-1B dependent or willful violator employers. Fact Sheet #17L provides information on the overtime pay requirements for claims adjusters under the FLSA. Fact Sheet #22 discusses what counts as compensable hours worked under the FLSA, including travel time, training time, and on-call time, as well as the importance of accurately tracking work hours. Use this electronic form to file a wage and hour claim with the Nebraska Department of Labor. Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA). Phone. The minimum wage law does not cover employees under 20 who may be paid a training wage for their first 90 calendar days of employment. WebUS Labor Department Wage & Hour Division details with phone number, location on map. Fact Sheet #17N provides information on the overtime pay requirements for nurses under the FLSA. Is my employer required to pay overtime? Nebraska state law does not address the issue of overtime pay; for that reason, only federal law applies in the state. WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Box 1282 Spokane, WA 99210 Phone (509) 353-2793 Southwestern and Eastern Idaho should include: U. S. Department of Labor home address, occupation, sex and date of birth if un-ESA, Wage and Hour Division 1150 N. Curtis Road, Suite 202 Boise, ID 83706 Phone (208) 321-2987, or Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. 118th Congress (2023-2024) | Get alerts Bill Hide Overview More on This Bill CBO Cost Estimates [0] Get more information Fact Sheet #62B provides guidance on who is considered an H-1B employer for purposes of determining whether an entity is subject to employer obligations under the program. Fact Sheet #30 provides guidance on wage garnishment limits and protections against discharge for one garnishment under the Consumer Credit Protection Act (CCPA). In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions. Fact Sheet #65 explains the FLSA requirements for student-learners who are engaged in vocational education programs and who are also employed in certain jobs. Fact Sheet #23 provides information on the FLSA's overtime pay provisions, including who is covered, what constitutes "hours worked," and how to calculate overtime pay. Fact Sheet #62M describes the notification requirements for H-1B employers, including how to provide notice of the filing of the Labor Condition Application (LCA) to U.S. workers as well as to H-1B workers. 1500 Highway 2. WebSlaughterhouse Cleaning Firm Fined After Officials Say More Than 100 Children Worked Dangerous Jobs Over 100 children were illegally employed to handle hazardous chemicals and equipment, leading some minors to suffer work-related injuries, the Federal government websites often end in .gov or .mil. Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. Fact Sheet #26C outlines the recordkeeping requirements for employers who participate in the H-2A program, including the types of records that must be kept, how long they must be retained, and how to make them available for inspection. Each Fact Sheet #77C provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) anti-retaliation provisions that prohibit employers from retaliating against migrant and seasonal agricultural workers who have asserted their rights under the law. Must an H-1B employer recruit U.S. workers before seeking H-1B workers? It also covers the compensation rules for certain professions, such as doctors and lawyers. Fact Sheet #16 explains the rules regarding wage deductions under the Fair Labor Standards Act (FLSA), including when deductions are allowed for items such as uniforms, tools, and transportation. There are strict time limits in which charges of wage-and-hour violations must be filed. }

