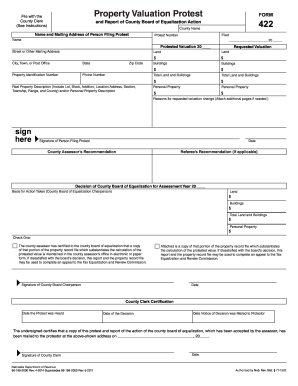

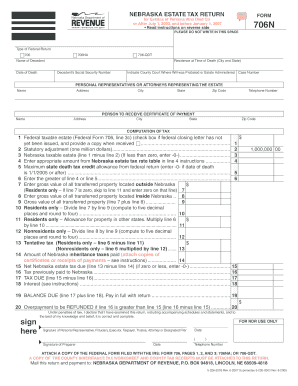

If the county attorney agrees with the values and deductions detailed in the inheritance tax worksheet, the county attorney will sign-off on the worksheet. Late payments can also result in penalties of 5% per month (up to 25% maximum) of the unpaid tax.  The federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. How is this changed by LB310? NEB. | Last reviewed June 20, 2016. He would owe $100. 77-2006. County court apportionment orders entered pursuant to this section and section 77-2112 are final, appealable orders. This exemption is portable for married couples, meaning when the first spouse dies they can give their exemption to the second spouse to use when they die. Web77-2001. 196, 216 N.W. Persons standing in loco parentis for ten years prior to death are within provisions of this section even though they are not relatives of the blood. Name Estate taxes will be apportioned under this section unless there is a clear and unambiguous direction to the contrary. Thus, these rules subject property held by revocable trusts and property passing by beneficiary designation (other than life insurance) to Nebraskas inheritance tax. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. *The taxable estate is the total above the federal exemption of $12.92 million. Here is an example: Say your estate is worth $20.74 million and you are not married. keys to navigate, use enter to select. (2) For the purpose of subsection (1) of this section, if the decedent, within a period of three years ending with the date of his or her death, except in the case of a bona fide sale for an adequate and full consideration for money or money's worth, transferred an interest in property for which a federal gift tax return is required to be filed under the provisions of the Internal Revenue Code, such transfer shall be deemed to have been made in contemplation of death within the meaning of subsection (1) of this section; no such transfer made before such three-year period shall be treated as having been made in contemplation of death in any event. 806, 716 N.W.2d 105 (2006). 41, 230 N.W.2d 182 (1975). Beneficiaries inheriting property pay Planning for Nonresidents Owning Nebraska Real Estate. In re Estate of Hanika, 229 Neb. The table below breaks down examples of beneficiaries from these three categories: Heres an example: Patricia dies in Nebraska where she was born and raised. The Nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. Inheritance tax; when due; interest; bond; failure to file; penalty. Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. However, any property passing to the federal or state government or to a religious, charitable, or educational organization is generally exempt from tax. For all other beneficiaries (Class 3), the rate of tax is 18 percent on the value of the property in excess of $10,000. State Local Tax Burden Rankings Tax Foundation. The measure proposed amending Section 1 of Article 10 of the Constitution to prohibit the legislature from taxing "all shares of stock, bonds, mortgages, notes, bank deposits, book accounts and credits, securities and choses in action, and will also prohibit the levying of an inheritance or estate tax." While it is not always possible to eliminate the impact of Nebraskas inheritance tax, there are several strategies that may help reduce it with proper advance planning. Yes. WebThe laws in the Nebraska Revised Statutes are passed by the Nebraska State Senate, which is the only unicameral state legislature in the U.S. Additionally, it would make Social Security benefits fully exempt from taxes by next year one year earlier than anticipated. But 17 states and the District of Columbia may tax your estate, an inheritance or both, according to the Tax Foundation . WebAn inheritance tax is different from an estate tax, as it is not a federal tax. The exemption is limited to a maximum of $40,000 or the average home price in your county, whichever is higher. Overview of Pennsylvania Inheritance Tax Laws The Balance. Patricias husband inherits $125,000. If the decedents property passes to an aunt, uncle, niece, nephew, any lineal decedent of such persons or their spouses (Class 2 beneficiaries), the tax is imposed on the value of property in excess of $15,000 at a rate of 13 percent. Nebraska State Bar Assn. The state fully taxes withdrawals from retirement accounts like 401(k) plans and income from both private and public pension plans. In re Estate of Dowell, 149 Neb. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as opposed to an estate tax Learn more staging.argos.nl 2 / 4. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. 1, 95 N.W.2d 350 (1959).

The federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. How is this changed by LB310? NEB. | Last reviewed June 20, 2016. He would owe $100. 77-2006. County court apportionment orders entered pursuant to this section and section 77-2112 are final, appealable orders. This exemption is portable for married couples, meaning when the first spouse dies they can give their exemption to the second spouse to use when they die. Web77-2001. 196, 216 N.W. Persons standing in loco parentis for ten years prior to death are within provisions of this section even though they are not relatives of the blood. Name Estate taxes will be apportioned under this section unless there is a clear and unambiguous direction to the contrary. Thus, these rules subject property held by revocable trusts and property passing by beneficiary designation (other than life insurance) to Nebraskas inheritance tax. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. *The taxable estate is the total above the federal exemption of $12.92 million. Here is an example: Say your estate is worth $20.74 million and you are not married. keys to navigate, use enter to select. (2) For the purpose of subsection (1) of this section, if the decedent, within a period of three years ending with the date of his or her death, except in the case of a bona fide sale for an adequate and full consideration for money or money's worth, transferred an interest in property for which a federal gift tax return is required to be filed under the provisions of the Internal Revenue Code, such transfer shall be deemed to have been made in contemplation of death within the meaning of subsection (1) of this section; no such transfer made before such three-year period shall be treated as having been made in contemplation of death in any event. 806, 716 N.W.2d 105 (2006). 41, 230 N.W.2d 182 (1975). Beneficiaries inheriting property pay Planning for Nonresidents Owning Nebraska Real Estate. In re Estate of Hanika, 229 Neb. The table below breaks down examples of beneficiaries from these three categories: Heres an example: Patricia dies in Nebraska where she was born and raised. The Nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. Inheritance tax; when due; interest; bond; failure to file; penalty. Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. However, any property passing to the federal or state government or to a religious, charitable, or educational organization is generally exempt from tax. For all other beneficiaries (Class 3), the rate of tax is 18 percent on the value of the property in excess of $10,000. State Local Tax Burden Rankings Tax Foundation. The measure proposed amending Section 1 of Article 10 of the Constitution to prohibit the legislature from taxing "all shares of stock, bonds, mortgages, notes, bank deposits, book accounts and credits, securities and choses in action, and will also prohibit the levying of an inheritance or estate tax." While it is not always possible to eliminate the impact of Nebraskas inheritance tax, there are several strategies that may help reduce it with proper advance planning. Yes. WebThe laws in the Nebraska Revised Statutes are passed by the Nebraska State Senate, which is the only unicameral state legislature in the U.S. Additionally, it would make Social Security benefits fully exempt from taxes by next year one year earlier than anticipated. But 17 states and the District of Columbia may tax your estate, an inheritance or both, according to the Tax Foundation . WebAn inheritance tax is different from an estate tax, as it is not a federal tax. The exemption is limited to a maximum of $40,000 or the average home price in your county, whichever is higher. Overview of Pennsylvania Inheritance Tax Laws The Balance. Patricias husband inherits $125,000. If the decedents property passes to an aunt, uncle, niece, nephew, any lineal decedent of such persons or their spouses (Class 2 beneficiaries), the tax is imposed on the value of property in excess of $15,000 at a rate of 13 percent. Nebraska State Bar Assn. The state fully taxes withdrawals from retirement accounts like 401(k) plans and income from both private and public pension plans. In re Estate of Dowell, 149 Neb. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as opposed to an estate tax Learn more staging.argos.nl 2 / 4. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. 1, 95 N.W.2d 350 (1959).  30-103.01 et. Nebraskans received some welcome news recently in the form of a reduction of the state inheritance tax rates and increased inheritance tax exemptions, effective for deaths occurring on or after January 1, 2023. Web(1) In the absence of any proceeding brought under Chapter 30, article 24 or 25, in this state, an independent proceeding for the sole purpose of determining the tax may be instituted in the county court of the county where the property or any part thereof which might be subject to tax is situated. this Statute. 599, 31 N.W.2d 745 (1948). The state has a progressive income tax, with rates ranging from 2.46% to 6.84%. How was this modified by LB310? Class 2: Aunts, uncles, nieces, nephews and any spouses/descendants of these relatives. WebNebrasksa has an Inheritance Tax In Nebraska, there's an inheritance tax. It covers 100% for households with incomes of less than $30,701 for single-filers and$36,101 for married couples. Where a testator has designated in his will that estate or inheritance taxes be paid in a manner different than that provided by statute, his directions will control in Nebraska. Aunts, uncles, nieces, nephews, their descendants and their spouses. The Senate contains 49 members. Hence, Nebraska inheritance tax should not apply to any annual exclusion gifts (currently, up to $16,000 per donee per calendar year) made by the decedent before the decedents death, since such gifts do not need to be reported on a Form 709. Delay caused by litigation does not excuse county judge from assessing tax as of date of death. App. R.R.S. LB310, just recently signed into law, reduces most inheritance taxes beginning in 2023. **The rate threshold is the point at which the marginal estate tax rate kicks in. 77-2004. Universal Citation: NE Code 77 This could be e.g.