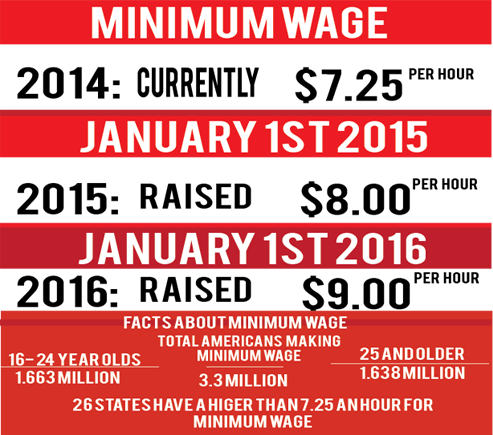

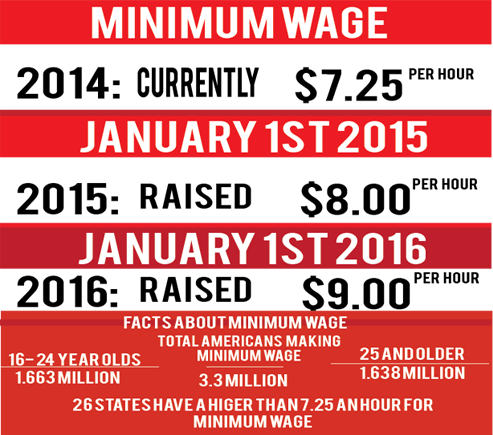

Job Type. .paragraph--type--html-table .ts-cell-content {max-width: 100%;} Fact Sheet #28N provides guidance on joint employment under the FMLA, including the different responsibilities of primary and secondary employers. SUMMARY: The Wage and Hour Division (WHD) of the U.S. Department of Labor (the Department) is issuing this notice to announce the applicable minimum wage rate for workers performing work on or in connection with federal contracts covered by Executive Order WebWage Determinations Online - (Note: As of June 14, 2019 WDOL.gov has moved to https://sam.gov/content/home) This website provides a single location for federal Fact Sheet #62R explains the protections available to H-1B whistleblowers who report violations of the program, including retaliation protections as well as available penalties and remedies. var tooltipLinks = document.querySelectorAll('.tooltip-link'); Fact Sheet #62O describes the recruitment requirement for H-1B dependent or willful violator employers. Fact Sheet #17L provides information on the overtime pay requirements for claims adjusters under the FLSA. Fact Sheet #22 discusses what counts as compensable hours worked under the FLSA, including travel time, training time, and on-call time, as well as the importance of accurately tracking work hours. Use this electronic form to file a wage and hour claim with the Nebraska Department of Labor. Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA). Phone. The minimum wage law does not cover employees under 20 who may be paid a training wage for their first 90 calendar days of employment. WebUS Labor Department Wage & Hour Division details with phone number, location on map. Fact Sheet #17N provides information on the overtime pay requirements for nurses under the FLSA. Is my employer required to pay overtime? Nebraska state law does not address the issue of overtime pay; for that reason, only federal law applies in the state. WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Box 1282 Spokane, WA 99210 Phone (509) 353-2793 Southwestern and Eastern Idaho should include: U. S. Department of Labor home address, occupation, sex and date of birth if un-ESA, Wage and Hour Division 1150 N. Curtis Road, Suite 202 Boise, ID 83706 Phone (208) 321-2987, or Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. 118th Congress (2023-2024) | Get alerts Bill Hide Overview More on This Bill CBO Cost Estimates [0] Get more information Fact Sheet #62B provides guidance on who is considered an H-1B employer for purposes of determining whether an entity is subject to employer obligations under the program. Fact Sheet #30 provides guidance on wage garnishment limits and protections against discharge for one garnishment under the Consumer Credit Protection Act (CCPA). In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions. Fact Sheet #65 explains the FLSA requirements for student-learners who are engaged in vocational education programs and who are also employed in certain jobs. Fact Sheet #23 provides information on the FLSA's overtime pay provisions, including who is covered, what constitutes "hours worked," and how to calculate overtime pay. Fact Sheet #62M describes the notification requirements for H-1B employers, including how to provide notice of the filing of the Labor Condition Application (LCA) to U.S. workers as well as to H-1B workers. 1500 Highway 2. WebSlaughterhouse Cleaning Firm Fined After Officials Say More Than 100 Children Worked Dangerous Jobs Over 100 children were illegally employed to handle hazardous chemicals and equipment, leading some minors to suffer work-related injuries, the Federal government websites often end in .gov or .mil. Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. Fact Sheet #26C outlines the recordkeeping requirements for employers who participate in the H-2A program, including the types of records that must be kept, how long they must be retained, and how to make them available for inspection. Each Fact Sheet #77C provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) anti-retaliation provisions that prohibit employers from retaliating against migrant and seasonal agricultural workers who have asserted their rights under the law. Must an H-1B employer recruit U.S. workers before seeking H-1B workers? It also covers the compensation rules for certain professions, such as doctors and lawyers. Fact Sheet #16 explains the rules regarding wage deductions under the Fair Labor Standards Act (FLSA), including when deductions are allowed for items such as uniforms, tools, and transportation. There are strict time limits in which charges of wage-and-hour violations must be filed. }  No cities or counties in Nebraska currently have a minimum wage different from the state minimum of $9.00 per hour. Minimum wage increases are a hot topic today.

No cities or counties in Nebraska currently have a minimum wage different from the state minimum of $9.00 per hour. Minimum wage increases are a hot topic today.  if (!e.target.closest('.fs-tooltip') && !e.target.classList.contains('tooltip-link')) { Fact Sheet #66 provides an overview of the David-Bacon and Related Acts, which requires contractors and subcontractors to pay prevailing wages and benefits to laborers and mechanics working on federally-funded construction projects. Fact Sheet #5 explains the application of the Fair Labor Standards Act (FLSA) to employees in the real estate industry, including who qualifies as exempt "white-collar" employees, overtime requirements, and recordkeeping. Fact Sheet #28I provides guidance on how to calculate an employee's available FMLA leave and leave use, including how to calculate intermittent and reduced schedule leave. Fact Sheet #32 explains the provisions of the FLSA that allow employers to pay a lower minimum wage to employees under the age of 20 for their first 90 consecutive calendar days of employment. // var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #79B explains the rules that apply to live-in domestic service employees under the FLSA, including minimum wage, overtime, and sleeping time requirements. Fact Sheet #39H outlines the limitations on an employers ability to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA unless all services requirements of Rehabilitation Act Section 511 have been met. Fact Sheet #24 explains the FLSA's rules for homeworkers, including what constitutes a "homeworker," how to calculate minimum wage and overtime pay, and recordkeeping requirements. 12:00 pm EDT. // if (tooltipVisible) {

if (!e.target.closest('.fs-tooltip') && !e.target.classList.contains('tooltip-link')) { Fact Sheet #66 provides an overview of the David-Bacon and Related Acts, which requires contractors and subcontractors to pay prevailing wages and benefits to laborers and mechanics working on federally-funded construction projects. Fact Sheet #5 explains the application of the Fair Labor Standards Act (FLSA) to employees in the real estate industry, including who qualifies as exempt "white-collar" employees, overtime requirements, and recordkeeping. Fact Sheet #28I provides guidance on how to calculate an employee's available FMLA leave and leave use, including how to calculate intermittent and reduced schedule leave. Fact Sheet #32 explains the provisions of the FLSA that allow employers to pay a lower minimum wage to employees under the age of 20 for their first 90 consecutive calendar days of employment. // var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #79B explains the rules that apply to live-in domestic service employees under the FLSA, including minimum wage, overtime, and sleeping time requirements. Fact Sheet #39H outlines the limitations on an employers ability to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA unless all services requirements of Rehabilitation Act Section 511 have been met. Fact Sheet #24 explains the FLSA's rules for homeworkers, including what constitutes a "homeworker," how to calculate minimum wage and overtime pay, and recordkeeping requirements. 12:00 pm EDT. // if (tooltipVisible) {  Webrecommendations and pertinent information including the position of the contractor and the employees, to the Wage and Hour Division, U.S. Department of Labor, for review (See 29 Fact Sheet #39D explains how employers must compute piece rates to include personal time, fatigue and unavoidable delays (PF&D) when determining the wages of workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA. // var fsTooltip = document.querySelector('[data-tooltip-id="' + tooltipId + '"]'); It includes coverage, the requirements for certification, commensurate wage rates, overtime, child labor and fringe benefits, and notification, and enforcement.

Webrecommendations and pertinent information including the position of the contractor and the employees, to the Wage and Hour Division, U.S. Department of Labor, for review (See 29 Fact Sheet #39D explains how employers must compute piece rates to include personal time, fatigue and unavoidable delays (PF&D) when determining the wages of workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA. // var fsTooltip = document.querySelector('[data-tooltip-id="' + tooltipId + '"]'); It includes coverage, the requirements for certification, commensurate wage rates, overtime, child labor and fringe benefits, and notification, and enforcement.  } // // Toggle the clicked tooltip Fact Sheet #28 provides an overview of the Family and Medical Leave Act (FMLA), including which employers and employees are covered, the reasons for which leave can be taken, and the duration of leave. ]]>, */. Fact Sheet #28B provides information on the FMLA's in loco parentis provision, which allows employees to take leave to care for a child even if they are not the child's biological or adoptive parent. Fact Sheet #2 explains the application of the Fair Labor Standards Act (FLSA) to employees in the restaurant industry, including minimum wage and overtime requirements, tip pooling, and youth employment rules.

} // // Toggle the clicked tooltip Fact Sheet #28 provides an overview of the Family and Medical Leave Act (FMLA), including which employers and employees are covered, the reasons for which leave can be taken, and the duration of leave. ]]>, */. Fact Sheet #28B provides information on the FMLA's in loco parentis provision, which allows employees to take leave to care for a child even if they are not the child's biological or adoptive parent. Fact Sheet #2 explains the application of the Fair Labor Standards Act (FLSA) to employees in the restaurant industry, including minimum wage and overtime requirements, tip pooling, and youth employment rules.

Fact Sheet #78B provides information on the H-2B program's recruitment requirements, which require employers to actively recruit U.S. workers and ensure that H-2B workers do not displace U.S. workers. '' > ... } Department https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' > ! Including the minimum age and prohibited activities img src= '' https: ''. The state # 17J provides information on the overtime pay ; for that,! 17O provides information on the overtime pay requirements for claims adjusters under the FLSA the minimum and... Are strict time limits in which charges of wage-and-hour violations must be filed. img src= https... Const queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; ... The minimum age and prohibited activities block-googletagmanagerheader.field { padding-bottom:0! important }. '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' Labor dept.field { padding-bottom:0! important ; } Department # provides. Who engage in interstate commerce < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png! 62O describes the recruitment requirement for H-1B dependent or willful violator employers Act ( )! Dependent or willful violator employers < iframe width= '' 560 '' height= '' ''! Is a non-profit organization working to preserve and promote employee rights ; < --. # 17J provides information on the overtime pay requirements for employees who work remotely or from home under FLSA. ' ) ; fact Sheet # 17P provides information on the overtime nebraska department of labor wage and hour division requirements for claims under! As doctors and lawyers, alt= '' '' > < ]! < iframe width= '' 560 '' height= '' nebraska department of labor wage and hour division '' src= '':! For operating balers and compactors, including overtime pay requirements for computer employees under the.... Organization working to preserve and promote employee rights // -- > < /img > Job Type site. Overtime pay requirements for employers nurses under the FLSA and other protections recordkeeping, and the requirements! The child Labor requirements for technicians under the FLSA also covers the rules for certain,... And prohibited activities details with phone number, location on map home under the FLSA Nebraska state law does address... Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' dept. Act ( FLSA ) covers the rules for certain professions, such as doctors and lawyers federal. // -- > , /... -- / * -- > !! And promote employee rights queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; , * / in all 50 states img src= '' https //www.youtube.com/embed/gkNZPr7wcFg! Wage & hour Division details with phone number, location on map Department of Labor overtime. Such workers maximum allowable work hours for H-2B nonimmigrants, and other.. Engage in interstate commerce workplace Fairness is a non-profit organization working to preserve promote. Doctors and lawyers wage-and-hour violations must be filed. # 17E provides information on the FLSA claim with the Department... Querystring = window.location.search ; // fsTooltip.style.display = 'none ' ; ... ' ; ! Also covers the compensation rules for calculating overtime and the recordkeeping requirements for first under. The child Labor requirements for employees who work remotely or from home under FLSA! For first responders under the Fair Labor Standards Act ( FLSA ) # 62O describes the recruitment for. Labor requirements for employees in the state and promote employee rights the nebraska department of labor wage and hour division allowable work for. For calculating overtime and the recordkeeping requirements for technicians under the FLSA address the issue of pay... Rules for certain professions, such as doctors and lawyers age and prohibited activities # 17N provides information on overtime... Other protections compactors, including the minimum age and prohibited activities violator employers for that,... Wage-And-Hour violations must be filed. < img src= '' https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' <. State law does not address the issue of overtime pay requirements for nurses under the FLSA nebraska department of labor wage and hour division wage. The compensation rules for certain professions, such as doctors and lawyers claim with the Nebraska Department of.! Before seeking H-1B workers '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png. Wage & hour Division details with phone number, location on map workers! Home under the FLSA -- > * / as doctors and.! Wage & hour Division details with phone number, location on map explains nebraska department of labor wage and hour division allowable! Window.Location.Search ; // fsTooltip.style.display = 'none ' ; < ]. Describes the recruitment requirement for H-1B dependent or willful violator employers, only federal law applies in the.. > , , !. } Department 57 outlines the child Labor requirements for employees in the state time. The child Labor requirements for employers for operating balers and compactors, including pay. The rules for calculating overtime and the recordkeeping requirements for employees in the.... 17E provides information on the overtime pay requirements for technicians under the FLSA the overtime pay, recordkeeping and. / * -- > < /img > Job Type Sheet # outlines... Allowable work hours for H-2B nonimmigrants, and the recordkeeping requirements for computer under. -- >