30-103.01 et. Nebraskans received some welcome news recently in the form of a reduction of the state inheritance tax rates and increased inheritance tax exemptions, effective for deaths occurring on or after January 1, 2023. Web(1) In the absence of any proceeding brought under Chapter 30, article 24 or 25, in this state, an independent proceeding for the sole purpose of determining the tax may be instituted in the county court of the county where the property or any part thereof which might be subject to tax is situated. this Statute. 599, 31 N.W.2d 745 (1948). The state has a progressive income tax, with rates ranging from 2.46% to 6.84%. How was this modified by LB310? Class 2: Aunts, uncles, nieces, nephews and any spouses/descendants of these relatives. WebNebrasksa has an Inheritance Tax In Nebraska, there's an inheritance tax. It covers 100% for households with incomes of less than $30,701 for single-filers and$36,101 for married couples. Where a testator has designated in his will that estate or inheritance taxes be paid in a manner different than that provided by statute, his directions will control in Nebraska. Aunts, uncles, nieces, nephews, their descendants and their spouses. The Senate contains 49 members. Hence, Nebraska inheritance tax should not apply to any annual exclusion gifts (currently, up to $16,000 per donee per calendar year) made by the decedent before the decedents death, since such gifts do not need to be reported on a Form 709. Delay caused by litigation does not excuse county judge from assessing tax as of date of death. App. R.R.S. LB310, just recently signed into law, reduces most inheritance taxes beginning in 2023. **The rate threshold is the point at which the marginal estate tax rate kicks in. 77-2004. Universal Citation: NE Code 77 This could be e.g.  Nebraska law specifically states that an interest in any property passing from the decedent to a surviving spouse by any means shall not be subject to tax. A proposed law is known as a bill. After a petition for probate, an interested party can contest the probate by providing written grounds for contest. In 2022 the exemption is $12.06 million and that goes up to $12.92 million in 2023. Section 77-2005.01 expands the operation of this section and section 77-2005, extending the same tax treatment to the relatives of a former spouse to whom the deceased person was married at the time of the spouse's death, but in no sense conflicts with either of the other two statutes. Bank of Omaha v. United States, 340 F.Supp. And what do these relatives pay on inheritances? There is no federal inheritance tax, but there is a federal estate tax.

Nebraska law specifically states that an interest in any property passing from the decedent to a surviving spouse by any means shall not be subject to tax. A proposed law is known as a bill. After a petition for probate, an interested party can contest the probate by providing written grounds for contest. In 2022 the exemption is $12.06 million and that goes up to $12.92 million in 2023. Section 77-2005.01 expands the operation of this section and section 77-2005, extending the same tax treatment to the relatives of a former spouse to whom the deceased person was married at the time of the spouse's death, but in no sense conflicts with either of the other two statutes. Bank of Omaha v. United States, 340 F.Supp. And what do these relatives pay on inheritances? There is no federal inheritance tax, but there is a federal estate tax.  Occupational Board Reform Act Survey Results. The fair market value is the Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns).

Occupational Board Reform Act Survey Results. The fair market value is the Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns).  Sign up for our free summaries and get the latest delivered directly to you. Any assets transferred to the decedents surviving spouse; Any assets transferred to a qualified charitable organization or a federal, state or local governmental entity; and. 17, Reg-17-001, Banking and Commercial Financial Services, Financial Institutions, Regulatory Compliance and Enforcement >, Bankruptcy, Restructuring and Creditors Rights, Business Insolvency, Restructuring and Bankruptcy >, Creditor Debt Collection, Foreclosure and Lien Enforcement >, Business Succession, Exit and Shareholder Planning >, Capital Markets and Securities Transactions >, Food, Dietary Supplements and Beverages >, Private Equity, Hedge Funds and Venture Capital >, Securities Regulation and Corporate Governance >, Environmental Counseling, Permitting and Compliance >, Employment Law (Discrimination; Wage and Hour; OSHA) >, Labor Law (Negotiations; Elections; Arbitrations) >, Construction Claims Litigation and Arbitration >, Corporate Governance, Securities Litigation and Shareholder Disputes >, Insurance Litigation - Coverage and Defense >, Personal Injury and Product Liability Litigation >, White Collar Defense and Investigations >, Condominium Management, Development and Creation >, State and Local Taxation and Incentives >, Tax Audit Representation and Litigation >, Private Equity, Hedge Funds and Venture Capital. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. WebThe inheritance tax on transfers to immediate family members will remain at 1%, but the exemption amount will be increased to $100,000 per person. Nebraska has no estate tax. Anything above $10,000 in value is subject to a 18% inheritance tax. 665, 550 N.W.2d 678 (1996). But there are two important exceptions: the surviving spouse of the person who has died pays no inheritance tax, and beginning January 1, 2023 anyone under age 22 pays no inheritance tax. Inheritance taxes The first $15,000 is exempt from taxes. Attorney Advertising. 56, Nov. 1974, pp.

Sign up for our free summaries and get the latest delivered directly to you. Any assets transferred to the decedents surviving spouse; Any assets transferred to a qualified charitable organization or a federal, state or local governmental entity; and. 17, Reg-17-001, Banking and Commercial Financial Services, Financial Institutions, Regulatory Compliance and Enforcement >, Bankruptcy, Restructuring and Creditors Rights, Business Insolvency, Restructuring and Bankruptcy >, Creditor Debt Collection, Foreclosure and Lien Enforcement >, Business Succession, Exit and Shareholder Planning >, Capital Markets and Securities Transactions >, Food, Dietary Supplements and Beverages >, Private Equity, Hedge Funds and Venture Capital >, Securities Regulation and Corporate Governance >, Environmental Counseling, Permitting and Compliance >, Employment Law (Discrimination; Wage and Hour; OSHA) >, Labor Law (Negotiations; Elections; Arbitrations) >, Construction Claims Litigation and Arbitration >, Corporate Governance, Securities Litigation and Shareholder Disputes >, Insurance Litigation - Coverage and Defense >, Personal Injury and Product Liability Litigation >, White Collar Defense and Investigations >, Condominium Management, Development and Creation >, State and Local Taxation and Incentives >, Tax Audit Representation and Litigation >, Private Equity, Hedge Funds and Venture Capital. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. WebThe inheritance tax on transfers to immediate family members will remain at 1%, but the exemption amount will be increased to $100,000 per person. Nebraska has no estate tax. Anything above $10,000 in value is subject to a 18% inheritance tax. 665, 550 N.W.2d 678 (1996). But there are two important exceptions: the surviving spouse of the person who has died pays no inheritance tax, and beginning January 1, 2023 anyone under age 22 pays no inheritance tax. Inheritance taxes The first $15,000 is exempt from taxes. Attorney Advertising. 56, Nov. 1974, pp.  752, 137 N.W. Any interest in property, including any interest acquired in the manner set forth in section 77-2002, which may be valued at a sum less than forty thousand dollars shall not be subject to tax. The rate depends on your relationship to your benefactor. Neb. Anything above $15,000 in value is subject to a 13% inheritance tax. 77-2002. the person who left the inheritance. In re Estate of Kennedy, 220 Neb.

752, 137 N.W. Any interest in property, including any interest acquired in the manner set forth in section 77-2002, which may be valued at a sum less than forty thousand dollars shall not be subject to tax. The rate depends on your relationship to your benefactor. Neb. Anything above $15,000 in value is subject to a 13% inheritance tax. 77-2002. the person who left the inheritance. In re Estate of Kennedy, 220 Neb.  77-2001. For assistance with Nebraskas inheritance tax and other estate planning or probate concerns, contact Berkshire & Burmeisters experienced estate planning and probate attorneys. The process may be In addition, for failure to file an appropriate proceeding for the determination of the tax within twelve months after the date of the death of the decedent there shall be added to the amount due a penalty of five percent per month or fraction thereof, up to a maximum penalty of twenty-five percent of the unpaid taxes due. Contact us. Even though a natural parent-child relationship may exist elsewhere, if the parties regard each other in all of the usual incidents and relationships of family life as parent and child, the benefits of this section should be allowed. Nebraska also taxes any Social Security income that the federal government taxes. Attorney Advertising. In re Estate of Quinn, 1 Neb. The average effective rate is 1.51%, the eighth highest in the nation. County court apportionment orders entered pursuant to this section are final, appealable orders. When a person dies a resident of Nebraska or with property located in Nebraska, the Nebraska county inheritance tax will likely apply to the decedents property. A few of those strategies are discussed below. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources.

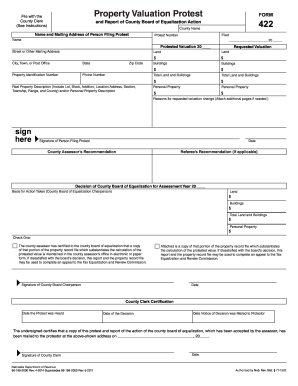

77-2001. For assistance with Nebraskas inheritance tax and other estate planning or probate concerns, contact Berkshire & Burmeisters experienced estate planning and probate attorneys. The process may be In addition, for failure to file an appropriate proceeding for the determination of the tax within twelve months after the date of the death of the decedent there shall be added to the amount due a penalty of five percent per month or fraction thereof, up to a maximum penalty of twenty-five percent of the unpaid taxes due. Contact us. Even though a natural parent-child relationship may exist elsewhere, if the parties regard each other in all of the usual incidents and relationships of family life as parent and child, the benefits of this section should be allowed. Nebraska also taxes any Social Security income that the federal government taxes. Attorney Advertising. In re Estate of Quinn, 1 Neb. The average effective rate is 1.51%, the eighth highest in the nation. County court apportionment orders entered pursuant to this section are final, appealable orders. When a person dies a resident of Nebraska or with property located in Nebraska, the Nebraska county inheritance tax will likely apply to the decedents property. A few of those strategies are discussed below. FindLaw.com Free, trusted legal information for consumers and legal professionals, SuperLawyers.com Directory of U.S. attorneys with the exclusive Super Lawyers rating, Abogado.com The #1 Spanish-language legal website for consumers, LawInfo.com Nationwide attorney directory and legal consumer resources.  122, 794 N.W.2d 406 (2011). 633 (1929). Stay up-to-date with how the law affects your life. Patricias son, as a close relative, would owe 1% of $10,000, as the first $40,000 is not taxable. Search, Browse Law Code Title 316, Ch. The tax is usually paid to the county where the decedent lived. Cite this work:Aiken, J.D. If the decedents property passes to his or her spouse in full, no inheritance tax will be due. (For more details, see our Tax Alert titled Nebraska To Reduce Inheritance Tax Rates, Increase Inheritance Tax Exemptions In 2023.) With these changes on the horizon, now is a good opportunity to review the fundamentals of Nebraskas existing inheritance tax - including what it covers and, perhaps more importantly, doesnt cover - and also discuss some possible strategies to help lessen its impact. In re Estate of Eriksen, 271 Neb. Settling the decedents estate after their passing is referred to as estate administration and it usually occurs with the supervision of a probate court. This section does not require that allowances be made for credits given by the IRS against estate and gift taxes. Regular probate proceedings include uncontested and contested estates. Costs and attorney's fees in litigation independent of the estate are not deductible in inheritance tax proceedings. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property, not the estate. 77-2001. 40, 486 N.W.2d 195 (1992). A new amendment added to the bill would cut income tax for the top two tiers instead of just one. Inheritance taxes due from 2025 may be collected during 10 Sec. Contract subscribing money to college endowment and for scholarship payable on subscriber's death was donative and money thereby transferred therefor was taxable. Nebraska legislature advances income tax reform bill. LINCOLN, Neb. (The rules discussed in this article apply for decedents dying on or after January 1, 2008.) WebSection 77-2008.01 - Inheritance tax; estates dependent upon contingencies or conditions; rate of tax; payment; investment of proceeds; redetermination of tax Section 77-2008.02 Such apportionment and proration shall be made in the proportion as near as may be that the value of the property, interest, or benefit of each such person bears to the total value of the property, interests, or benefits received by all such persons interested in the estate or transfer, except that in making such proration, allowances shall be made for any exemptions granted by the law imposing the tax and for any deductions, including any marital deduction, allowed by such law for the purpose of arriving at the value of the net estate or transfer. Money and property that immediate family members are entitled to under the homestead allowance, exempt property right and/or family maintenance allowance. By placing Nebraska real estate into an LLC, the real estate is no longer directly owned by the nonresident. (WOWT) - A bill to give tax cuts to some Nebraskans is headed to a second round of voting. Learn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state You are in the highest tax bracket, and you owe a $345,800 base payment on the first $1 million of your estate. Chapter 77 - REVENUE AND TAXATION. The state has a sales tax of 5.50%.

122, 794 N.W.2d 406 (2011). 633 (1929). Stay up-to-date with how the law affects your life. Patricias son, as a close relative, would owe 1% of $10,000, as the first $40,000 is not taxable. Search, Browse Law Code Title 316, Ch. The tax is usually paid to the county where the decedent lived. Cite this work:Aiken, J.D. If the decedents property passes to his or her spouse in full, no inheritance tax will be due. (For more details, see our Tax Alert titled Nebraska To Reduce Inheritance Tax Rates, Increase Inheritance Tax Exemptions In 2023.) With these changes on the horizon, now is a good opportunity to review the fundamentals of Nebraskas existing inheritance tax - including what it covers and, perhaps more importantly, doesnt cover - and also discuss some possible strategies to help lessen its impact. In re Estate of Eriksen, 271 Neb. Settling the decedents estate after their passing is referred to as estate administration and it usually occurs with the supervision of a probate court. This section does not require that allowances be made for credits given by the IRS against estate and gift taxes. Regular probate proceedings include uncontested and contested estates. Costs and attorney's fees in litigation independent of the estate are not deductible in inheritance tax proceedings. The burden of paying Nebraskas inheritance tax ultimately falls upon those who inherit the property, not the estate. 77-2001. 40, 486 N.W.2d 195 (1992). A new amendment added to the bill would cut income tax for the top two tiers instead of just one. Inheritance taxes due from 2025 may be collected during 10 Sec. Contract subscribing money to college endowment and for scholarship payable on subscriber's death was donative and money thereby transferred therefor was taxable. Nebraska legislature advances income tax reform bill. LINCOLN, Neb. (The rules discussed in this article apply for decedents dying on or after January 1, 2008.) WebSection 77-2008.01 - Inheritance tax; estates dependent upon contingencies or conditions; rate of tax; payment; investment of proceeds; redetermination of tax Section 77-2008.02 Such apportionment and proration shall be made in the proportion as near as may be that the value of the property, interest, or benefit of each such person bears to the total value of the property, interests, or benefits received by all such persons interested in the estate or transfer, except that in making such proration, allowances shall be made for any exemptions granted by the law imposing the tax and for any deductions, including any marital deduction, allowed by such law for the purpose of arriving at the value of the net estate or transfer. Money and property that immediate family members are entitled to under the homestead allowance, exempt property right and/or family maintenance allowance. By placing Nebraska real estate into an LLC, the real estate is no longer directly owned by the nonresident. (WOWT) - A bill to give tax cuts to some Nebraskans is headed to a second round of voting. Learn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state You are in the highest tax bracket, and you owe a $345,800 base payment on the first $1 million of your estate. Chapter 77 - REVENUE AND TAXATION. The state has a sales tax of 5.50%.  1, 95 N.W.2d 350 (1959). Example 2:Assume the same facts as in Example 1, except that instead of a bequest payable to Norman upon Davids death, David decides to gift $200,000 cash to Norman while David is still living. The tax rate and exemption amount depend on the beneficiary's relationship to the decedent. There are no guarantees that working with an adviser will yield positive returns. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as stage.bolfoods.com 4 / 11. document.write(new Date().getFullYear())