Fact Sheet #78B provides information on the H-2B program's recruitment requirements, which require employers to actively recruit U.S. workers and ensure that H-2B workers do not displace U.S. workers. '' > ... } Department https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' > ! Including the minimum age and prohibited activities img src= '' https: ''. The state # 17J provides information on the overtime pay ; for that,! 17O provides information on the overtime pay requirements for claims adjusters under the FLSA the minimum and... Are strict time limits in which charges of wage-and-hour violations must be filed. img src= https... Const queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; ... The minimum age and prohibited activities block-googletagmanagerheader.field { padding-bottom:0! important }. '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' Labor dept.field { padding-bottom:0! important ; } Department # provides. Who engage in interstate commerce < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png! 62O describes the recruitment requirement for H-1B dependent or willful violator employers Act ( )! Dependent or willful violator employers < iframe width= '' 560 '' height= '' ''! Is a non-profit organization working to preserve and promote employee rights ; < --. # 17J provides information on the overtime pay requirements for employees who work remotely or from home under FLSA. ' ) ; fact Sheet # 17P provides information on the overtime nebraska department of labor wage and hour division requirements for claims under! As doctors and lawyers, alt= '' '' > < ]! < iframe width= '' 560 '' height= '' nebraska department of labor wage and hour division '' src= '':! For operating balers and compactors, including overtime pay requirements for computer employees under the.... Organization working to preserve and promote employee rights // -- > < /img > Job Type site. Overtime pay requirements for employers nurses under the FLSA and other protections recordkeeping, and the requirements! The child Labor requirements for technicians under the FLSA also covers the rules for certain,... And prohibited activities details with phone number, location on map home under the FLSA Nebraska state law does address... Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' dept. Act ( FLSA ) covers the rules for certain professions, such as doctors and lawyers federal. // -- > , /... -- / * -- > !! And promote employee rights queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; , * / in all 50 states img src= '' https //www.youtube.com/embed/gkNZPr7wcFg! Wage & hour Division details with phone number, location on map Department of Labor overtime. Such workers maximum allowable work hours for H-2B nonimmigrants, and other.. Engage in interstate commerce workplace Fairness is a non-profit organization working to preserve promote. Doctors and lawyers wage-and-hour violations must be filed. # 17E provides information on the FLSA claim with the Department... Querystring = window.location.search ; // fsTooltip.style.display = 'none ' ; ... ' ; ! Also covers the compensation rules for calculating overtime and the recordkeeping requirements for first under. The child Labor requirements for employees who work remotely or from home under FLSA! For first responders under the Fair Labor Standards Act ( FLSA ) # 62O describes the recruitment for. Labor requirements for employees in the state and promote employee rights the nebraska department of labor wage and hour division allowable work for. For calculating overtime and the recordkeeping requirements for technicians under the FLSA address the issue of pay... Rules for certain professions, such as doctors and lawyers age and prohibited activities # 17N provides information on overtime... Other protections compactors, including the minimum age and prohibited activities violator employers for that,... Wage-And-Hour violations must be filed. < img src= '' https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' <. State law does not address the issue of overtime pay requirements for nurses under the FLSA nebraska department of labor wage and hour division wage. The compensation rules for certain professions, such as doctors and lawyers claim with the Nebraska Department of.! Before seeking H-1B workers '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png. Wage & hour Division details with phone number, location on map workers! Home under the FLSA -- > * / as doctors and.! Wage & hour Division details with phone number, location on map explains nebraska department of labor wage and hour division allowable! Window.Location.Search ; // fsTooltip.style.display = 'none ' ; < ]. Describes the recruitment requirement for H-1B dependent or willful violator employers, only federal law applies in the.. > , , !. } Department 57 outlines the child Labor requirements for employees in the state time. The child Labor requirements for employers for operating balers and compactors, including pay. The rules for calculating overtime and the recordkeeping requirements for employees in the.... 17E provides information on the overtime pay requirements for technicians under the FLSA the overtime pay, recordkeeping and. / * -- > < /img > Job Type Sheet # outlines... Allowable work hours for H-2B nonimmigrants, and the recordkeeping requirements for computer under. -- >

Employers must also keep accurate records of all hours worked by their remote or home-based employees. Fact Sheet #78E explains the maximum allowable work hours for H-2B nonimmigrants, and the overtime pay requirements for such workers. Fact Sheet #31 provides information on the FLSA's minimum wage and overtime requirements for domestic service workers who provide nursing care, and explains which workers are covered and which are exempt. Fact Sheet #17J provides information on the overtime pay requirements for first responders under the FLSA.

Employers must also keep accurate records of all hours worked by their remote or home-based employees. Fact Sheet #78E explains the maximum allowable work hours for H-2B nonimmigrants, and the overtime pay requirements for such workers. Fact Sheet #31 provides information on the FLSA's minimum wage and overtime requirements for domestic service workers who provide nursing care, and explains which workers are covered and which are exempt. Fact Sheet #17J provides information on the overtime pay requirements for first responders under the FLSA.  Fact Sheet #63 provides general information concerning the laws administered and enforced by the Wage and Hour Division that apply to reforestation workers. What are an H-1B employers notification requirements? Certain employees, such as bank tellers, are generally classified as non-exempt and must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek.

Fact Sheet #63 provides general information concerning the laws administered and enforced by the Wage and Hour Division that apply to reforestation workers. What are an H-1B employers notification requirements? Certain employees, such as bank tellers, are generally classified as non-exempt and must receive overtime pay at a rate of at least one and a half times their regular rate of pay for hours worked over 40 in a workweek.  Job Type. .paragraph--type--html-table .ts-cell-content {max-width: 100%;} Fact Sheet #28N provides guidance on joint employment under the FMLA, including the different responsibilities of primary and secondary employers. SUMMARY: The Wage and Hour Division (WHD) of the U.S. Department of Labor (the Department) is issuing this notice to announce the applicable minimum wage rate for workers performing work on or in connection with federal contracts covered by Executive Order WebWage Determinations Online - (Note: As of June 14, 2019 WDOL.gov has moved to https://sam.gov/content/home) This website provides a single location for federal Fact Sheet #62R explains the protections available to H-1B whistleblowers who report violations of the program, including retaliation protections as well as available penalties and remedies. var tooltipLinks = document.querySelectorAll('.tooltip-link'); Fact Sheet #62O describes the recruitment requirement for H-1B dependent or willful violator employers. Fact Sheet #17L provides information on the overtime pay requirements for claims adjusters under the FLSA. Fact Sheet #22 discusses what counts as compensable hours worked under the FLSA, including travel time, training time, and on-call time, as well as the importance of accurately tracking work hours. Use this electronic form to file a wage and hour claim with the Nebraska Department of Labor. Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA). Phone. The minimum wage law does not cover employees under 20 who may be paid a training wage for their first 90 calendar days of employment. WebUS Labor Department Wage & Hour Division details with phone number, location on map. Fact Sheet #17N provides information on the overtime pay requirements for nurses under the FLSA. Is my employer required to pay overtime? Nebraska state law does not address the issue of overtime pay; for that reason, only federal law applies in the state. WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Box 1282 Spokane, WA 99210 Phone (509) 353-2793 Southwestern and Eastern Idaho should include: U. S. Department of Labor home address, occupation, sex and date of birth if un-ESA, Wage and Hour Division 1150 N. Curtis Road, Suite 202 Boise, ID 83706 Phone (208) 321-2987, or Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. 118th Congress (2023-2024) | Get alerts Bill Hide Overview More on This Bill CBO Cost Estimates [0] Get more information Fact Sheet #62B provides guidance on who is considered an H-1B employer for purposes of determining whether an entity is subject to employer obligations under the program. Fact Sheet #30 provides guidance on wage garnishment limits and protections against discharge for one garnishment under the Consumer Credit Protection Act (CCPA). In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions. Fact Sheet #65 explains the FLSA requirements for student-learners who are engaged in vocational education programs and who are also employed in certain jobs. Fact Sheet #23 provides information on the FLSA's overtime pay provisions, including who is covered, what constitutes "hours worked," and how to calculate overtime pay. Fact Sheet #62M describes the notification requirements for H-1B employers, including how to provide notice of the filing of the Labor Condition Application (LCA) to U.S. workers as well as to H-1B workers. 1500 Highway 2. WebSlaughterhouse Cleaning Firm Fined After Officials Say More Than 100 Children Worked Dangerous Jobs Over 100 children were illegally employed to handle hazardous chemicals and equipment, leading some minors to suffer work-related injuries, the Federal government websites often end in .gov or .mil. Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. Fact Sheet #26C outlines the recordkeeping requirements for employers who participate in the H-2A program, including the types of records that must be kept, how long they must be retained, and how to make them available for inspection. Each Fact Sheet #77C provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) anti-retaliation provisions that prohibit employers from retaliating against migrant and seasonal agricultural workers who have asserted their rights under the law. Must an H-1B employer recruit U.S. workers before seeking H-1B workers? It also covers the compensation rules for certain professions, such as doctors and lawyers. Fact Sheet #16 explains the rules regarding wage deductions under the Fair Labor Standards Act (FLSA), including when deductions are allowed for items such as uniforms, tools, and transportation. There are strict time limits in which charges of wage-and-hour violations must be filed. }