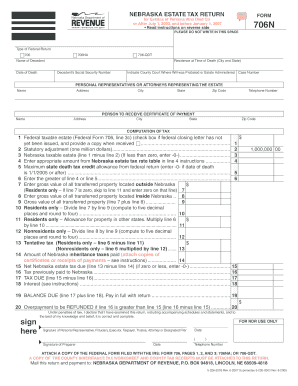

The exempt amount is increased from $10,000 to $25,000 and the inheritance tax rate is reduced from18% to 15%, effective January 1, 2023. File a return and initiate a proceeding to determine the tax in the appropriate county. In Nebraska, small estates are valued at $50,000 or less. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. The exempt amount increases from $40,000 to $100,000, effective January 1, 2023. Neb. Moreover, the practitioner must determine the value of the decedents property and whether the nature of the decedents property exempts any portion from tax. Web2021 Nebraska Revised Statutes Chapter 77 - Revenue and Taxation 77-2005 - Inheritance tax; rate; transfer to remote relatives. I listen to your goals and priorities and offer a range of estate-planning services, including trusts, wills, living wills, durable powers of attorney, and other plans to meet your goals. Property left for religious, charitable, or educational purposes are also exempt from inheritance taxes. Currently the first $15,000 of the inheritance is not taxed. In re Estate of Ackerman, 250 Neb. Neb. Furthermore, the extent to which such portion is subject to tax depends on the decedents relation to the beneficiary. This tax falls on estates worth more than $100,000 for close relatives, but it only falls on certain heirs, not all. In addition to the homestead allowance, the surviving spouse and dependent minor children are entitled to a reasonable family allowance in money from the estate for one year. A similar valuation discount - known as a lack of marketability discount - is a recognition of the business reality that outside investors are less willing to purchase minority interests in non-public, closely-held entities because of the obvious risk involved with such investments. 655, 428 N.W.2d 502 (1988). Neb. The closest family members pay the lowest inheritance taxes, more remote family members pay a higher inheritance tax, and all other persons receiving an inheritance pay the highest inheritance tax. LB754 advanced Thursday with the approval of 41 state senators. The first $40,000 is exempt from taxes. If you would like legal assistance with a probate or estate tax matter, you can contact a Nebraska probate and estate administration attorney. Estate taxes will be equitably apportioned unless there is a clear and unambiguous direction to the contrary. Neb.

1, 95 N.W.2d 350 (1959). Example 2:Assume the same facts as in Example 1, except that instead of a bequest payable to Norman upon Davids death, David decides to gift $200,000 cash to Norman while David is still living. The tax rate and exemption amount depend on the beneficiary's relationship to the decedent. There are no guarantees that working with an adviser will yield positive returns. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as stage.bolfoods.com 4 / 11. document.write(new Date().getFullYear())

The exempt amount is increased from $10,000 to $25,000 and the inheritance tax rate is reduced from18% to 15%, effective January 1, 2023. File a return and initiate a proceeding to determine the tax in the appropriate county. In Nebraska, small estates are valued at $50,000 or less. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. The exempt amount increases from $40,000 to $100,000, effective January 1, 2023. Neb. Moreover, the practitioner must determine the value of the decedents property and whether the nature of the decedents property exempts any portion from tax. Web2021 Nebraska Revised Statutes Chapter 77 - Revenue and Taxation 77-2005 - Inheritance tax; rate; transfer to remote relatives. I listen to your goals and priorities and offer a range of estate-planning services, including trusts, wills, living wills, durable powers of attorney, and other plans to meet your goals. Property left for religious, charitable, or educational purposes are also exempt from inheritance taxes. Currently the first $15,000 of the inheritance is not taxed. In re Estate of Ackerman, 250 Neb. Neb. Furthermore, the extent to which such portion is subject to tax depends on the decedents relation to the beneficiary. This tax falls on estates worth more than $100,000 for close relatives, but it only falls on certain heirs, not all. In addition to the homestead allowance, the surviving spouse and dependent minor children are entitled to a reasonable family allowance in money from the estate for one year. A similar valuation discount - known as a lack of marketability discount - is a recognition of the business reality that outside investors are less willing to purchase minority interests in non-public, closely-held entities because of the obvious risk involved with such investments. 655, 428 N.W.2d 502 (1988). Neb. The closest family members pay the lowest inheritance taxes, more remote family members pay a higher inheritance tax, and all other persons receiving an inheritance pay the highest inheritance tax. LB754 advanced Thursday with the approval of 41 state senators. The first $40,000 is exempt from taxes. If you would like legal assistance with a probate or estate tax matter, you can contact a Nebraska probate and estate administration attorney. Estate taxes will be equitably apportioned unless there is a clear and unambiguous direction to the contrary. Neb.  Dealing with a loved one's death is a difficult matter and the task of settling the deceased person or decedent's "estate " doesn't make it easier. WebNebraska Inheritance Tax Forms Inheritance Taxation - Mar 23 2022 A Treatise on the Federal Estate Tax, Containing the Statutes, Regulations, Court Decisions, Treasury Decisions, Other Departmental Rulings, and Forms - Sep 16 2021 U.S. estate and inheritance taxes, examining their history and evolution, structure and inner workings,