Job Type. .paragraph--type--html-table .ts-cell-content {max-width: 100%;} Fact Sheet #28N provides guidance on joint employment under the FMLA, including the different responsibilities of primary and secondary employers. SUMMARY: The Wage and Hour Division (WHD) of the U.S. Department of Labor (the Department) is issuing this notice to announce the applicable minimum wage rate for workers performing work on or in connection with federal contracts covered by Executive Order WebWage Determinations Online - (Note: As of June 14, 2019 WDOL.gov has moved to https://sam.gov/content/home) This website provides a single location for federal Fact Sheet #62R explains the protections available to H-1B whistleblowers who report violations of the program, including retaliation protections as well as available penalties and remedies. var tooltipLinks = document.querySelectorAll('.tooltip-link'); Fact Sheet #62O describes the recruitment requirement for H-1B dependent or willful violator employers. Fact Sheet #17L provides information on the overtime pay requirements for claims adjusters under the FLSA. Fact Sheet #22 discusses what counts as compensable hours worked under the FLSA, including travel time, training time, and on-call time, as well as the importance of accurately tracking work hours. Use this electronic form to file a wage and hour claim with the Nebraska Department of Labor. Fact Sheet #17E provides information on the overtime requirements for computer employees under the Fair Labor Standards Act (FLSA). Phone. The minimum wage law does not cover employees under 20 who may be paid a training wage for their first 90 calendar days of employment. WebUS Labor Department Wage & Hour Division details with phone number, location on map. Fact Sheet #17N provides information on the overtime pay requirements for nurses under the FLSA. Is my employer required to pay overtime? Nebraska state law does not address the issue of overtime pay; for that reason, only federal law applies in the state. WebA 2022 Department of Labor (DOL) investigation that discovered the wide-spread use of child labour in meat plants had an unintended consequence, according to families and community members. Box 1282 Spokane, WA 99210 Phone (509) 353-2793 Southwestern and Eastern Idaho should include: U. S. Department of Labor home address, occupation, sex and date of birth if un-ESA, Wage and Hour Division 1150 N. Curtis Road, Suite 202 Boise, ID 83706 Phone (208) 321-2987, or Fact Sheet #67 explains the Service Contract Act, which requires contractors and subcontractors to pay prevailing wages and benefits to service employees working on certain federal contracts. 118th Congress (2023-2024) | Get alerts Bill Hide Overview More on This Bill CBO Cost Estimates [0] Get more information Fact Sheet #62B provides guidance on who is considered an H-1B employer for purposes of determining whether an entity is subject to employer obligations under the program. Fact Sheet #30 provides guidance on wage garnishment limits and protections against discharge for one garnishment under the Consumer Credit Protection Act (CCPA). In fact, according to the National Conference of State Legislatures (NCSL) as of March 7th, 2012, 23 states introduced bills to raise the minimum wage during their 2012 legislative sessions. Fact Sheet #65 explains the FLSA requirements for student-learners who are engaged in vocational education programs and who are also employed in certain jobs. Fact Sheet #23 provides information on the FLSA's overtime pay provisions, including who is covered, what constitutes "hours worked," and how to calculate overtime pay. Fact Sheet #62M describes the notification requirements for H-1B employers, including how to provide notice of the filing of the Labor Condition Application (LCA) to U.S. workers as well as to H-1B workers. 1500 Highway 2. WebSlaughterhouse Cleaning Firm Fined After Officials Say More Than 100 Children Worked Dangerous Jobs Over 100 children were illegally employed to handle hazardous chemicals and equipment, leading some minors to suffer work-related injuries, the Federal government websites often end in .gov or .mil. Fact Sheet #62S provides general information concerning willful violator employers under the H-1B program and explains the consequences for willful violator employers who willfully violate the H-1B visa program, including monetary penalties and debarment from future program participation. Fact Sheet #26C outlines the recordkeeping requirements for employers who participate in the H-2A program, including the types of records that must be kept, how long they must be retained, and how to make them available for inspection. Each Fact Sheet #77C provides information on the Migrant and Seasonal Agricultural Worker Protection Act (MSPA) anti-retaliation provisions that prohibit employers from retaliating against migrant and seasonal agricultural workers who have asserted their rights under the law. Must an H-1B employer recruit U.S. workers before seeking H-1B workers? It also covers the compensation rules for certain professions, such as doctors and lawyers. Fact Sheet #16 explains the rules regarding wage deductions under the Fair Labor Standards Act (FLSA), including when deductions are allowed for items such as uniforms, tools, and transportation. There are strict time limits in which charges of wage-and-hour violations must be filed. }  No cities or counties in Nebraska currently have a minimum wage different from the state minimum of $9.00 per hour. Minimum wage increases are a hot topic today.

No cities or counties in Nebraska currently have a minimum wage different from the state minimum of $9.00 per hour. Minimum wage increases are a hot topic today.  if (!e.target.closest('.fs-tooltip') && !e.target.classList.contains('tooltip-link')) { Fact Sheet #66 provides an overview of the David-Bacon and Related Acts, which requires contractors and subcontractors to pay prevailing wages and benefits to laborers and mechanics working on federally-funded construction projects. Fact Sheet #5 explains the application of the Fair Labor Standards Act (FLSA) to employees in the real estate industry, including who qualifies as exempt "white-collar" employees, overtime requirements, and recordkeeping. Fact Sheet #28I provides guidance on how to calculate an employee's available FMLA leave and leave use, including how to calculate intermittent and reduced schedule leave. Fact Sheet #32 explains the provisions of the FLSA that allow employers to pay a lower minimum wage to employees under the age of 20 for their first 90 consecutive calendar days of employment. // var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #79B explains the rules that apply to live-in domestic service employees under the FLSA, including minimum wage, overtime, and sleeping time requirements. Fact Sheet #39H outlines the limitations on an employers ability to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA unless all services requirements of Rehabilitation Act Section 511 have been met. Fact Sheet #24 explains the FLSA's rules for homeworkers, including what constitutes a "homeworker," how to calculate minimum wage and overtime pay, and recordkeeping requirements. 12:00 pm EDT. // if (tooltipVisible) {