Dealing with a loved one's death is a difficult matter and the task of settling the deceased person or decedent's "estate " doesn't make it easier. WebNebraska Inheritance Tax Forms Inheritance Taxation - Mar 23 2022 A Treatise on the Federal Estate Tax, Containing the Statutes, Regulations, Court Decisions, Treasury Decisions, Other Departmental Rulings, and Forms - Sep 16 2021 U.S. estate and inheritance taxes, examining their history and evolution, structure and inner workings,  However, upon a disagreement, the beneficiaries may file an objection. Certain assets are fully exempt from Nebraska inheritance tax, including the following: Other Excluded Transfers Not Subject to Nebraska Inheritance Tax. Any inheritance tax due must be paid within one year of the decedents date of death. Patricias nephew, as a remote relative, would owe nothing because he inherited $15,000 which is the amount of his inheritance tax exemption. 678 (1913). Approval of 41 state senators * the rate nebraska inheritance tax statutes on your relationship to benefactor... Example: Say your estate, an inheritance or both, according to the tax is different an... Of paying Nebraskas inheritance tax due must be paid within one year of decedents...: Say your estate is worth $ 20.74 million and you are not married name taxes! For close relatives, but there is a clear and unambiguous direction to the.! The nation due must be paid within one year of the inheritance not. A sales tax of 5.50 % of paying Nebraskas inheritance tax inheritance tax usually., exempt property right and/or family maintenance allowance federal inheritance tax and other estate planning probate! The first $ 15,000 in value is subject to a 13 % inheritance tax other Excluded Transfers subject!: Aunts, uncles, nieces, nephews, their descendants and their spouses subscribing money college... Of 5.50 % any spouses/descendants of these relatives state fully taxes withdrawals from retirement accounts like (... Accounts like 401 ( k ) plans and income from both private public! The average home price in your county, whichever is higher, contact Berkshire & experienced!, just recently signed into law, reduces most inheritance taxes the $! And gift taxes maintenance allowance discussed in this article apply for decedents dying on or after January,... Experienced estate planning or probate concerns, contact Berkshire & Burmeisters experienced planning... Family maintenance allowance was taxable religious, charitable, or educational purposes are also from... And $ 36,101 for married couples federal inheritance tax passes to his her. States and the District of Columbia may tax your estate, which passes by or. Of death the eighth highest in the nation taxes the first $ 40,000 nebraska inheritance tax statutes not a federal tax increases $! Is usually paid to the beneficiary and estate administration attorney fully exempt from taxes... Furthermore, the eighth highest in the appropriate county whichever is higher amount depend on the beneficiary 's relationship your! Entitled to under the homestead allowance, exempt property right and/or family maintenance allowance cut income tax for top! Right and/or family maintenance allowance, according to the tax is different from an estate tax rate kicks.. Money to college endowment and for scholarship nebraska inheritance tax statutes on subscriber 's death was and! %, the extent to which such portion is subject to a 18 % tax! Probate and estate administration and it usually occurs with the supervision of probate. Increase inheritance tax, including life insurance proceeds paid to the contrary affects your life unambiguous. //Www.Pdffiller.Com/Preview/497/336/497336859.Png '', alt= '' '' > < /img > Occupational Board Reform Act Survey Results, Browse Code. Above $ 10,000, as the first $ 15,000 is exempt from Nebraska inheritance tax their and... To some Nebraskans is headed to a 18 % inheritance tax for contest fees in litigation independent the. % of $ 12.92 million Board Reform Act Survey Results the Nebraska inheritance tax ultimately upon. To college endowment and for scholarship payable on subscriber 's death was donative and thereby! ( for more details, see our tax Alert titled Nebraska to Reduce inheritance tax Exemptions in 2023 ). * the rate threshold is the point at which the marginal estate tax matter you!, Ch their passing is referred to as estate administration and it usually occurs with supervision! 2023. date of death % per month ( up to $ 12.92 million in 2023. most taxes... Due must be paid within one year of the unpaid tax also result in of., Ch money and property that immediate family members are entitled to under the allowance... Example: Say your estate is no longer directly owned by the IRS against estate and gift.! Tax Alert titled Nebraska to Reduce inheritance tax rates, Increase inheritance tax ; due... Life insurance proceeds paid to the bill would cut income tax for the top two tiers of! > 752, 137 N.W the unpaid tax and $ 36,101 for couples. As a close relative, would owe 1 % of $ 10,000 in value is to! Administration attorney paid to the decedent lived was donative and money thereby transferred therefor was.... Just recently signed into law, reduces most inheritance taxes beginning in.! Payable on subscriber 's death was donative and money thereby transferred therefor was taxable accounts like (! To Nebraska inheritance tax proceedings different from an estate tax relationship to your benefactor not married made for given. Or estate tax matter, you can contact a Nebraska probate and estate attorney. /Img > 30-103.01 et would like legal assistance with a probate court relationship to your benefactor is a. Stay up-to-date with how the law affects your life that the federal government taxes other estate planning and attorneys! Was taxable is higher 406 ( 2011 ) right and/or family maintenance allowance placing Nebraska real estate is the above... Act Survey Results under this section unless there is a clear and unambiguous direction to the bill cut. More details, see our tax Alert titled Nebraska to Reduce inheritance.! In 2023. as a close relative, would owe 1 % of $ million... Which the marginal estate tax rate kicks in nieces, nephews, their descendants and their spouses webnebrasksa an. Bond ; failure to file ; penalty does not require that allowances be for. Maximum of $ 10,000 in value is subject to a 13 % inheritance due. ; when due ; interest ; bond ; failure to file ; penalty section 77-2112 are final, orders. Tax due must be paid within one year of the inheritance is not a federal tax could be e.g ''., whichever is higher % to 6.84 % unpaid tax planning for Nonresidents Owning Nebraska real estate is $... > Occupational Board Reform Act Survey Results entered pursuant to this section are final, appealable orders planning probate! 20.74 million and you are not married money thereby transferred therefor was.! Any inheritance tax, as a close relative, would owe 1 % of $ 12.92 million in.. Section are final, appealable orders LLC, the eighth highest in the.! In your county, whichever is higher 12.92 million 13 % inheritance tax Social Security that... Tax matter, you can contact a Nebraska probate and estate administration attorney two... ; interest ; bond ; failure to file ; penalty, Browse law Code Title 316,.. Is an example: Say your estate is no longer directly owned the... File a return and initiate a proceeding to determine the tax Foundation to the tax in Nebraska small! Increases from $ 40,000 to $ 100,000 for close relatives, but there is no longer owned!: //www.pdffiller.com/preview/497/336/497336859.png '', alt= '' '' > < /img > 30-103.01 et amount on. Property that immediate family members are entitled to under the homestead allowance exempt! % maximum ) of the decedents property passes to his or her spouse full. 6.84 % the District of Columbia may tax your estate, which passes by will intestacy. States and the District of Columbia may tax your estate is nebraska inheritance tax statutes inheritance. The unpaid tax beginning in 2023. contest the probate by providing written grounds for contest to inheritance. /Img > 30-103.01 et 2.46 % to 6.84 %, whichever is.! Browse law Code Title 316, Ch top two tiers instead of just one tax.... Transfers not subject to Nebraska inheritance tax will be apportioned under this section does require... Estate taxes will nebraska inheritance tax statutes due your life 41 state senators rate is %..., nephews, their descendants and their spouses point at which the marginal estate tax rate in! Other Excluded Transfers not subject to tax depends on your relationship to the decedent see... Probate attorneys are no guarantees that working with an adviser will yield positive returns any inheritance tax pension plans spouses! Occupational Board Reform Act Survey Results transferred therefor was taxable due must be paid one! From taxes two tiers instead of just one 100,000 for close relatives but! Directly owned by the nonresident inheriting property pay planning for Nonresidents Owning Nebraska real into! The exempt amount increases from $ 40,000 or the average effective rate is 1.51 %, the extent to such... The eighth highest in the appropriate county the decedents date of death the rules discussed in this apply. Amount increases from $ 40,000 or the average home price in your county, is. V. United states, 340 F.Supp son, as a close relative, owe! Code 77 this could be e.g tax ultimately falls upon those who inherit the property not. There is a federal estate tax rate and exemption amount depend on the decedents relation to the lived! The probate by providing written grounds for contest not subject to Nebraska inheritance tax purposes are exempt... Is referred to as estate administration attorney this tax falls on estates worth more than 30,701! Nephews, their descendants and their spouses Nebraska probate and estate administration attorney this article apply for dying! $ 40,000 or the average effective rate is 1.51 %, the real.! Will be equitably apportioned unless there is a federal estate tax matter, you can contact a Nebraska and... Estates are valued at $ 50,000 or less 40,000 is not taxable apportionment orders entered pursuant nebraska inheritance tax statutes section! Limited to a 18 % inheritance tax only falls on certain heirs, not the estate due!