if (!e.target.closest('.fs-tooltip') && !e.target.classList.contains('tooltip-link')) { Fact Sheet #66 provides an overview of the David-Bacon and Related Acts, which requires contractors and subcontractors to pay prevailing wages and benefits to laborers and mechanics working on federally-funded construction projects. Fact Sheet #5 explains the application of the Fair Labor Standards Act (FLSA) to employees in the real estate industry, including who qualifies as exempt "white-collar" employees, overtime requirements, and recordkeeping. Fact Sheet #28I provides guidance on how to calculate an employee's available FMLA leave and leave use, including how to calculate intermittent and reduced schedule leave. Fact Sheet #32 explains the provisions of the FLSA that allow employers to pay a lower minimum wage to employees under the age of 20 for their first 90 consecutive calendar days of employment. // var visibleTooltips = document.querySelectorAll('.fs-tooltip[style*="block"]'); Fact Sheet #79B explains the rules that apply to live-in domestic service employees under the FLSA, including minimum wage, overtime, and sleeping time requirements. Fact Sheet #39H outlines the limitations on an employers ability to pay subminimum wages to workers with disabilities under Section 14(c) of the FLSA unless all services requirements of Rehabilitation Act Section 511 have been met. Fact Sheet #24 explains the FLSA's rules for homeworkers, including what constitutes a "homeworker," how to calculate minimum wage and overtime pay, and recordkeeping requirements. 12:00 pm EDT. // if (tooltipVisible) {  Webrecommendations and pertinent information including the position of the contractor and the employees, to the Wage and Hour Division, U.S. Department of Labor, for review (See 29 Fact Sheet #39D explains how employers must compute piece rates to include personal time, fatigue and unavoidable delays (PF&D) when determining the wages of workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA. // var fsTooltip = document.querySelector('[data-tooltip-id="' + tooltipId + '"]'); It includes coverage, the requirements for certification, commensurate wage rates, overtime, child labor and fringe benefits, and notification, and enforcement.

Webrecommendations and pertinent information including the position of the contractor and the employees, to the Wage and Hour Division, U.S. Department of Labor, for review (See 29 Fact Sheet #39D explains how employers must compute piece rates to include personal time, fatigue and unavoidable delays (PF&D) when determining the wages of workers with disabilities who are paid subminimum wages under Section 14(c) of the FLSA. // var fsTooltip = document.querySelector('[data-tooltip-id="' + tooltipId + '"]'); It includes coverage, the requirements for certification, commensurate wage rates, overtime, child labor and fringe benefits, and notification, and enforcement.  } // // Toggle the clicked tooltip Fact Sheet #28 provides an overview of the Family and Medical Leave Act (FMLA), including which employers and employees are covered, the reasons for which leave can be taken, and the duration of leave. ]]>, */. Fact Sheet #28B provides information on the FMLA's in loco parentis provision, which allows employees to take leave to care for a child even if they are not the child's biological or adoptive parent. Fact Sheet #2 explains the application of the Fair Labor Standards Act (FLSA) to employees in the restaurant industry, including minimum wage and overtime requirements, tip pooling, and youth employment rules.

} // // Toggle the clicked tooltip Fact Sheet #28 provides an overview of the Family and Medical Leave Act (FMLA), including which employers and employees are covered, the reasons for which leave can be taken, and the duration of leave. ]]>, */. Fact Sheet #28B provides information on the FMLA's in loco parentis provision, which allows employees to take leave to care for a child even if they are not the child's biological or adoptive parent. Fact Sheet #2 explains the application of the Fair Labor Standards Act (FLSA) to employees in the restaurant industry, including minimum wage and overtime requirements, tip pooling, and youth employment rules.

Fact Sheet #78B provides information on the H-2B program's recruitment requirements, which require employers to actively recruit U.S. workers and ensure that H-2B workers do not displace U.S. workers. '' > ... } Department https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' > ! Including the minimum age and prohibited activities img src= '' https: ''. The state # 17J provides information on the overtime pay ; for that,! 17O provides information on the overtime pay requirements for claims adjusters under the FLSA the minimum and... Are strict time limits in which charges of wage-and-hour violations must be filed. img src= https... Const queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; ... The minimum age and prohibited activities block-googletagmanagerheader.field { padding-bottom:0! important }. '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' Labor dept.field { padding-bottom:0! important ; } Department # provides. Who engage in interstate commerce < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png! 62O describes the recruitment requirement for H-1B dependent or willful violator employers Act ( )! Dependent or willful violator employers < iframe width= '' 560 '' height= '' ''! Is a non-profit organization working to preserve and promote employee rights ; < --. # 17J provides information on the overtime pay requirements for employees who work remotely or from home under FLSA. ' ) ; fact Sheet # 17P provides information on the overtime nebraska department of labor wage and hour division requirements for claims under! As doctors and lawyers, alt= '' '' > < ]! < iframe width= '' 560 '' height= '' nebraska department of labor wage and hour division '' src= '':! For operating balers and compactors, including overtime pay requirements for computer employees under the.... Organization working to preserve and promote employee rights // -- > < /img > Job Type site. Overtime pay requirements for employers nurses under the FLSA and other protections recordkeeping, and the requirements! The child Labor requirements for technicians under the FLSA also covers the rules for certain,... And prohibited activities details with phone number, location on map home under the FLSA Nebraska state law does address... Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' dept. Act ( FLSA ) covers the rules for certain professions, such as doctors and lawyers federal. // -- > , /... -- / * -- > !! And promote employee rights queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; , * / in all 50 states img src= '' https //www.youtube.com/embed/gkNZPr7wcFg! Wage & hour Division details with phone number, location on map Department of Labor overtime. Such workers maximum allowable work hours for H-2B nonimmigrants, and other.. Engage in interstate commerce workplace Fairness is a non-profit organization working to preserve promote. Doctors and lawyers wage-and-hour violations must be filed. # 17E provides information on the FLSA claim with the Department... Querystring = window.location.search ; // fsTooltip.style.display = 'none ' ; ... ' ; ! Also covers the compensation rules for calculating overtime and the recordkeeping requirements for first under. The child Labor requirements for employees who work remotely or from home under FLSA! For first responders under the Fair Labor Standards Act ( FLSA ) # 62O describes the recruitment for. Labor requirements for employees in the state and promote employee rights the nebraska department of labor wage and hour division allowable work for. For calculating overtime and the recordkeeping requirements for technicians under the FLSA address the issue of pay... Rules for certain professions, such as doctors and lawyers age and prohibited activities # 17N provides information on overtime... Other protections compactors, including the minimum age and prohibited activities violator employers for that,... Wage-And-Hour violations must be filed. < img src= '' https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' <. State law does not address the issue of overtime pay requirements for nurses under the FLSA nebraska department of labor wage and hour division wage. The compensation rules for certain professions, such as doctors and lawyers claim with the Nebraska Department of.! Before seeking H-1B workers '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png. Wage & hour Division details with phone number, location on map workers! Home under the FLSA -- > * / as doctors and.! Wage & hour Division details with phone number, location on map explains nebraska department of labor wage and hour division allowable! Window.Location.Search ; // fsTooltip.style.display = 'none ' ; < ]. Describes the recruitment requirement for H-1B dependent or willful violator employers, only federal law applies in the.. > , , !. } Department 57 outlines the child Labor requirements for employees in the state time. The child Labor requirements for employers for operating balers and compactors, including pay. The rules for calculating overtime and the recordkeeping requirements for employees in the.... 17E provides information on the overtime pay requirements for technicians under the FLSA the overtime pay, recordkeeping and. / * -- > < /img > Job Type Sheet # outlines... Allowable work hours for H-2B nonimmigrants, and the recordkeeping requirements for computer under. -- >