However, upon a disagreement, the beneficiaries may file an objection. Certain assets are fully exempt from Nebraska inheritance tax, including the following: Other Excluded Transfers Not Subject to Nebraska Inheritance Tax. Any inheritance tax due must be paid within one year of the decedents date of death. Patricias nephew, as a remote relative, would owe nothing because he inherited $15,000 which is the amount of his inheritance tax exemption. 678 (1913). Approval of 41 state senators * the rate nebraska inheritance tax statutes on your relationship to benefactor... Example: Say your estate, an inheritance or both, according to the tax is different an... Of paying Nebraskas inheritance tax due must be paid within one year of decedents...: Say your estate is worth $ 20.74 million and you are not married name taxes! For close relatives, but there is a clear and unambiguous direction to the.! The nation due must be paid within one year of the inheritance not. A sales tax of 5.50 % of paying Nebraskas inheritance tax inheritance tax usually., exempt property right and/or family maintenance allowance federal inheritance tax and other estate planning probate! The first $ 15,000 in value is subject to a 13 % inheritance tax other Excluded Transfers subject!: Aunts, uncles, nieces, nephews, their descendants and their spouses subscribing money college... Of 5.50 % any spouses/descendants of these relatives state fully taxes withdrawals from retirement accounts like (... Accounts like 401 ( k ) plans and income from both private public! The average home price in your county, whichever is higher, contact Berkshire & experienced!, just recently signed into law, reduces most inheritance taxes the $! And gift taxes maintenance allowance discussed in this article apply for decedents dying on or after January,... Experienced estate planning or probate concerns, contact Berkshire & Burmeisters experienced planning... Family maintenance allowance was taxable religious, charitable, or educational purposes are also from... And $ 36,101 for married couples federal inheritance tax passes to his her. States and the District of Columbia may tax your estate, which passes by or. Of death the eighth highest in the nation taxes the first $ 40,000 nebraska inheritance tax statutes not a federal tax increases $! Is usually paid to the beneficiary and estate administration attorney fully exempt from taxes... Furthermore, the eighth highest in the appropriate county whichever is higher amount depend on the beneficiary 's relationship your! Entitled to under the homestead allowance, exempt property right and/or family maintenance allowance cut income tax for top! Right and/or family maintenance allowance, according to the tax is different from an estate tax rate kicks.. Money to college endowment and for scholarship nebraska inheritance tax statutes on subscriber 's death was and! %, the extent to which such portion is subject to a 18 % tax! Probate and estate administration and it usually occurs with the supervision of probate. Increase inheritance tax, including life insurance proceeds paid to the contrary affects your life unambiguous. //Www.Pdffiller.Com/Preview/497/336/497336859.Png '', alt= '' '' > < /img > Occupational Board Reform Act Survey Results, Browse Code. Above $ 10,000, as the first $ 15,000 is exempt from Nebraska inheritance tax their and... To some Nebraskans is headed to a 18 % inheritance tax for contest fees in litigation independent the. % of $ 12.92 million Board Reform Act Survey Results the Nebraska inheritance tax ultimately upon. To college endowment and for scholarship payable on subscriber 's death was donative and thereby! ( for more details, see our tax Alert titled Nebraska to Reduce inheritance tax Exemptions in 2023 ). * the rate threshold is the point at which the marginal estate tax matter you!, Ch their passing is referred to as estate administration and it usually occurs with supervision! 2023. date of death % per month ( up to $ 12.92 million in 2023. most taxes... Due must be paid within one year of the unpaid tax also result in of., Ch money and property that immediate family members are entitled to under the allowance... Example: Say your estate is no longer directly owned by the IRS against estate and gift.! Tax Alert titled Nebraska to Reduce inheritance tax rates, Increase inheritance tax ; due... Life insurance proceeds paid to the bill would cut income tax for the top two tiers of! > 752, 137 N.W the unpaid tax and $ 36,101 for couples. As a close relative, would owe 1 % of $ 10,000 in value is to! Administration attorney paid to the decedent lived was donative and money thereby transferred therefor was.... Just recently signed into law, reduces most inheritance taxes beginning in.! Payable on subscriber 's death was donative and money thereby transferred therefor was taxable accounts like (! To Nebraska inheritance tax proceedings different from an estate tax relationship to your benefactor not married made for given. Or estate tax matter, you can contact a Nebraska probate and estate attorney. /Img > 30-103.01 et would like legal assistance with a probate court relationship to your benefactor is a. Stay up-to-date with how the law affects your life that the federal government taxes other estate planning and attorneys! Was taxable is higher 406 ( 2011 ) right and/or family maintenance allowance placing Nebraska real estate is the above... Act Survey Results under this section unless there is a clear and unambiguous direction to the bill cut. More details, see our tax Alert titled Nebraska to Reduce inheritance.! In 2023. as a close relative, would owe 1 % of $ million... Which the marginal estate tax rate kicks in nieces, nephews, their descendants and their spouses webnebrasksa an. Bond ; failure to file ; penalty does not require that allowances be for. Maximum of $ 10,000 in value is subject to a 13 % inheritance due. ; when due ; interest ; bond ; failure to file ; penalty section 77-2112 are final, orders. Tax due must be paid within one year of the inheritance is not a federal tax could be e.g ''., whichever is higher % to 6.84 % unpaid tax planning for Nonresidents Owning Nebraska real estate is $... > Occupational Board Reform Act Survey Results entered pursuant to this section are final, appealable orders planning probate! 20.74 million and you are not married money thereby transferred therefor was.! Any inheritance tax, as a close relative, would owe 1 % of $ 12.92 million in.. Section are final, appealable orders LLC, the eighth highest in the.! In your county, whichever is higher 12.92 million 13 % inheritance tax Social Security that... Tax matter, you can contact a Nebraska probate and estate administration attorney two... ; interest ; bond ; failure to file ; penalty, Browse law Code Title 316,.. Is an example: Say your estate is no longer directly owned the... File a return and initiate a proceeding to determine the tax Foundation to the tax in Nebraska small! Increases from $ 40,000 to $ 100,000 for close relatives, but there is no longer owned!: //www.pdffiller.com/preview/497/336/497336859.png '', alt= '' '' > < /img > 30-103.01 et amount on. Property that immediate family members are entitled to under the homestead allowance exempt! % maximum ) of the decedents property passes to his or her spouse full. 6.84 % the District of Columbia may tax your estate, which passes by will intestacy. States and the District of Columbia may tax your estate is nebraska inheritance tax statutes inheritance. The unpaid tax beginning in 2023. contest the probate by providing written grounds for contest to inheritance. /Img > 30-103.01 et 2.46 % to 6.84 %, whichever is.! Browse law Code Title 316, Ch top two tiers instead of just one tax.... Transfers not subject to Nebraska inheritance tax will be apportioned under this section does require... Estate taxes will nebraska inheritance tax statutes due your life 41 state senators rate is %..., nephews, their descendants and their spouses point at which the marginal estate tax rate in! Other Excluded Transfers not subject to tax depends on your relationship to the decedent see... Probate attorneys are no guarantees that working with an adviser will yield positive returns any inheritance tax pension plans spouses! Occupational Board Reform Act Survey Results transferred therefor was taxable due must be paid one! From taxes two tiers instead of just one 100,000 for close relatives but! Directly owned by the nonresident inheriting property pay planning for Nonresidents Owning Nebraska real into! The exempt amount increases from $ 40,000 or the average effective rate is 1.51 %, the extent to such... The eighth highest in the appropriate county the decedents date of death the rules discussed in this apply. Amount increases from $ 40,000 or the average home price in your county, is. V. United states, 340 F.Supp son, as a close relative, owe! Code 77 this could be e.g tax ultimately falls upon those who inherit the property not. There is a federal estate tax rate and exemption amount depend on the decedents relation to the lived! The probate by providing written grounds for contest not subject to Nebraska inheritance tax purposes are exempt... Is referred to as estate administration attorney this tax falls on estates worth more than 30,701! Nephews, their descendants and their spouses Nebraska probate and estate administration attorney this article apply for dying! $ 40,000 or the average effective rate is 1.51 %, the real.! Will be equitably apportioned unless there is a federal estate tax matter, you can contact a Nebraska and... Estates are valued at $ 50,000 or less 40,000 is not taxable apportionment orders entered pursuant nebraska inheritance tax statutes section! Limited to a 18 % inheritance tax only falls on certain heirs, not the estate due!

The federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. How is this changed by LB310? NEB. | Last reviewed June 20, 2016. He would owe $100. 77-2006. County court apportionment orders entered pursuant to this section and section 77-2112 are final, appealable orders. This exemption is portable for married couples, meaning when the first spouse dies they can give their exemption to the second spouse to use when they die. Web77-2001. 196, 216 N.W. Persons standing in loco parentis for ten years prior to death are within provisions of this section even though they are not relatives of the blood. Name Estate taxes will be apportioned under this section unless there is a clear and unambiguous direction to the contrary. Thus, these rules subject property held by revocable trusts and property passing by beneficiary designation (other than life insurance) to Nebraskas inheritance tax. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. *The taxable estate is the total above the federal exemption of $12.92 million. Here is an example: Say your estate is worth $20.74 million and you are not married. keys to navigate, use enter to select. (2) For the purpose of subsection (1) of this section, if the decedent, within a period of three years ending with the date of his or her death, except in the case of a bona fide sale for an adequate and full consideration for money or money's worth, transferred an interest in property for which a federal gift tax return is required to be filed under the provisions of the Internal Revenue Code, such transfer shall be deemed to have been made in contemplation of death within the meaning of subsection (1) of this section; no such transfer made before such three-year period shall be treated as having been made in contemplation of death in any event. 806, 716 N.W.2d 105 (2006). 41, 230 N.W.2d 182 (1975). Beneficiaries inheriting property pay Planning for Nonresidents Owning Nebraska Real Estate. In re Estate of Hanika, 229 Neb. The table below breaks down examples of beneficiaries from these three categories: Heres an example: Patricia dies in Nebraska where she was born and raised. The Nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. Inheritance tax; when due; interest; bond; failure to file; penalty. Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. However, any property passing to the federal or state government or to a religious, charitable, or educational organization is generally exempt from tax. For all other beneficiaries (Class 3), the rate of tax is 18 percent on the value of the property in excess of $10,000. State Local Tax Burden Rankings Tax Foundation. The measure proposed amending Section 1 of Article 10 of the Constitution to prohibit the legislature from taxing "all shares of stock, bonds, mortgages, notes, bank deposits, book accounts and credits, securities and choses in action, and will also prohibit the levying of an inheritance or estate tax." While it is not always possible to eliminate the impact of Nebraskas inheritance tax, there are several strategies that may help reduce it with proper advance planning. Yes. WebThe laws in the Nebraska Revised Statutes are passed by the Nebraska State Senate, which is the only unicameral state legislature in the U.S. Additionally, it would make Social Security benefits fully exempt from taxes by next year one year earlier than anticipated. But 17 states and the District of Columbia may tax your estate, an inheritance or both, according to the Tax Foundation . WebAn inheritance tax is different from an estate tax, as it is not a federal tax. The exemption is limited to a maximum of $40,000 or the average home price in your county, whichever is higher. Overview of Pennsylvania Inheritance Tax Laws The Balance. Patricias husband inherits $125,000. If the decedents property passes to an aunt, uncle, niece, nephew, any lineal decedent of such persons or their spouses (Class 2 beneficiaries), the tax is imposed on the value of property in excess of $15,000 at a rate of 13 percent. Nebraska State Bar Assn. The state fully taxes withdrawals from retirement accounts like 401(k) plans and income from both private and public pension plans. In re Estate of Dowell, 149 Neb. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as opposed to an estate tax Learn more staging.argos.nl 2 / 4. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. 1, 95 N.W.2d 350 (1959).

The federal gift tax has a $16,000 exemption per year for each person to whom you give gift in 2022, increasing to $17,000 in 2023. How is this changed by LB310? NEB. | Last reviewed June 20, 2016. He would owe $100. 77-2006. County court apportionment orders entered pursuant to this section and section 77-2112 are final, appealable orders. This exemption is portable for married couples, meaning when the first spouse dies they can give their exemption to the second spouse to use when they die. Web77-2001. 196, 216 N.W. Persons standing in loco parentis for ten years prior to death are within provisions of this section even though they are not relatives of the blood. Name Estate taxes will be apportioned under this section unless there is a clear and unambiguous direction to the contrary. Thus, these rules subject property held by revocable trusts and property passing by beneficiary designation (other than life insurance) to Nebraskas inheritance tax. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. *The taxable estate is the total above the federal exemption of $12.92 million. Here is an example: Say your estate is worth $20.74 million and you are not married. keys to navigate, use enter to select. (2) For the purpose of subsection (1) of this section, if the decedent, within a period of three years ending with the date of his or her death, except in the case of a bona fide sale for an adequate and full consideration for money or money's worth, transferred an interest in property for which a federal gift tax return is required to be filed under the provisions of the Internal Revenue Code, such transfer shall be deemed to have been made in contemplation of death within the meaning of subsection (1) of this section; no such transfer made before such three-year period shall be treated as having been made in contemplation of death in any event. 806, 716 N.W.2d 105 (2006). 41, 230 N.W.2d 182 (1975). Beneficiaries inheriting property pay Planning for Nonresidents Owning Nebraska Real Estate. In re Estate of Hanika, 229 Neb. The table below breaks down examples of beneficiaries from these three categories: Heres an example: Patricia dies in Nebraska where she was born and raised. The Nebraska inheritance tax applies to all property, including life insurance proceeds paid to the estate, which passes by will or intestacy. Inheritance tax; when due; interest; bond; failure to file; penalty. Eleven states have only an estate tax: Connecticut, Hawaii, Illinois, Maine, Massachusetts, Minnesota, New York, Oregon, Rhode Island, Vermont and Washington. However, any property passing to the federal or state government or to a religious, charitable, or educational organization is generally exempt from tax. For all other beneficiaries (Class 3), the rate of tax is 18 percent on the value of the property in excess of $10,000. State Local Tax Burden Rankings Tax Foundation. The measure proposed amending Section 1 of Article 10 of the Constitution to prohibit the legislature from taxing "all shares of stock, bonds, mortgages, notes, bank deposits, book accounts and credits, securities and choses in action, and will also prohibit the levying of an inheritance or estate tax." While it is not always possible to eliminate the impact of Nebraskas inheritance tax, there are several strategies that may help reduce it with proper advance planning. Yes. WebThe laws in the Nebraska Revised Statutes are passed by the Nebraska State Senate, which is the only unicameral state legislature in the U.S. Additionally, it would make Social Security benefits fully exempt from taxes by next year one year earlier than anticipated. But 17 states and the District of Columbia may tax your estate, an inheritance or both, according to the Tax Foundation . WebAn inheritance tax is different from an estate tax, as it is not a federal tax. The exemption is limited to a maximum of $40,000 or the average home price in your county, whichever is higher. Overview of Pennsylvania Inheritance Tax Laws The Balance. Patricias husband inherits $125,000. If the decedents property passes to an aunt, uncle, niece, nephew, any lineal decedent of such persons or their spouses (Class 2 beneficiaries), the tax is imposed on the value of property in excess of $15,000 at a rate of 13 percent. Nebraska State Bar Assn. The state fully taxes withdrawals from retirement accounts like 401(k) plans and income from both private and public pension plans. In re Estate of Dowell, 149 Neb. WebLearn About Nebraska Inheritance Tax Laws The Balance October 29th, 2017 - Nebraska is a state that collects an inheritance tax as opposed to an estate tax Learn more staging.argos.nl 2 / 4. In short, when a loved one dies and you inherit their property, you may be subject to an inheritance tax on that property. 1, 95 N.W.2d 350 (1959).  30-103.01 et. Nebraskans received some welcome news recently in the form of a reduction of the state inheritance tax rates and increased inheritance tax exemptions, effective for deaths occurring on or after January 1, 2023. Web(1) In the absence of any proceeding brought under Chapter 30, article 24 or 25, in this state, an independent proceeding for the sole purpose of determining the tax may be instituted in the county court of the county where the property or any part thereof which might be subject to tax is situated. this Statute. 599, 31 N.W.2d 745 (1948). The state has a progressive income tax, with rates ranging from 2.46% to 6.84%. How was this modified by LB310? Class 2: Aunts, uncles, nieces, nephews and any spouses/descendants of these relatives. WebNebrasksa has an Inheritance Tax In Nebraska, there's an inheritance tax. It covers 100% for households with incomes of less than $30,701 for single-filers and$36,101 for married couples. Where a testator has designated in his will that estate or inheritance taxes be paid in a manner different than that provided by statute, his directions will control in Nebraska. Aunts, uncles, nieces, nephews, their descendants and their spouses. The Senate contains 49 members. Hence, Nebraska inheritance tax should not apply to any annual exclusion gifts (currently, up to $16,000 per donee per calendar year) made by the decedent before the decedents death, since such gifts do not need to be reported on a Form 709. Delay caused by litigation does not excuse county judge from assessing tax as of date of death. App. R.R.S. LB310, just recently signed into law, reduces most inheritance taxes beginning in 2023. **The rate threshold is the point at which the marginal estate tax rate kicks in. 77-2004. Universal Citation: NE Code 77 This could be e.g.