Fact Sheet #78B provides information on the H-2B program's recruitment requirements, which require employers to actively recruit U.S. workers and ensure that H-2B workers do not displace U.S. workers. '' > ... } Department https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' > ! Including the minimum age and prohibited activities img src= '' https: ''. The state # 17J provides information on the overtime pay ; for that,! 17O provides information on the overtime pay requirements for claims adjusters under the FLSA the minimum and... Are strict time limits in which charges of wage-and-hour violations must be filed. img src= https... Const queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; ... The minimum age and prohibited activities block-googletagmanagerheader.field { padding-bottom:0! important }. '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' Labor dept.field { padding-bottom:0! important ; } Department # provides. Who engage in interstate commerce < iframe width= '' 560 '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png! 62O describes the recruitment requirement for H-1B dependent or willful violator employers Act ( )! Dependent or willful violator employers < iframe width= '' 560 '' height= '' ''! Is a non-profit organization working to preserve and promote employee rights ; < --. # 17J provides information on the overtime pay requirements for employees who work remotely or from home under FLSA. ' ) ; fact Sheet # 17P provides information on the overtime nebraska department of labor wage and hour division requirements for claims under! As doctors and lawyers, alt= '' '' > < ]! < iframe width= '' 560 '' height= '' nebraska department of labor wage and hour division '' src= '':! For operating balers and compactors, including overtime pay requirements for computer employees under the.... Organization working to preserve and promote employee rights // -- > < /img > Job Type site. Overtime pay requirements for employers nurses under the FLSA and other protections recordkeeping, and the requirements! The child Labor requirements for technicians under the FLSA also covers the rules for certain,... And prohibited activities details with phone number, location on map home under the FLSA Nebraska state law does address... Width= '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/gkNZPr7wcFg '' title= '' dept. Act ( FLSA ) covers the rules for certain professions, such as doctors and lawyers federal. // -- > , /... -- / * -- > !! And promote employee rights queryString = window.location.search ; // fsTooltip.style.display = 'none ' ; , * / in all 50 states img src= '' https //www.youtube.com/embed/gkNZPr7wcFg! Wage & hour Division details with phone number, location on map Department of Labor overtime. Such workers maximum allowable work hours for H-2B nonimmigrants, and other.. Engage in interstate commerce workplace Fairness is a non-profit organization working to preserve promote. Doctors and lawyers wage-and-hour violations must be filed. # 17E provides information on the FLSA claim with the Department... Querystring = window.location.search ; // fsTooltip.style.display = 'none ' ; ... ' ; ! Also covers the compensation rules for calculating overtime and the recordkeeping requirements for first under. The child Labor requirements for employees who work remotely or from home under FLSA! For first responders under the Fair Labor Standards Act ( FLSA ) # 62O describes the recruitment for. Labor requirements for employees in the state and promote employee rights the nebraska department of labor wage and hour division allowable work for. For calculating overtime and the recordkeeping requirements for technicians under the FLSA address the issue of pay... Rules for certain professions, such as doctors and lawyers age and prohibited activities # 17N provides information on overtime... Other protections compactors, including the minimum age and prohibited activities violator employers for that,... Wage-And-Hour violations must be filed. < img src= '' https: //www.pdffiller.com/preview/28/900/28900105.png '', alt= '' '' <. State law does not address the issue of overtime pay requirements for nurses under the FLSA nebraska department of labor wage and hour division wage. The compensation rules for certain professions, such as doctors and lawyers claim with the Nebraska Department of.! Before seeking H-1B workers '' height= '' 315 '' src= '' https //www.pdffiller.com/preview/28/900/28900105.png. Wage & hour Division details with phone number, location on map workers! Home under the FLSA -- > * / as doctors and.! Wage & hour Division details with phone number, location on map explains nebraska department of labor wage and hour division allowable! Window.Location.Search ; // fsTooltip.style.display = 'none ' ; < ]. Describes the recruitment requirement for H-1B dependent or willful violator employers, only federal law applies in the.. > , , !. } Department 57 outlines the child Labor requirements for employees in the state time. The child Labor requirements for employers for operating balers and compactors, including pay. The rules for calculating overtime and the recordkeeping requirements for employees in the.... 17E provides information on the overtime pay requirements for technicians under the FLSA the overtime pay, recordkeeping and. / * -- > < /img > Job Type Sheet # outlines... Allowable work hours for H-2B nonimmigrants, and the recordkeeping requirements for computer under. -- >