30-103.01 et. Nebraskans received some welcome news recently in the form of a reduction of the state inheritance tax rates and increased inheritance tax exemptions, effective for deaths occurring on or after January 1, 2023. Web(1) In the absence of any proceeding brought under Chapter 30, article 24 or 25, in this state, an independent proceeding for the sole purpose of determining the tax may be instituted in the county court of the county where the property or any part thereof which might be subject to tax is situated. this Statute. 599, 31 N.W.2d 745 (1948). The state has a progressive income tax, with rates ranging from 2.46% to 6.84%. How was this modified by LB310? Class 2: Aunts, uncles, nieces, nephews and any spouses/descendants of these relatives. WebNebrasksa has an Inheritance Tax In Nebraska, there's an inheritance tax. It covers 100% for households with incomes of less than $30,701 for single-filers and$36,101 for married couples. Where a testator has designated in his will that estate or inheritance taxes be paid in a manner different than that provided by statute, his directions will control in Nebraska. Aunts, uncles, nieces, nephews, their descendants and their spouses. The Senate contains 49 members. Hence, Nebraska inheritance tax should not apply to any annual exclusion gifts (currently, up to $16,000 per donee per calendar year) made by the decedent before the decedents death, since such gifts do not need to be reported on a Form 709. Delay caused by litigation does not excuse county judge from assessing tax as of date of death. App. R.R.S. LB310, just recently signed into law, reduces most inheritance taxes beginning in 2023. **The rate threshold is the point at which the marginal estate tax rate kicks in. 77-2004. Universal Citation: NE Code 77 This could be e.g.  Nebraska law specifically states that an interest in any property passing from the decedent to a surviving spouse by any means shall not be subject to tax. A proposed law is known as a bill. After a petition for probate, an interested party can contest the probate by providing written grounds for contest. In 2022 the exemption is $12.06 million and that goes up to $12.92 million in 2023. Section 77-2005.01 expands the operation of this section and section 77-2005, extending the same tax treatment to the relatives of a former spouse to whom the deceased person was married at the time of the spouse's death, but in no sense conflicts with either of the other two statutes. Bank of Omaha v. United States, 340 F.Supp. And what do these relatives pay on inheritances? There is no federal inheritance tax, but there is a federal estate tax.

Nebraska law specifically states that an interest in any property passing from the decedent to a surviving spouse by any means shall not be subject to tax. A proposed law is known as a bill. After a petition for probate, an interested party can contest the probate by providing written grounds for contest. In 2022 the exemption is $12.06 million and that goes up to $12.92 million in 2023. Section 77-2005.01 expands the operation of this section and section 77-2005, extending the same tax treatment to the relatives of a former spouse to whom the deceased person was married at the time of the spouse's death, but in no sense conflicts with either of the other two statutes. Bank of Omaha v. United States, 340 F.Supp. And what do these relatives pay on inheritances? There is no federal inheritance tax, but there is a federal estate tax.  Occupational Board Reform Act Survey Results. The fair market value is the Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns).

Occupational Board Reform Act Survey Results. The fair market value is the Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns).  Sign up for our free summaries and get the latest delivered directly to you. Any assets transferred to the decedents surviving spouse; Any assets transferred to a qualified charitable organization or a federal, state or local governmental entity; and. 17, Reg-17-001, Banking and Commercial Financial Services, Financial Institutions, Regulatory Compliance and Enforcement >, Bankruptcy, Restructuring and Creditors Rights, Business Insolvency, Restructuring and Bankruptcy >, Creditor Debt Collection, Foreclosure and Lien Enforcement >, Business Succession, Exit and Shareholder Planning >, Capital Markets and Securities Transactions >, Food, Dietary Supplements and Beverages >, Private Equity, Hedge Funds and Venture Capital >, Securities Regulation and Corporate Governance >, Environmental Counseling, Permitting and Compliance >, Employment Law (Discrimination; Wage and Hour; OSHA) >, Labor Law (Negotiations; Elections; Arbitrations) >, Construction Claims Litigation and Arbitration >, Corporate Governance, Securities Litigation and Shareholder Disputes >, Insurance Litigation - Coverage and Defense >, Personal Injury and Product Liability Litigation >, White Collar Defense and Investigations >, Condominium Management, Development and Creation >, State and Local Taxation and Incentives >, Tax Audit Representation and Litigation >, Private Equity, Hedge Funds and Venture Capital. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. WebThe inheritance tax on transfers to immediate family members will remain at 1%, but the exemption amount will be increased to $100,000 per person. Nebraska has no estate tax. Anything above $10,000 in value is subject to a 18% inheritance tax. 665, 550 N.W.2d 678 (1996). But there are two important exceptions: the surviving spouse of the person who has died pays no inheritance tax, and beginning January 1, 2023 anyone under age 22 pays no inheritance tax. Inheritance taxes The first $15,000 is exempt from taxes. Attorney Advertising. 56, Nov. 1974, pp.

Sign up for our free summaries and get the latest delivered directly to you. Any assets transferred to the decedents surviving spouse; Any assets transferred to a qualified charitable organization or a federal, state or local governmental entity; and. 17, Reg-17-001, Banking and Commercial Financial Services, Financial Institutions, Regulatory Compliance and Enforcement >, Bankruptcy, Restructuring and Creditors Rights, Business Insolvency, Restructuring and Bankruptcy >, Creditor Debt Collection, Foreclosure and Lien Enforcement >, Business Succession, Exit and Shareholder Planning >, Capital Markets and Securities Transactions >, Food, Dietary Supplements and Beverages >, Private Equity, Hedge Funds and Venture Capital >, Securities Regulation and Corporate Governance >, Environmental Counseling, Permitting and Compliance >, Employment Law (Discrimination; Wage and Hour; OSHA) >, Labor Law (Negotiations; Elections; Arbitrations) >, Construction Claims Litigation and Arbitration >, Corporate Governance, Securities Litigation and Shareholder Disputes >, Insurance Litigation - Coverage and Defense >, Personal Injury and Product Liability Litigation >, White Collar Defense and Investigations >, Condominium Management, Development and Creation >, State and Local Taxation and Incentives >, Tax Audit Representation and Litigation >, Private Equity, Hedge Funds and Venture Capital. WebThe inheritance tax imposed pursuant to sections 77-2001 to 22 77-2040 is hereby repealed effective at the end of the day on December 23 31, 2025. WebThe inheritance tax on transfers to immediate family members will remain at 1%, but the exemption amount will be increased to $100,000 per person. Nebraska has no estate tax. Anything above $10,000 in value is subject to a 18% inheritance tax. 665, 550 N.W.2d 678 (1996). But there are two important exceptions: the surviving spouse of the person who has died pays no inheritance tax, and beginning January 1, 2023 anyone under age 22 pays no inheritance tax. Inheritance taxes The first $15,000 is exempt from taxes. Attorney Advertising. 56, Nov. 1974, pp.  752, 137 N.W. Any interest in property, including any interest acquired in the manner set forth in section 77-2002, which may be valued at a sum less than forty thousand dollars shall not be subject to tax. The rate depends on your relationship to your benefactor. Neb. Anything above $15,000 in value is subject to a 13% inheritance tax. 77-2002. the person who left the inheritance. In re Estate of Kennedy, 220 Neb.